- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Additional medical insurance premiums

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Additional medical insurance premiums

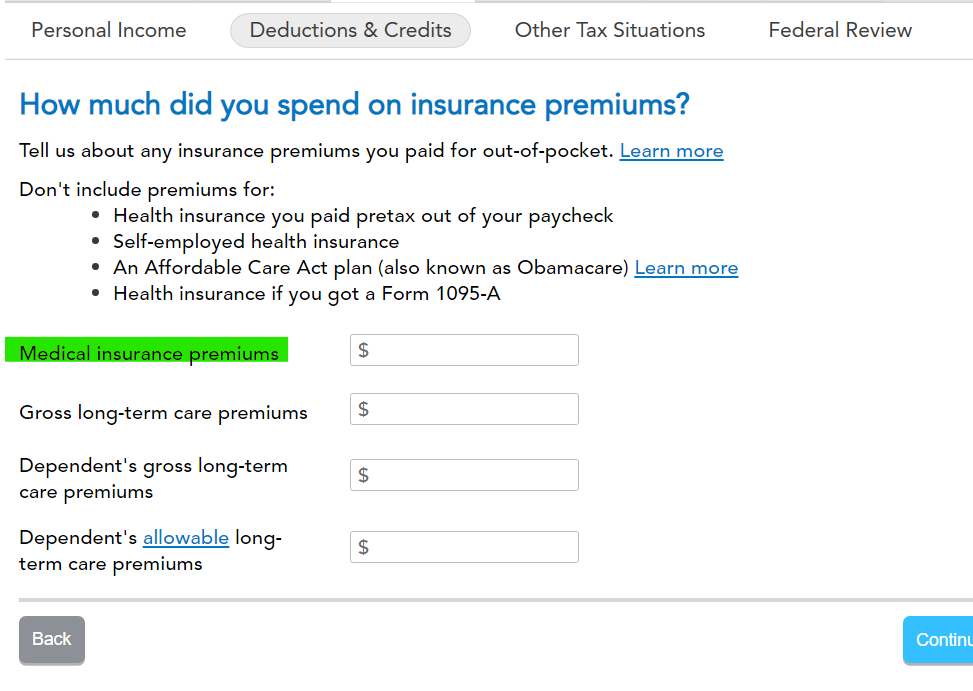

Hi, I am using Turbo Tax (and have used it for years!) and have a question about functionality. In the Federal Tax section, Deduction & Credits, Medical - there is a screen that says, "How much did you spend on insurance premiums?". One option is "Additional medical insurance premiums" and Turbo Tax has it grayed out and won't let me input any data. WHY??? Shouldn't I be able to add the cost of supplemental insurance there? Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Additional medical insurance premiums

where do I enter additional medical insurance premiums

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Additional medical insurance premiums

Medical, dental, and vision expenses are reported on Schedule A and entered in the Deductions & Credits section.

- With your return open, search for Schedule A and then select the Jump to link in the search results.

- Answer YES to the ''Did you spend more than $XXX on medical costs?'' question. You can't get to the premiums screen if you answer no.

- Click through the screens and enter your expenses for RXs, Doctors, Facilities, Lab fees, Long-Term Care, Vision, and Supplies - they each have their own entry screen.

- Enter Travel expense on the next screen, hit Continue.

- Premiums are entered on this screen. You can combine all of your medical premiums you paid except for expenses you reported on another form or Long-Term Care Premiums. Those go on the line under Premiums, as they are limited based on your age.

To deduct unreimbursed, out-of-pocket medical, dental, and vision costs on your federal return:

- You must take the itemized deduction;

- The expenses for you, your jointly-filing spouse, and your dependent(s) must exceed 7.5% of your AGI (adjusted gross income); and

- Only the portion above and beyond 7.5% of your AGI is deductible.

What kinds of medical expenses are deductible?

Can I deduct Medicare premiums?

Why doesn't my refund change after I enter my medical expenses?

Can I deduct medical, dental, and vision expenses?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jvej

Level 1

user17704114277

New Member

RodBurnsKS

Level 2

kristy411green

New Member

1971rere

New Member