in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 529 Plan for my spouse

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 Plan for my spouse

My wife is getting her Doctorate and so we transferred some of our children's 529 money into a 529 account in her name. Then we took a distribution this year for her tuition. TurboTax is not recognizing this as an authorized distribution. It is listing the earning portion of the distribution as taxable income. In the section of TurboTax where you normal enter the education expenses (tuition, books, room and board, etc.) that option does not even pop up for my wife. What am I doing wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 Plan for my spouse

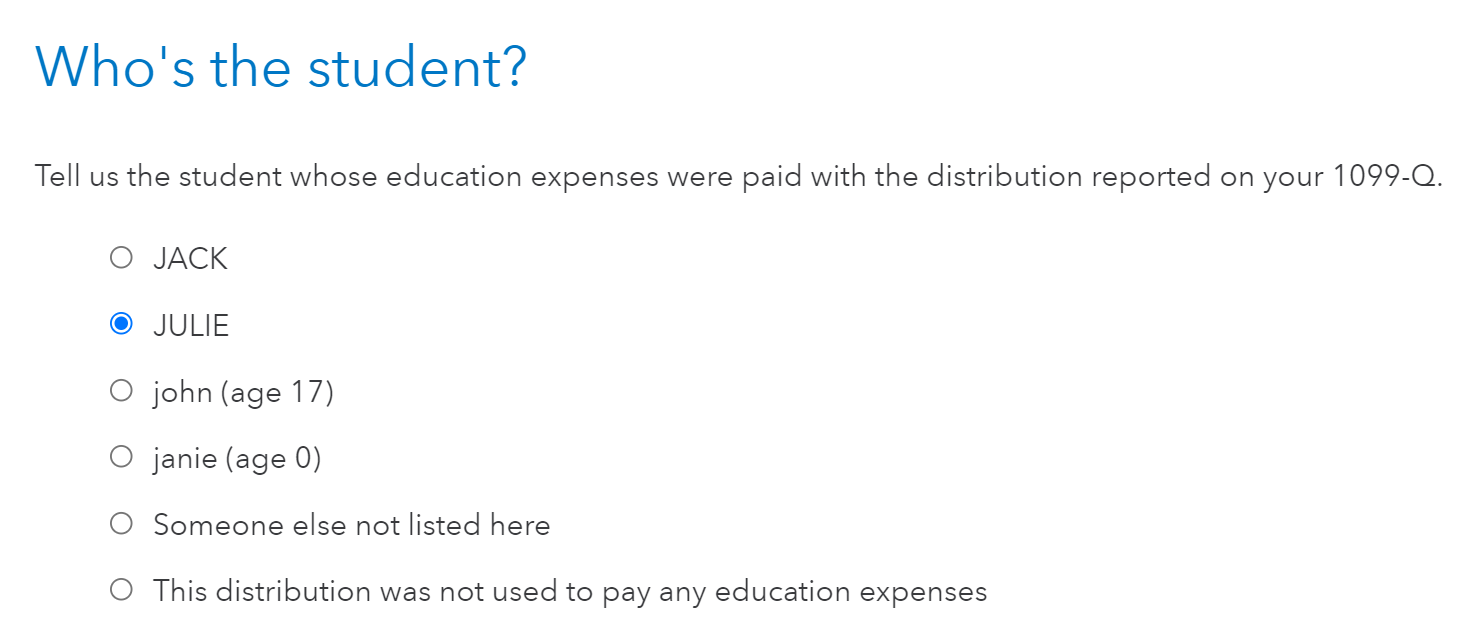

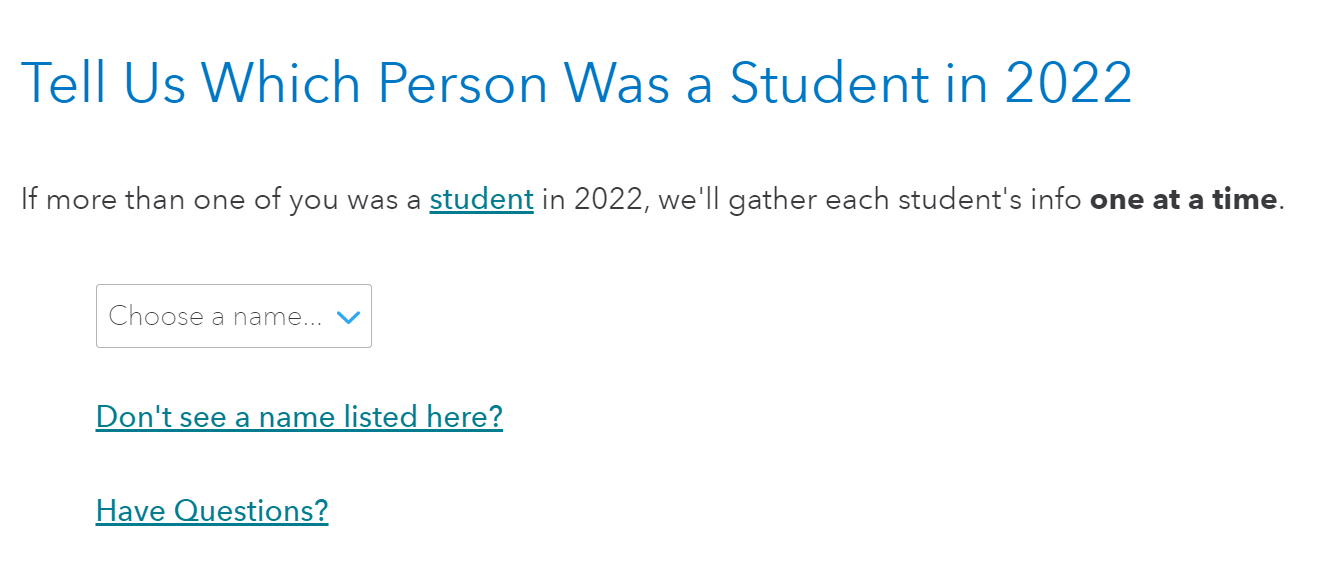

There are two places where you have to indicate the student- once in the 1099-Q entry and again in the Educational Expenses section. Be sure you entered the information in both places.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 Plan for my spouse

Thank you for the reply. I believe I have selected my wife as a student in both locations. We get a message stating our modified adjusted gross income exceeds the maximum limit so we can't claim tuition and other fees because our income is too high. I understand that would be the case for a deduction but that should not be the case for using the 529 money to reimburse ourselves for the tuition payment. Should it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 Plan for my spouse

This sounds like a message for not qualifying for the American Opportunity Credit or the Lifetime Learning Credit, not a 529 account that provided a Form 1099-Q. There is no income limitation on qualifying educational expenses toward a 529 distribution.

You may not be receiving the credit for one of these common reasons:

- You are using the Married Filing Separately filing status

- Your adjusted gross income (AGI) is too high

- The American Opportunity Tax Credit AGI limit is $90,000 ($180,000 for joint returns)

- The Lifetime Learning Credit AGI limit is $90,000 ($180,000 for joint returns)

- Your educational expenses were paid with tax-free scholarships, fellowships, grants, education savings account funds, tax-free savings bond interest, or employer-provided education assistance.

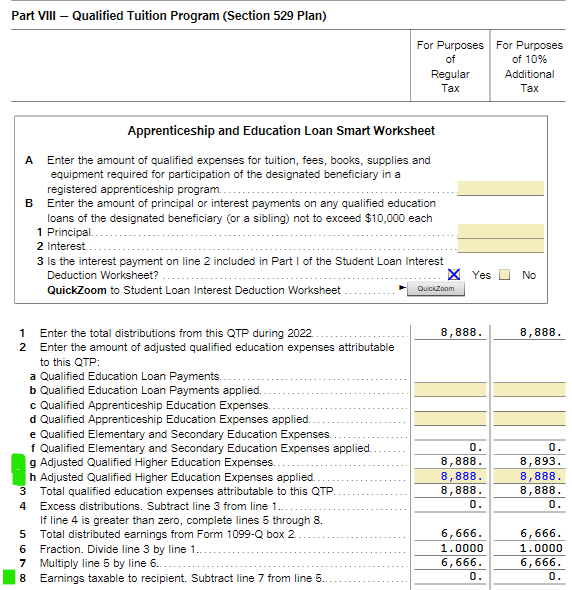

To be sure the educational expenses were reconciled with your 529 distribution, you can check Part VIII of the Student Worksheet on your return, when you view or download before filing.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anonymouse1

Level 5

user17523150919

New Member

strawberrypizza

Level 2

in Education

mcfdlf

Level 1

in Education

new-frog

Level 2

in Education