- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Medical, dental, and vision expenses are reported on Schedule A and entered in the Deductions & Credits section.

- With your return open, search for Schedule A and then select the Jump to link in the search results.

- Answer YES to the ''Did you spend more than $XXX on medical costs?'' question. You can't get to the premiums screen if you answer no.

- Click through the screens and enter your expenses for RXs, Doctors, Facilities, Lab fees, Long-Term Care, Vision, and Supplies - they each have their own entry screen.

- Enter Travel expense on the next screen, hit Continue.

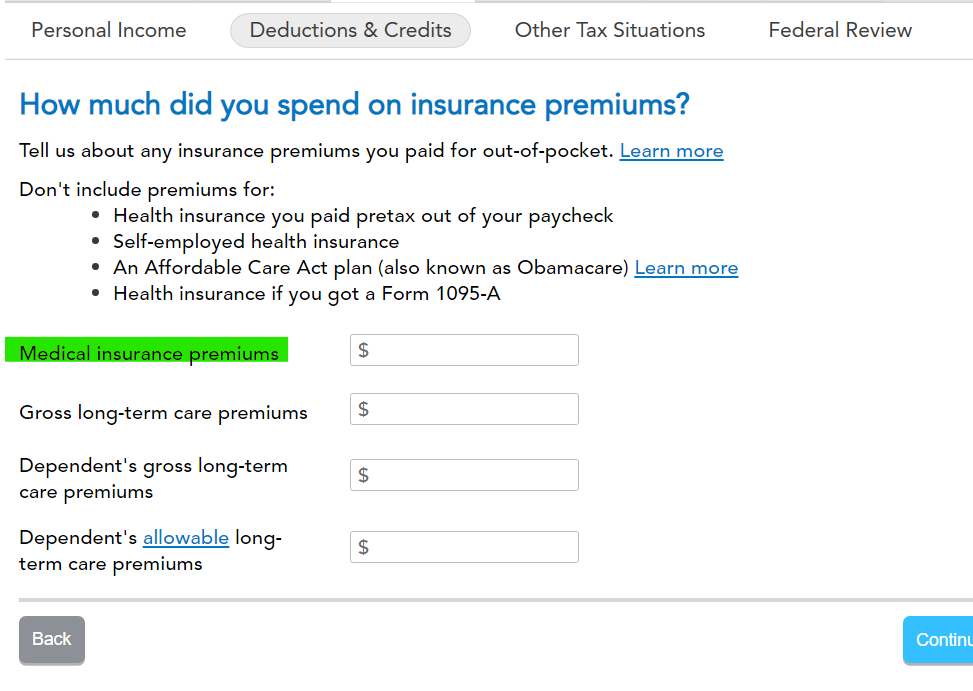

- Premiums are entered on this screen. You can combine all of your medical premiums you paid except for expenses you reported on another form or Long-Term Care Premiums. Those go on the line under Premiums, as they are limited based on your age.

To deduct unreimbursed, out-of-pocket medical, dental, and vision costs on your federal return:

- You must take the itemized deduction;

- The expenses for you, your jointly-filing spouse, and your dependent(s) must exceed 7.5% of your AGI (adjusted gross income); and

- Only the portion above and beyond 7.5% of your AGI is deductible.

What kinds of medical expenses are deductible?

Can I deduct Medicare premiums?

Why doesn't my refund change after I enter my medical expenses?

Can I deduct medical, dental, and vision expenses?

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 22, 2022

3:00 PM