- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

This sounds like a message for not qualifying for the American Opportunity Credit or the Lifetime Learning Credit, not a 529 account that provided a Form 1099-Q. There is no income limitation on qualifying educational expenses toward a 529 distribution.

You may not be receiving the credit for one of these common reasons:

- You are using the Married Filing Separately filing status

- Your adjusted gross income (AGI) is too high

- The American Opportunity Tax Credit AGI limit is $90,000 ($180,000 for joint returns)

- The Lifetime Learning Credit AGI limit is $90,000 ($180,000 for joint returns)

- Your educational expenses were paid with tax-free scholarships, fellowships, grants, education savings account funds, tax-free savings bond interest, or employer-provided education assistance.

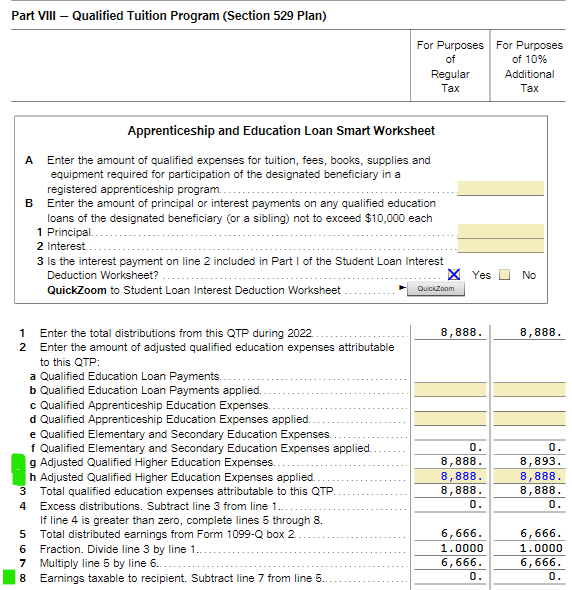

To be sure the educational expenses were reconciled with your 529 distribution, you can check Part VIII of the Student Worksheet on your return, when you view or download before filing.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 7, 2023

7:09 PM