- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

[Edited] That makes more sense. When entering the code-7 Form 1099-R, be sure to indicate that you moved the money to another retirement account, that you did a combination of rolling over, converting and cashing out, the indicate that $57,500 was converted to Roth.

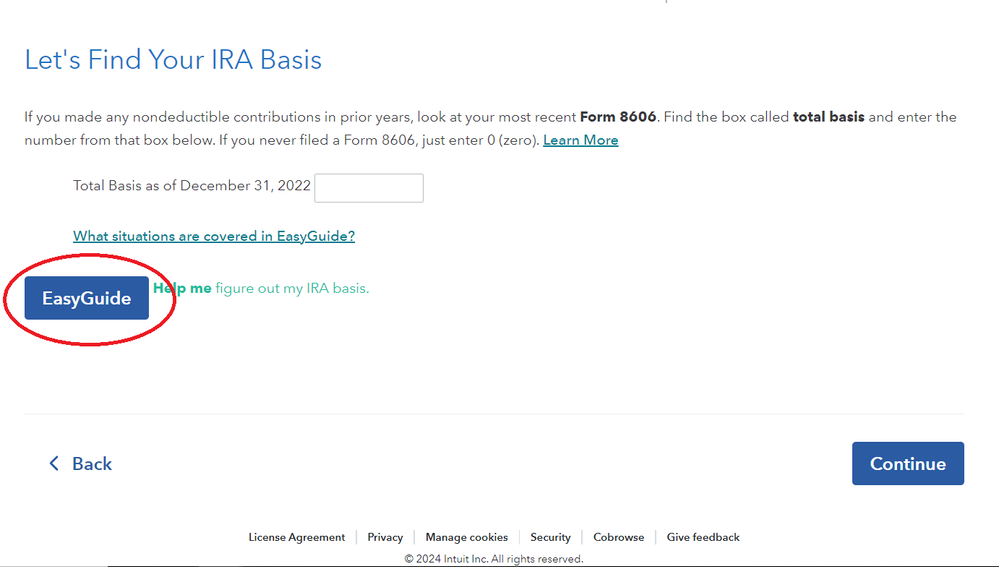

When you get back to the page that lists the Forms 1099-R that you have entered, click the Continue button. After answering Yes, you made nondeductible contributions to your traditional IRAs, TurboTax will preset the following page:

February 11, 2024

7:27 AM