- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 401K Transfer to Rollover IRA with After Tax Contribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

Hello - I transferred/converted $200,000 of the $250,000 total amount from my 401K to a Rollover IRA. The 401 plan administrator, which also holds my Rollover IRA, had to allocate % of the each of my 401K holding categories (i.e., large cap, mid cap, cash; and before tax and after tax contributions) to make up the $200,000 transfer, so a small portion of the transfer was from "after tax contributions" in my 401K. The after tax contribution total in the 401K was about $2,000, with $1,200 contributed by me (unmatched?), and $800 by my company (matched?). The 401K administrator allocated the "after tax amounts" from my 401K to the rollover IRA as follows:

my 401K after tax contribution - transferred $800 of the $1,200 to rollover IRA

my 401K after tax company match (?) - transferred $500 of the $800 to rollover IRA

so a total of $1,300 of the $2,000 "after tax 401 amounts" was transferred from the 401K to rollover IRA

My rollover IRA statement shows $200,000 was deposited into my rollover IRA account, and did not show any after tax amount separately. I did not get a check for the after tax amount (i.e., the $1,300) so I assume that all the after tax amounts went into the rollover IRA. The 1099R for the 401K distribution shows $200,000 in box 1 "gross distribution", $0 in box 2 "taxable amount", $350 in box 5 "employee contribution/designated Roth contributions or insurance premiums", code "G" in box 7 with IRA/SEP/Simple box "unchecked".

Since I have after tax contributions in the 401K that I already paid tax (?):

1. Should the after tax amount, or at least my contribution, not taxable?

2. Since the entire $200,000 is shown in my IRA statement, would I have to pay tax on my "after tax contribution" again when I start taking money out the rollover IRA account?

3. Also, I don't know how the $350 in box 5 was determined because it did not match with the after tax distributions/withdrawals (was this my initial contribution that was out of my pocket?) .

Please advise. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

[Edited] That makes more sense. When entering the code-7 Form 1099-R, be sure to indicate that you moved the money to another retirement account, that you did a combination of rolling over, converting and cashing out, the indicate that $57,500 was converted to Roth.

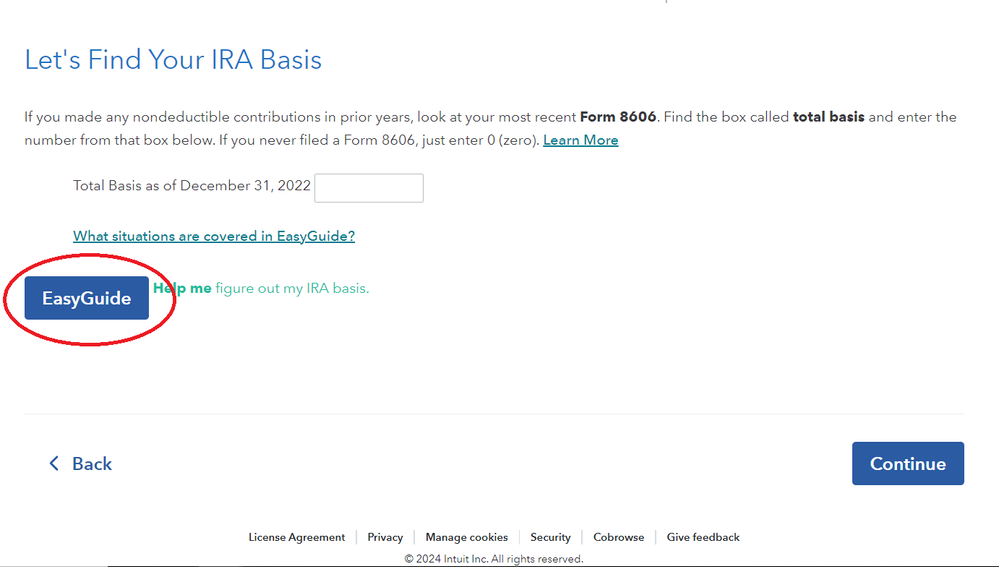

When you get back to the page that lists the Forms 1099-R that you have entered, click the Continue button. After answering Yes, you made nondeductible contributions to your traditional IRAs, TurboTax will preset the following page:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

$400 is the correct amount to have entered via the EasyGuide. That was implied when I said that everything on your forms appeared to be correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

The after tax contribution amount was information for the administrator of the IRA. When you take the money out of the IRA you will have to pay taxes on all of the pre-tax distributions but not the after tax distributions. So the 1099-R that you receive somewhere down the road will show the total distribution in box 1 and the taxable distribution in box 2 will be a little less.

As far as the rollover that you have to enter for this year go ahead and enter that 1099 just as it is written. There are no taxes due on anything at this time.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

Hello, thank you for the information. To clarify my understanding:

1. The year 2023 1099R (from the 401K administrator) for the 401K distribution to the traditional IRA with the employee contribution after-tax amount of $400 in Box 5 (or the data on the 1099R?) was supposed to be sent to the IRA administrator (the recipient of the 401K distribution), and the IRA administrator would put into their records to show $400 of the $200,000 transfer is after-tax? So when I start pulling money out of the traditional IRA, the IRA administrator will have the information to put on the future 1099R for the IRA distribution to show the taxable amount on Box 2a? For instance, if I pull all the money out or convert to Roth, the 1099R at that time will show Box 1 gross distribution of $200,000, and Box 2a taxable amount of $199,600 ($200,000 minus $400)? What will show in Box 5 and what code will be in Box 7?

2. The after-tax of $400 would not show anywhere on the 2023 tax forms, such as Form 8606? I read somewhere that the after-tax amount needs to be put on Form 8606 (don't know which lines on the form) so IRS will have the record of the after-tax amount for the future traditional IRA distribution that $400 should be deducted from the IRA distributions since it was already been taxed?

3. The "investment gains" and company matches related to the after-tax 401 contributions (paid by me with after-tax dollars) that also went into the traditional IRA will be taxable when I pull the money out since I did not "pay" them and they are pre-tax dollars?

4. When I input the current 1099R into TurboTax, the software will correctly calculate and generate the tax forms with all the correct amounts? For instance, I input the $400 in Box 5 of 1099, and it won't show anywhere on the tax forms and that is correct?

Thank you in advance for your reply.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

"The year 2023 1099R (from the 401K administrator) for the 401K distribution to the traditional IRA with the employee contribution after-tax amount of $400 in Box 5 (or the data on the 1099R?) was supposed to be sent to the IRA administrator (the recipient of the 401K distribution), and the IRA administrator would put into their records to show $400 of the $200,000 transfer is after-tax?"

No, it's your responsibility to track your basis in nondeductible traditional IRA contributions. When you are next required to file Form 8606, you'll add the $400 on line 2 an provide an explanation for this adjustment to your basis as after-tax basis rolled over from an employer plan. Because this rollover of basis is not to be reported on Form 8606 until you are next required to file Form 8606, TurboTax does not automatically make this adjustment. When you do need to file Form 8606 for some other reason, you'll indicate to TurboTax that you made nondeductible contributions to your traditional IRAs, click the EasyGuide button, mark a box to indicate that you moved after-tax basis for an employer plan to your traditional IRAs, then enter the $400 adjustment. TurboTax will then prompt you to enter an explanation of the adjustment.

The investment gains and company match in the traditional 401(k) are pre-tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

Hello, thank you for the info. I do need to file Form 8606 for tax year 2023, because I have another/different traditional IRA that I rolled over a portion of it to a Roth IRA (I also did this in year 2022). Here is what I have:

1099R for partial 401K distribution to a traditional IRA (my question of this post)

Box 1 gross distribution - $200,000 (out of total amount $250M in 401K)

Box 2a taxable amount - blank

Box 5 employee contributions (portion of my after-tax contribution?) - $400

Box 7 distribution code - G with IRA/SEP box unchecked

1099R (different event/account from the 1099R above) for partial traditional IRA (different IRA account from above) rollover to Roth

IRA distribution - $60,000 (To Roth - $57,500, Tax Withheld - $2,500)

Box 1 - $60,000

Box 7 - code G with IRA/SEP unchecked

I also had this type of rollover for tax year 2022, and TurboTax filled out Form 8606 Part II, line 16-18. There were no numbers on Part I.

For tax year 2023, looking at the Form 8606,

- I have one 1099R for 401K distribution to traditional IRA, which is a non-taxable event. However, since some of the 401K distribution amount was after-tax ($400), so I have to fill out Part I, because I have a "non-deductible IRA", which is the $400?

- I have another 1099R for partial conversion of another traditional IRA to Roth, so I have to fill out Part II.

- Is Part I supposed to also include the $ for the traditional IRA to Roth conversion? on Form 8606 line 3, it asks "in 2023, did you take a distribution from traditional IRA...or make a Roth IRA conversion?". And I did, although it is a different traditional IRA account from the one that I made the 401K distribution. It looks that Part I would include both (1) the 401K distribution to traditional IRA, and (2) the traditional IRA (different IRA account) conversion to Roth? And then the Roth conversion number ($60,000 - $2,500 tax withheld = $57,500?) would be transferred from a line (i.e., line 8?) to line 16 on Part II?

I have the window desktop version of TurboTax Premier, and I cannot find the "EasyGuide" button per your reply. So I used the step by step interview feature in TurboTax to enter the two 1099Rs. The interview questions did not ask me about after-tax 401 distribution or non-deductible IRA. After the 1099R input, I checked the printed format of Form 8606, there are nothing on Part I, and it only shows my conversion from traditional IRA to Roth on line 16-18.

No sure what I did wrong. Please advise. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

The Forms 1099R that you have listed show no traditional IRA distribution. A Form 1099-R for a distribution from a traditional IRA will have the IRA/SEP/SIMPLE box marked and for a Roth conversion from a traditional IRA cannot have code G. Both Forms 1099-R appear to describe rollovers from a 401(k) to a traditional IRA. Also, tax withholding is not permitted to be reported on a code-G Form 1099-R because withholding is money that is not being directly rolled over, so it seems that the second of the Forms 1099-R that you listed has been messed up by the payer and will need to be corrected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

Hello, I made some typo errors on the data that is on the second 1099R. Here is the info on the two 1099Rs:

1099R for partial 401K distribution to a traditional IRA (my question of this post)

Box 1 gross distribution - $200,000 (out of total amount $250M in 401K)

Box 2a taxable amount - blank

Box 5 employee contributions (portion of my after-tax contribution?) - $400

Box 7 distribution code - G with IRA/SEP box unchecked

1099R (different event/account from the 1099R above) for partial traditional IRA (different IRA account from above) rollover to Roth

IRA distribution - $60,000 (To Roth - $57,500, Tax Withheld - $2,500)

Box 1 - $60,000

Box 2a taxable amount - $60,000

Box 4 FIT - $2,000

Box 7 - code “7” with IRA/SEP “checked”

Box 14 state tax - $500

Per my previous post on filling out Form 8606,

- I have one 1099R for 401K distribution to traditional IRA, which is a non-taxable event. However, since some of the 401K distribution amount was after-tax ($400), so I have to fill out Part I, because I have a "non-deductible IRA", which is the $400?

- I have another 1099R for partial conversion of another traditional IRA to Roth, so I have to fill out Part II.

- Is Part I supposed to also include the $ for the traditional IRA to Roth conversion? on Form 8606 line 3, it asks "in 2023, did you take a distribution from traditional IRA...or make a Roth IRA conversion?". And I did, although it is a different traditional IRA account from the one that I made the 401K distribution. It looks that Part I would include both (1) the 401K distribution to traditional IRA, and (2) the traditional IRA (different IRA account) conversion to Roth? And then the Roth conversion number ($60,000 - $2,500 tax withheld = $57,500?) would be transferred from a line (i.e., line 8?) to line 16 on Part II?

I have the window desktop version of TurboTax Premier, and I cannot find the "EasyGuide" button per your reply. So I used the step by step interview feature in TurboTax to enter the two 1099Rs. The interview questions did not ask me about after-tax 401 distribution or non-deductible IRA. After the 1099R input, I checked the printed format of Form 8606, there are nothing on Part I, and it only shows my conversion from traditional IRA to Roth on line 16-18.

No sure what I did wrong. Please advise. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

[Edited] That makes more sense. When entering the code-7 Form 1099-R, be sure to indicate that you moved the money to another retirement account, that you did a combination of rolling over, converting and cashing out, the indicate that $57,500 was converted to Roth.

When you get back to the page that lists the Forms 1099-R that you have entered, click the Continue button. After answering Yes, you made nondeductible contributions to your traditional IRAs, TurboTax will preset the following page:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

I've edited by previous reply. I though I saw that the second Form 1099-R still had code G even though the IRA/SEP/SIMPLE box is marked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

Hello, thank you again for the additional information. I re-input the two 1099Rs to TurboTax as a test to see how it calculates and generate the Form 8606 (without other data, just two 1099Rs). I appreciate if you could review the numbers to see if I did it correctly. See below for the input and result.:

First 1099R - for partial 401K distribution to a traditional IRA

Box 1 gross distribution - $200,000 (out of total amount $250M in 401K)

Box 2a taxable amount - blank

Box 5 employee contributions (portion of my after-tax contribution?) - $400

Box 7 distribution code - G with IRA/SEP box unchecked

Second 1099R - for partial traditional IRA (different IRA account from above) rollover to Roth – I also did a partial conversion for tax year 2022 which was the first roll-over year.

Year 2023 IRA distribution - $60,000 (To Roth - $57,500, Tax Withheld - $2,500)

Box 1 - $60,000

Box 2a taxable amount - $60,000

Box 2b taxable amount not determined – “checked”

Box 4 FIT - $2,000

Box 7 - code “7” with IRA/SEP “checked”

Box 14 state tax - $500

The second 1099R is related to a 401K conversion (this is a different 401K from the one converted in 2023 per the first 1099R) to the traditional IRA that I did in 2022. I also did a partial conversion in 2022 to Roth – the initial rollover amount to the traditional IRA was $300,000, and I moved $15,000, with $14,000 to Roth, $1,000 to FIT and state tax. A 2022 Form 8606 was generated, the only numbers that showed on the Form 8606 wee $14,000 Roth conversion on line 16 and 18 in Part II. All the lines on Part I are blank.

For 2022 -

Form 8606, Line 16 - $14,000, Line 17 – $0, Line 18 - $14,000

1040 4a and 4b (rollover) - $15,000 ($14,000 to Roth, $1,000 to taxes withheld)

2022 rollover IRA – 12/31/2023 balance per broker statement - $248,000 ($300,000 initial balance minus $15,000 distribution/conversion to Roth in 2022, minus $60,000 distribution/conversion to Roth in 2023, plus $23,000 investment gains through end of 2023)

2023 TurboTax Input

First 1099R - partial 401K distribution to a traditional IRA in 2023

- Input 1099R with data shown above for the first 1099R, including the $400 in Box 5

- Screen input – select “no this money didn’t rollover to a Roth 401K account”

- “no this money wasn’t rolled over to a Roth IRA account”

- “not public safety officer”, “not qualified disaster”

Second 1099R - partial traditional IRA (different IRA account from the first 1099R) rollover to Roth

- Input 1099R with data shown above for the second 1099R

- Screen input – “No” button for Roth Simple or SEP account, “No” for inherited IRA and transfer to charity, (My spouse has an inherited IRA account that she is taking required minimum distribution. Does her IRA count toward this calculation since it is her IRA, not mine, but we are filing a joint return?)

- “What did you do with the money?”-

- “I moved money to another retirement account”, “I did a combination, of rolling over, converting, or cashing out”, “amount converted to Roth IRA = $57,500” ($60,000 gross minus $2,500 taxes withheld”

- “did not put money in HSA”, “not disaster distribution”

“Continue” to “Any nondeductible contributions to your IRA?”

- “Yes, I made and tracked nondeductible contributions to my IRA” (per the first 1099R that has $400 in Box 5?)

- “Let’s find your IRA basis” -

- Total basis as of Dec 31, 2022 – What is this number? Is it the Non-deductible IRA basis? If so, it would be zero since I did not have any after-tax distributions in 2022.

- “EasyGuide” button -

- “Let’s see if there was a basis in your traditional IRAs on Dec 31, 2022” – again, what is this basis? Is it non-deductible IRA basis, or total IRA balances that I had at the end of 2022?

- I checked two boxes – “I filed Form 8606 in 2022”, and “I transferred money from an employer’s retirement plan to an IRA in 2023” (per the first 1099R with box 5 employee distribution)

- “Transfer from employer plans” – “net rollover basis from employer retirement plans = $400” (I used $400 that is in box 5 on the first 1099R, but the broker’s 401K statement that show the distribution from 401K to traditional IRA has a different amount of $900 labeled “after tax”. When I put $900 in this box as a test, Form 8606 picked up the $900 and the $400 is nowhere to be found. Does TurboTax ignore the $ on Box 5 of the 1099R? I don’t know which $ to use.)

- “Explanation” – I typed in “Some of the 401K rollover dollars were after-tax 401K contributions.” (Is the explanation sufficient? TurboTax generated a separate sheet to show this explanation)

- “Report Basis From Form 8606” – “IRA basis on Dec 31, 2022 = 0” (when I clicked “find this”, it says 2022 line 14. My 2022 Form 8606 only shows #s on line 16-18, all the lines in Part including line 14 are blank. So I put in zero/blank. Am I correct?)

- The next “EasyGuide” screen shows “rollover basis from employer retirement plans = $400”, all other lines are blank (including IRA basis as of Dec 31, 2022. Again, I don’t know what this is – is it non-deductible IRA from 2022, or my total IRA balances as of end of 2022?)

- “Tell us the value of your traditional IRA” – Is this the total of all my traditional IRAs, including the one that I converted from a different 401K in 2022, and the 401K that I just partially converted in 2023? If so, the one for the conversion done in 2022 has a balance of $248,000 at end of 2023 per the broker’s traditional IRA statement. And for the one that the conversion done in 2023, the 1099R shows $200,000 gross distribution. The screen says the information is on Form 5498. Form 5498 for the conversion done in 2023 won’t be available until May which will be after the tax filing. The broker’s traditional IRA statement for the 2023 conversion shows $201,000 ($200,000 from 401K conversion plus investment gains). For the 2022 distribution, the Form 5498 for the 2022 conversion/distribution “rollover contribution of $300,000” and “fair market value of $247,000”. To recap:

- 2023 401K conversion – IRA initial rollover = $200,000, broker’s traditional IRA statement at end of 2023 = $201,000, Form 5498 is not available.

- 2022 401K conversion (a different 401K) – IRA initial rollover = $300,000, Form 5498 for the 2022 conversion = rollover distribution $300,000, fair market value $287,000, broker traditional IRA statement end of 2022 was $296,000, and the broker's traditional IRA statement as the end of 2023 was $248,000. (with subtraction of the $60,000 converted to Roth in 2023). Which numbers do I use – initial rollover, broker statement at end of 2022 or 2023, or fair market value, which for the 401K conversion done in 2023, I don’t have the Form 5498 to get the fair market value).

- For the sake of testing, for the 401K conversion done in 2022, I used $248,000 on the traditional IRA broker’s statement at end of 2023, and for the 401K conversion done in 2023, I also used the $201,000 on the traditional IRA broker’s statement at end of 2023 (The 401K gross distribution was $200,000 per the first 1099R). The two IRAs total to $449,000.

Now the input is done. Looking at Form 8606:

- Line 2, 3, 5 show $400

- Below Line 3, A decision box asks “in 2023, did you take a distribution from traditional IRA...or make a Roth IRA conversion?". I made a Roth IRA conversion per the second 1099R which is for the traditional IRA that I converted in 2022. So it is “yes” and I go to Line 4, which would be zero since I was done with the Roth conversion at end of 2023?

- Line 6 = $449,000 ($201,000 is on the broker’s stmt as of 12/31/23 for the 2023 401K partial conversion to traditional IRA related to the first 1099R; $248,000 is on the broker’s stmt as of 12/31/23 for the partial traditional IRA conversion to Roth related to the second 1099R)

- Line 7 =$2,500 (per the second 1099R conversion to Roth, of the $60,000, $57,500 went into Roth, $2,500 went into taxes withheld)

- Line 8 = $57,500 (second 1099R, $57,500 went into Roth)

- Line 9 = $509,000 ($449M + $2.5M + $57.5M)

- Line 10 = 0.00079 ($400/509,000)

- Line 11 = $45 ($57,500 Roth amount x 0.00079)

- Line 12 = $2 ($2,500 taxes withheld x 0.00079)

- Line 13 = $47 (line 11 + line 12)

- Line 14 = $353 ($400 minus $47) – this will become the non-deductible IRA basis for 2024? If I have additional 401K after-tax contributions converted to traditional IRA in 2024, the two numbers will be the total basis on the 2024 Form 8606?

- Line 15a and 15c = $2,498 ($2,500 taxes withheld is “cash distribution”, which $2 is pro-rated as non-taxable amount to derive $2,498?)

- Line 16 = $57,500 ($60,000 IRA distribution per the second 1099R that $57,500 went into Roth)

- Line 17 = $45 (from line 11, pro-rated non-taxable Roth distribution based on the $400 after tax 401K contribution)

- Line 18 = $57,455 ($57,500 Roth minus $45 non-taxable amount based on the $400 after tax 401K contribution)

- TurboTax printed a separate sheet (no on the tax forms) which says “Some of the 401K rollover dollars were after-tax 401K contributions.” instead of on Form 8606.

Looking at 1040

- Line 4a = $60,000 (gross distribution on second 1099R, converted portion of the traditional IRA started in 2022).

- Line 4b = $59,953 ($60,000 minus $45 non-taxable pro-rated adj for Roth, and $2 non-taxable adj for cash distribution to fund the taxes withheld).

- Line 5 a = $200,000 (first 1099R Box 1, gross distribution for the 2023 401K conversion to traditional IRA),

- Line 5b = 0 (non-taxable event conversion from 401K to traditional IRA)

I know there is a lot to read. If you are willing to do the review, I appreciate very much of your time and feedback in advance. Thanks much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

Everything looks right. If I understand correctly, the $449,000 in traditional IRAs on December 31, 2023 is the sum of $201,000 in one traditional IRA and $248,000 in a different traditional IRA.

Your spouse's inherited IRA has nothing to do with this.

Basis in your traditional IRAs is nondeductible contributions. Your basis in traditional IRAs on December 31, 2022 was zero if you never made any nondeductible contributions to your traditional IRAs prior to 2023.

I suspect that the $900 on your 401(k) statement indicated the dollar amount rolled over to the traditional IRA from the entire after-tax sub-account in the 401(k) which consisted of $400 of after-tax funds and $500 of taxable earnings. The amount in box 5 of the Form 1099-R, $400, is the amount of after-tax basis that rolled over to your traditional IRA which is transformed into nondeductible traditional IRA contributions.

I would be a little more specific in the explanation statement by indicating the actual amount, $400.

Regarding the $353 on line 14 of your 2023 Form 8606, yes, this amount carries forward to line 2 of the next Form 8606 that you file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

Hello, I appreciate the fast turnaround time of your review and feedback. To summarize my questions and your answers:

- The “value of all your traditional….IRAs” per Form 8606 line 6 are supposed to be the balances as of 12/31/2023? So, it is correct that I used the ending balances as of December 31, 2023 on the two broker’s traditional IRA statements, $201,000 and $248,000.

- Under “EasyGuide” – the “Let’s Find Your Basis – Total Basis as of Dec 31, 2022”, “IRA Basis as of Dec 31, 2022”, all are referred to “non-deductible IRA basis”. I did not have any after-tax 401K contributions that were converted to a traditional IRA in 2022, so it is zero (just wanted to clarify what you told me).

- The 2023 401K conversion to a traditional IRA is a partial distribution from the 401K. I still have dollars in the 401K and a small portion is “after-tax contributions”. The 401K administrator used % allocation of the holdings to come up with the amount that I wanted to convert, and now I have “after-tax” dollars sitting in both my 401K and traditional IRA.

- Under “EasyGuide” - The “Transfer From Employer Plans” screen input is confusing to me. The instruction says:

- “check paperwork…Look for nondeductible or after-tax contributions made from 2002 through the date of rollover” – I think I understand this instruction. My after-tax contributions made to 401K were from 2010 through 2013. I contributed over the annual limit, and instead of cutting the contribution off at the limit, my employer’s payroll system accepted the overage and put them as after-tax contributions. The total was about $600.

- “subtract the nontaxable portion of any withdrawals you took from the IRA after the rollover but before 2023” – I don’t understand this instruction. Subtract from “what”? Is it telling me to subtract the “IRA withdrawal” from the $600, which is the total after-tax contributions per the “paperwork” such as old 401K statements, to calculate the “Net Rollover Basis From Employer Retirement Plans”? So in the period after the rollover to IRA but before 2023, if I withdrew $1,000 from the IRA, of which $2 was non-taxable dollars using some kind of % allocation (i.e., 98% pre-tax, 2% after tax, which I don’t know what to use to calculate, and I assume I have to pro-rate the amounts since Form 8606 uses pro-ration to determine the after-tax adjustments), I am supposed to subtract $2 from $600? And then, how would I further come up with the “Net Rollover Basis”? I am confused.

- Since I don’t understand the instructions on this screen, for the “Net Rollover Basis From Employer Retirement Plans”, I just used the $400 in Box 5 of the 1099R. But I would like to know what the instruction means because I must have misunderstood it.

5. Per the paperwork that I found, for my after-tax 401K contributions (excluding any company match to my contributions and investment gains on the contributions), I should have $600 minus $400 (1099R box 5) = $200 still in my 401K as after-tax dollars. And when I convert the remaining 401K dollars to the IRA, say in 2024, in theory I’ll have this $200 after-tax dollars going into the IRA in 2024, and the $200 would be added to the $353 on line 14 of the 2023 Form 8606, and the total of $553 would be put on line 2 as non-deductible IRA basis?

6. For the explanation, I'll put in something like “The conversion of a 401K to IRA in 2023 included $400 after-tax 401K contributions. The IRA distributions were adjusted to reflect the after-tax amounts.”

Please let me know of your further feedback, particularly the meaning of #4 “Transfer From Employer Plans” instructions. Thank you again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

Any discrepancy between the $400 reported in box 5 of your Form 1099-R and the amount of after-tax basis you believe was actually included in your rollover would have to taken up with the plan administrator.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

Hello again,

I wasn't saying the $400 in Box 5 is incorrect. The $ looks reasonable per my 401K statement and your comment re: taxable earnings on top of the after-tax contributions. I am trying to understand what the instruction under “EasyGuide”, “Transfer From Employer Plans” screen input tells me to do - “subtract the nontaxable portion of any withdrawals you took from the IRA after the rollover but before 2023”,

to come up with the “Net Rollover Basis From Employer Retirement Plans”. What would I subtract the nontaxable portion of withdrawals from? Just want to find out in case I misunderstood or missed something in the process. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Transfer to Rollover IRA with After Tax Contribution

$400 is the correct amount to have entered via the EasyGuide. That was implied when I said that everything on your forms appeared to be correct.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

waynelandry1

Returning Member

tcondon21

Returning Member

VAer

Level 4

alien1676

New Member

mpapadop

Level 1