- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 2023 federal tax estimated payments not calculated -- ball dropped

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 federal tax estimated payments not calculated -- ball dropped

Apparently, TurboTax omits calculating 2023 estimated taxes and preparing 1040-ES vouchers. This was calculated and prepared for NY state, but not for federal. Phone support informed me that TT was not "given access" to the federal 1040-ES worksheet for this year. I guess that's ok, but there was no warning or message, no note informing me to calculate this myself on the irs.gov site. I fear people will simply not make estimated tax payments if they use TT, thinking they just don't need to. they will then be hit with late payment penalties that will really be TT's responsibility. Also, that is part of what I paid for when I bought TT, and was offered a 20% off coupon that I can't used since I already filed. This is a pretty shocking oversight with absolutely no heads up given.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 federal tax estimated payments not calculated -- ball dropped

Unfortunately, you were given the wrong information.

The Federal estimated tax form preparation is still in the Federal tax preparation area,,,,and is in the exact same place it has been for quite a few years.

>"Federal" tax section

>>"Other Tax Situations" page ...just before the first Federal Review

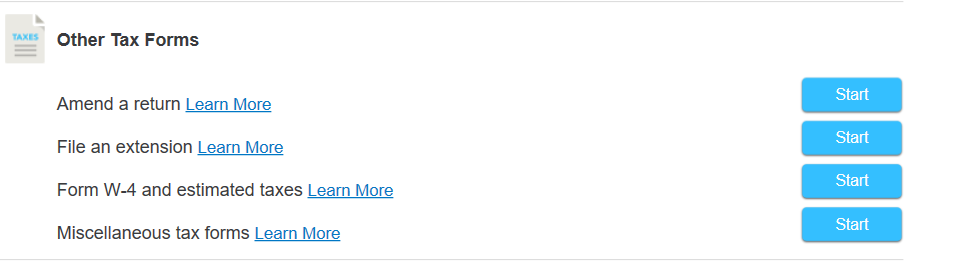

>>>Scroll down to "Other Tax forms" and expand it.

>>>> select "Form W-4 and Estimated Taxes"

Then when you go in there you skip the W-4 and continue on thru preparing the Federal Quarterly Estimated tax forms.

______

It's been on that page in the software...like...forever.

____________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 federal tax estimated payments not calculated -- ball dropped

My Desktop program automatically made federal estimated payments without me doing anything. But I will go in and refigure them. Had some extra income in 2022 so I can reduce them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 federal tax estimated payments not calculated -- ball dropped

Mine automatically prepares too....but I think (raw guess at this point) the trigger point for auto-prep may be whether the taxes owed is under $1000(?) for the current year .while ignoring any estimated taxes paid.

I always need to pay 3k-4k estimated taxes each year and come out around even....so ignoring those estimates paid I would have owed 3k-4k at tax time without them..so they autoprep without my doing anything to prompt their preparation. (But I also just shut them off, and pay what flat amounts I think I need to...electronically...online)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 federal tax estimated payments not calculated -- ball dropped

And the IRS always sends me preprinted 1040ES forms in the mail with my ssn and name but no amount and envelopes. Very nice. I just need to write in the amount. Then it fits in the window envelopes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 federal tax estimated payments not calculated -- ball dropped

Possibly, but they did say this was a specific and new omission for the 2023 filing process with the online version of TT when filing electronically. I did see that and filled out my estimated 2023 income. TT did calculate quarterly estimates for state and included printable vouchers in my final pdf. It omitted mention of estimated taxes and did not produce printable 1040-ES forms with my 2022 filing. The impression this could leave someone who wasn't sure what they should pre-pay in 2023 would be that they should pay state and not federal estimates. This is worse than just a warning that TT omitted calculating federal estimates. The state quarterly estimates are based on the same AGI number I put in for federal. So, long story short, I did enter and ask it to calculate quarterly estimates for federal, and it just ignored that request. When I called and this was elevated to "tier 2" support, they told me they couldn't provide 2023 estimates due to not "receiving access to the IRS's 2023 estimated taxes worksheets." That doesn't sound like something someone would make up to get a customer off the phone.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 federal tax estimated payments not calculated -- ball dropped

Yes, they said this problem was with the online version, not the desktop version, when used to efile. It is quite odd that they would claim they could not access the calculation sheets this year, then have that only apply to one version of their software. This makes me not trust TT's response. I'm guessing they just didn't have time to program this into both versions of their product. I guess they didn't even have time to provide the warning message: You're state estimated payments have been calculated and included in your return, but federal has been omitted. You should visit irs.gov for the 1040-ES worksheet and do that part yourself." --there TT, you can cut and paste this from here for other users.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 federal tax estimated payments not calculated -- ball dropped

I'm well above the trigger point, fortunately, which is how I know I need to pay quarterly estimates. If I were near it, I would have no way of knowing that TT whiffed on this. My problem may have been that I didn't need to pay quarterly estimates in 2022, then do need to for 2023. Again though, to calculate state estimates and omit federal without any warning or message is not a good glitch for tax prep software to have.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 federal tax estimated payments not calculated -- ball dropped

I just printed them myself from irs.gov. My complaint about TT is that they included printable forms in my pdf for state and nothing in federal, then told me to do it myself over the phone. Their risk is that other people don't think they need to pay federal estimates because the software omits them from the final filing and doesn't indicate they've been omitted (granted, maybe only in the online, efile version).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 federal tax estimated payments not calculated -- ball dropped

Thanks for the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 federal tax estimated payments not calculated -- ball dropped

same problem with desktop. thanks for sharing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 federal tax estimated payments not calculated -- ball dropped

Estimated payments are in the program. The form was later being released by the IRS but has been released and you should have full access online and desktop.

- Go to Other Tax situations

- Other Tax Forms

- Select W-4 and estimated taxes

- Select prepare now

- No to W-4

- Prepare estimated taxes? Select Prepare Now

- continue through the questions

You can choose to print the forms. The 1040-ES is not a part of your tax return since it does not affect your 2022 taxes. It is for your convenience.

The recalculated form shows up in your paperwork.

Below are some screenshots from the desktop version. Both step-by-step and Forms mode show the estimates.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 federal tax estimated payments not calculated -- ball dropped

I had to look for this too using the gaslighting-inspired advice provided in this thread. Found it. The software said it didn't print any vouchers because I didn't have to pay estimated taxes based on my information provided. BUT, I had to look for that statement. TurboTax should have notified me of this situation at the same location I would have otherwise found the printouts without me having to waste an evening hunting it down in the dusty corners of the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 federal tax estimated payments not calculated -- ball dropped

I second that comment. And worse, the "help" is a joke - it brings up a robo unit that does not even allow text input! So I cannot find where to calculate the estimated taxes ... if I wish to make different assumptions than TT apparently made when printing the ES forms. Where the heck did it get the numbers? I don't know.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 federal tax estimated payments not calculated -- ball dropped

Okay I goofed, I received and printed my tax return with the vouchers. I thought these vouchers were for my income tax due for 2022.

they were for estimated 2023 tax year.

is there any way to get the amounts transferred to my 2022 debt?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

elgato81

Level 2

rosanta

New Member

kwilcox695

New Member

lodami

New Member

paul22mcintosh

New Member