- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

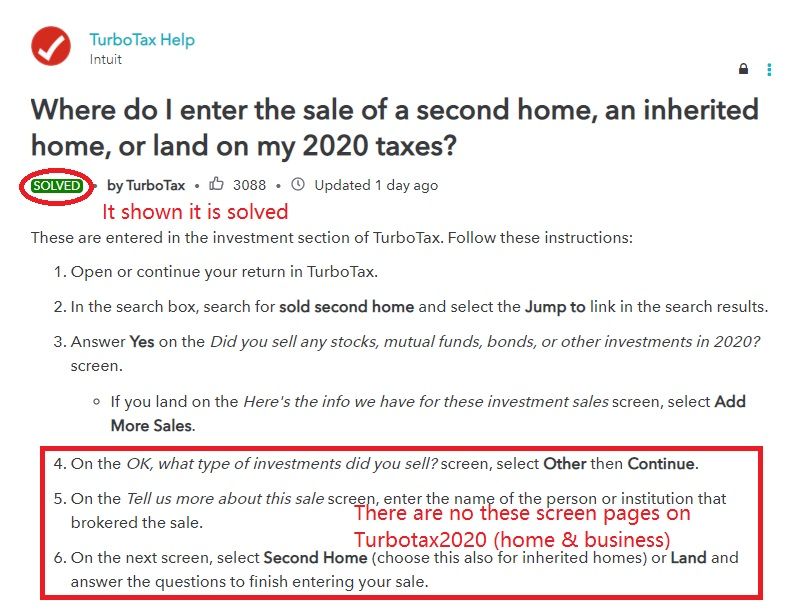

I have TurboTax2020(Home & Business). I followed the following instructions from the Intuit website on

"Where do I enter the sale of a second home… on my 2020 taxes?"

but I still could not find the right page to enter the sale of a second home.

In my 2020 TurboTax (Home & Business), I did:

- Open or continue your return in TurboTax.

- In the search box, search for sold second home and select the Jump to link in the search results.

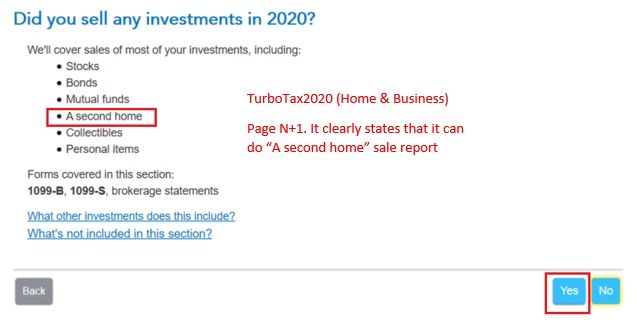

- Answer Yes on the “Did you sell any investments in 2020?” screen.

- If you land on the “Here's the info we have for these investment sales” screen, select Add More Sales.

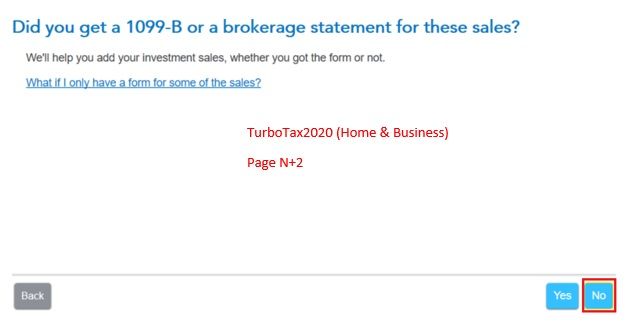

- Answer No on the “Did you get a 1099-B or a brokerage statement for these sales?” screen.

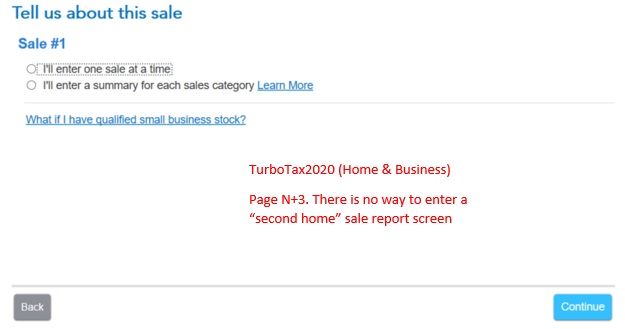

- The next screen is “Tell us about this sale”. The 2 choices on this screen are:

- I’ll enter one sale at a time

- I’ll enter a summary for each sales category

Both choices are for stock sales ONLY and there is no way to enter second home sale.

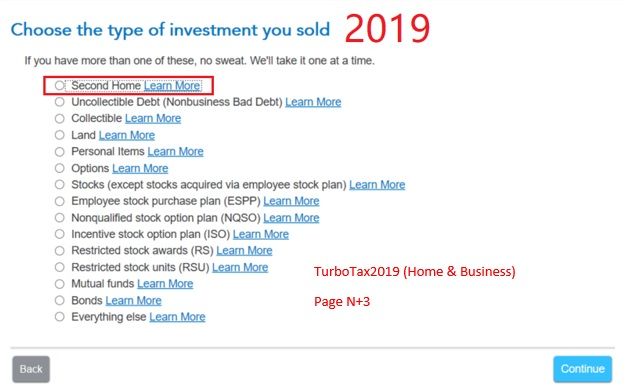

The 2019 TurboTax (Home & Business) do NOT have this problem and it can report a second home sale without any problem.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

@LT21 wrote:The 2019 TurboTax (Home & Business) do NOT have this problem and it can report a second home sale without any problem.

The screen to which you are referring has been deleted for 2020. The new algorithm, purportedly, is able to account for sales of various types of property.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

@LT21 wrote:The 2019 TurboTax (Home & Business) do NOT have this problem and it can report a second home sale without any problem.

The screen to which you are referring has been deleted for 2020. The new algorithm, purportedly, is able to account for sales of various types of property.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

Hi Tagteam,

You said "The screen to which you are referring has been deleted for 2020. The new algorithm, purportedly, is able to account for sales of various types of property".

But you did not provide a solution... Can you let me know how can I enter a "second home" sale in Turbotax2020 (home & business version)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

Hi Everyone,

Can someone here help me to either guide me to a "second home" sale screen in Turbotax2020 (Home & Business) or help me to relay this question/issue to Turbotax/Intuit tech support team? I tried to email/call tech support many times without success response.

The bottom line is I bought Turbotax2020 (Home & Business) and I can not use it to do my tax due to Turbotax2020 (Home & Business) software issue... And I exhausted my ways to get help form the Turbotax/Intuit!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

You can report the sale in the Investment Income section or the Less Common Income section (see screenshots below).

If you report the sale in the Investment Income section, be sure to indicate that you did not receive a 1099-B.

If you report the sale in the Less Common Income section, be sure to follow the prompts closely so you do not wind up excluding any gain since this is a second home and not your principal residence.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

Hi Tagteam,

Thank you for your reply and screen shot illustrations. Very appreciated!

I still think it is a bug in Turbotax2020 (Home & Business) for the "second home" sale approach and Turbotax team needs to fix it.

Your 2nd screenshot is for the main home sale so I don't think it is appropriate to use this to report a second home sale.

Your 1st screenshot is the right way to report a second home sale. I followed your 1st. screenshot (I call it page N) and I list screenshots after the page N as follows:

In Turbotax2019 (Home & Business), The screen N, N+1, and N+2 were the same as Turbotax2020 (Home & Business) but the N+3 page (see below) had choices to enter "Second Home" sale.

So please help or help me tp relay this problem/issue to Turbotax team!

Thank you again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

Somehow the N+2 screenshot did not display properly in my above message...

I reload it again as follow

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

@LT21 wrote:I still think it is a bug in Turbotax2020 (Home & Business) for the "second home" sale approach and Turbotax team needs to fix it.

This is not a bug; it is by design. If the developers feel the screens should be changed, they will certainly do that but the absence of the screen is not an oversight on their part.

@LT21 wrote:Your 2nd screenshot is for the main home sale so I don't think it is appropriate to use this to report a second home sale.

The second screenshot for the main home sale (Sale of Home) is most definitely appropriate (and actually required) if a user selling a second home had ever rented and claimed depreciation deductions on the home.

The first screenshot is appropriate if the home had always been held exclusively for personal use, however.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

Hi Tagteam,

Thank you for relaying my this issue to Turbotax team.

For what you mentioned "but you should not hold out much hope for a change since they (Turbotax team) have apparently decided, for now, that the screens will remain as they now appear".

I ONLY want to know the solution for me to properly report a "second home" sale on Turbotax2020. If they (Turbotax team) don't want to do the change, they MUST show me how to do it, do you agree?

BTW, are you an employee of Intuit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

Have you ever used your second home as a rental? If not, then simply enter the sale in the screenshot in your post that you refer to as N+2.

Select I'll enter one sale at a time and then proceed through the screens. For the description, you can use the address or just "second home" - basically whatever you like.

The sale will be reported properly provided you have a gain (if not check the box indicating the loss is not deductible on one of the screens that follow).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

Hi Tagteam,

You mentioned "The first screenshot is appropriate if the home had always been held exclusively for personal use, however".

This is my case!!!

BTW, in my very first message, I posted a link https://ttlc.intuit.com/community/entering-importing/help/where-do-i-enter-the-sale-of-a-second-home...

This is for an official answer for the question of "Where do I enter the sale of a second home, an inherited home, or land on my 2020 taxes?". The screenshot for this link is as follows:

It also says to report a second home sale at "Investment Income" category (as you suggested in your 1st. screenshot). So I don't believe it was deleted... It is just not shown (a bug???) on Turbotax2020 (home & business) version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

@LT21 wrote:So I don't believe it was deleted... It is just not shown (a bug???) on Turbotax2020 (home & business) version.

No, it is not a bug. The developers simply omitted that screen to which you are referring on purpose.

The TurboTax Help article to which you referred is absolutely wrong; it has not been updated for the 2020 desktop versions of TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

Hi Tagteam,

Thank you for your reply and answers... At least, you tried to help me!!!

I asked before and I ask again here: are you an employee Intuit or a member of tech support team work for Intuit? I just want to know if your answers representing Turbotax/Intuit or not? I am an end user who just wants to use Turbotax to file my tax return.

You said: "it is not a bug. The developers simply omitted that screen to which you are referring on purpose". That is fine. Again, please guide me to the proper screen/page to report a "second home" sale in Turbotax2020 (home & business)...

You said: "The TurboTax Help article to which you referred is absolutely wrong; it has not been updated for the 2020 desktop versions of TurboTax".

If you are representing Turbotax team/Intuit, please have this absolutely wrong TurboTax Help article removed from the official Turbotax/Intuit web site immediately (it shown it was updated one day ago by Turbotax).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A possible bug in Turbotax2020 (home & Business) on entering "second home sale"???

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bbolsm82

Returning Member

pamelafenner

New Member

mave589991

Returning Member

dannytran01

Level 1

DrG6

Returning Member