- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Above the line deductions for legal fees

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

How do I report “above the line” legal fees from an unlawful discrimination claim on the 2019 forms?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

Officially TurboTax does not support the above-the-line deduction for attorney fees for an unlawful discrimination claim. It is listed in the Unsupported Calculations document. However, it can still be entered in forms mode in TurboTax for 2019. Forms mode is available only in the CD/Download TurboTax software, not in TurboTax Online.

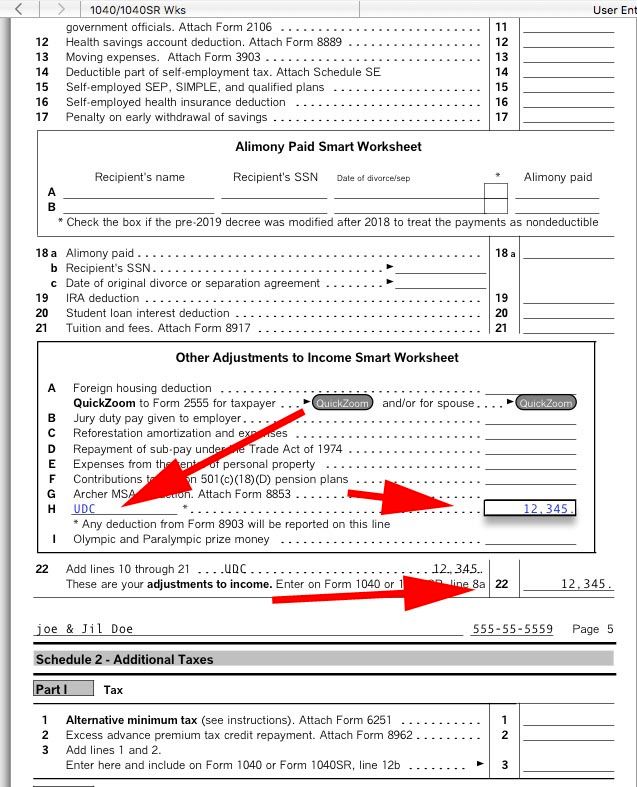

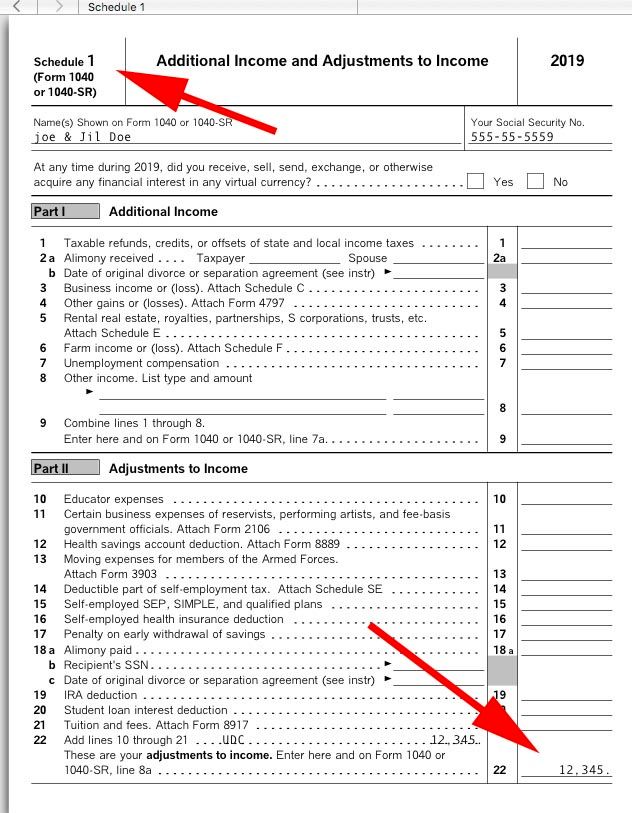

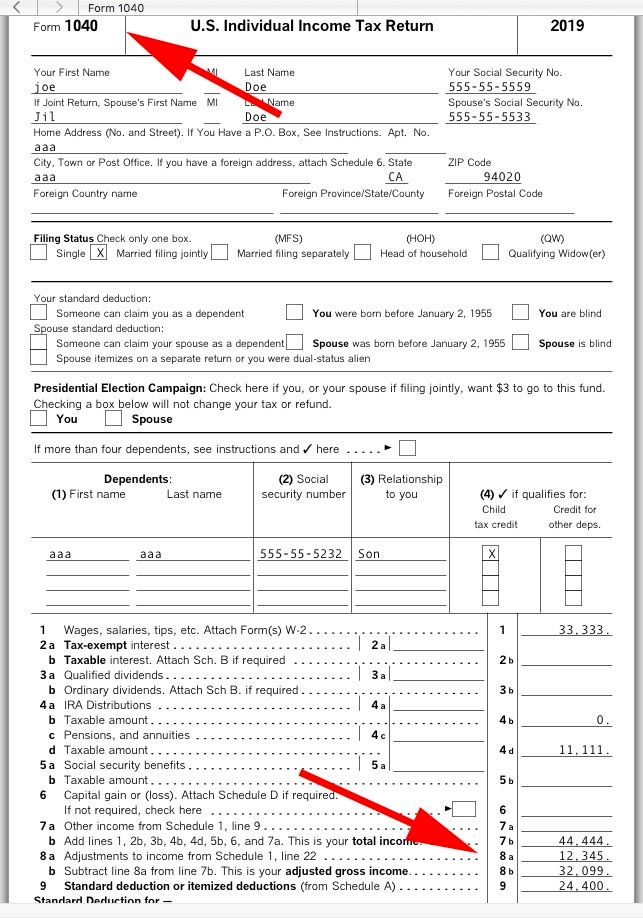

Here's how to enter the above-the-line deduction for attorney fees for an unlawful discrimination claim in TurboTax. In forms mode open the "Form 1040 or Form 1040SR Worksheet" (1040/1040SR Wks). Scroll down to the Schedule 1 section (Additional Income and Adjustments), then to Part II Adjustments to Income, and then to the Other Adjustments to Income Smart Worksheet between lines 21 and 22. The attorney fees are entered on line H of the Smart Worksheet. In the text entry box on the left side, right after the H, enter UDC. Enter the amount in the space on the right. The letters UDC and the amount will then appear on the dotted line to the left of the amount on line 22, and the fees will be added to any other amount that was already on line 22. The same notation, UDC and the amount, will appear on line 22 on Schedule 1.

Refer to IRS Publication 525 for important additional information about this deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

I am relating a post from user rjs who provides fairly thorough instructions on how to enter the information in the desktop version. You would need to manually enter it. The online edition does not support this entry. See the instructions above.

Please also continue to read:

With the new tax reform TCJA, it eliminates miscellaneous itemized deductions including the legal fees. Prior to the 2017 Act, you could deduct legal fees that were greater than 2% of your adjusted gross income as a miscellaneous expense. However, not anymore after 2017. However, there are still some legal fees that might qualify for an above-the-line deduction against your gross income like discrimination or Trade & Business related.

[Edited 2/25/2020 |10:13 AM]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

Officially TurboTax does not support the above-the-line deduction for attorney fees for an unlawful discrimination claim. It is listed in the Unsupported Calculations document. However, it can still be entered in forms mode in TurboTax for 2019. Forms mode is available only in the CD/Download TurboTax software, not in TurboTax Online.

Here's how to enter the above-the-line deduction for attorney fees for an unlawful discrimination claim in TurboTax. In forms mode open the "Form 1040 or Form 1040SR Worksheet" (1040/1040SR Wks). Scroll down to the Schedule 1 section (Additional Income and Adjustments), then to Part II Adjustments to Income, and then to the Other Adjustments to Income Smart Worksheet between lines 21 and 22. The attorney fees are entered on line H of the Smart Worksheet. In the text entry box on the left side, right after the H, enter UDC. Enter the amount in the space on the right. The letters UDC and the amount will then appear on the dotted line to the left of the amount on line 22, and the fees will be added to any other amount that was already on line 22. The same notation, UDC and the amount, will appear on line 22 on Schedule 1.

Refer to IRS Publication 525 for important additional information about this deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

Also refer to the 1040 instructions page 90 for Line 22.

https://www.irs.gov/pub/irs-pdf/i1040gi.pdf

"Line 22

• Attorney fees and court costs for

actions involving certain unlawful discrimination

claims, but only to the extent

of gross income from such actions

(see Pub. 525). Identify as “UDC.”"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

I am not seeing anywhere to enter that information. There is no "Less Common Income" showing under the Wages and Income tab. I am using Turbotax Deluxe.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

Thank you!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

@Panta Rhei wrote:

I am not seeing anywhere to enter that information. There is no "Less Common Income" showing under the Wages and Income tab. I am using Turbotax Deluxe.

As @rjs said above - this CANNOT be done in the online versions since it is not supported. It can only be done in the CD/download desktop version installed on a Mac or Windows computer in the "forms mode" so that you can make direct form entries and not in the interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

@Panta Rhei wrote:

I am not seeing anywhere to enter that information. There is no "Less Common Income" showing under the Wages and Income tab. I am using Turbotax Deluxe.

You do not enter the deduction under Less Common Income. The instructions posted by KittyM are wrong. Follow the instructions that I gave you above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

I appreciate the help! I still need to enter the award from the settlement and following the instructions posted by turbotax has not been useful as I do not see any "jump to" link. I was not issued a 1099 from this settlement. (https://ttlc.intuit.com/community/entering-importing/help/where-do-i-enter-an-award-from-a-taxable-l...)

Can you tell me where I enter this information?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

@Panta Rhei wrote:

I appreciate the help! I still need to enter the award from the settlement and following the instructions posted by turbotax has not been useful as I do not see any "jump to" link. I was not issued a 1099 from this settlement. (https://ttlc.intuit.com/community/entering-importing/help/where-do-i-enter-an-award-from-a-tax[produ...)

Can you tell me where I enter this information?

The original question was for "Above the line" discrimination settlement.

User rjs gave you the way to enter it. That *cannot* be done in the online version since it is not supported.

It mist be manually entered on the 1040 Worksheet.

It can ONLY be done by using the "forms mode" that is only in the CD/download desktop versions installed on a Windows or Mac computer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

I have entered the attorney's fees in form mode. I have the downloaded version. This is a follow up question pertaining to the amount I received. I still need to enter this amount and it is not clear where I enter this specifically. I am not seeing any "jump to" link.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

There is no "jump to" link - that is only in the interview mode. It only gets entered on the Schedule 1 worksheet and nowhere else. That will place it on the 1040 form

[Edited to fix UDC]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

My mistype - should be "UDC" in the above screenshots, not UTD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

Maybe I'm not phrasing my question right. I have already done this part; this was for entering the attorney's fees. However, the amount I received will be treated differently - correct? Turbotax addresses this here (https://ttlc.intuit.com/community/entering-importing/help/where-do-i-enter-an-award-from-a-taxable-l... ) ; I did not receive a 1099-MISC from this lawsuit and do not see the "jump to" link it mentions.

So, where does that, then, get entered?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

You misunderstand. The 1099-MISC is for *taxable* income from a legal settlement.

What you have is an "above the line" tax *deduction* for a discrimination lawsuit.

The 1040 line 8a amount *subtracts* from your AGI to reduce your tax, not *add* to it to increase the tax that misc. 1099 income would do.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jeannieb82

New Member

afrystak89

Level 1

Ol_Stever

Level 2

kashyapvijay

Level 2

mpruitt71

New Member