- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 2022 Turbotax Form 8915F-T - Cannot e-file

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbotax Form 8915F-T - Cannot e-file

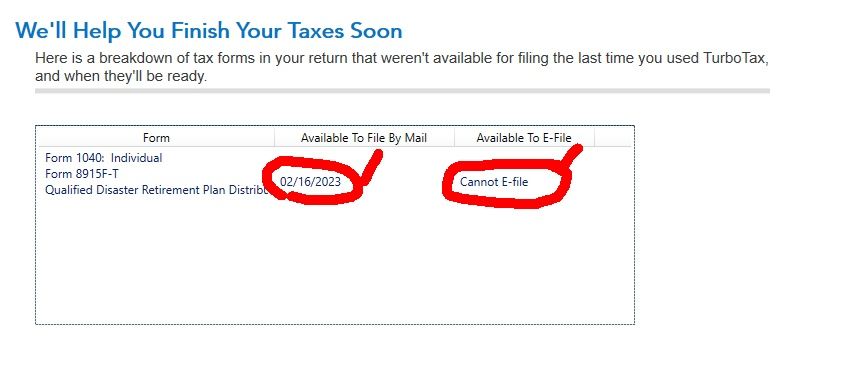

So I have been checking a couple of times a week to see when Form 8915F-T will be available in the 2022 desktop version. The software has consistently been saying that this form will be available to file by mail and e-file on 02/16/2023. All good.

Today the software says available to file by mail on 02/16/2023, but now says "Cannot e-file." This form and it's variants were able to be e-filed in TY 2021 and TY 2020.

Does anyone know more about this? Will we be unable to e-file for TY 2022 if we need to use this form?

-MER

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbotax Form 8915F-T - Cannot e-file

Bump on this. I have been waiting on this form as well and just noticed today that it says "Cannot E-file".

It previously said I would be able to e-file on 2/16/2023.

Does anyone have additional information on this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbotax Form 8915F-T - Cannot e-file

Just wait for it to be available.

Go to this TurboTax website for federal and state forms availability - https://form-status.app.intuit.com/tax-forms-availability/formsavailability?albRedirect=true&product...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbotax Form 8915F-T - Cannot e-file

Well that doesn't really answer my question. Will it be available for e-file? how do you know it is a typo?

I didn't ask about the table on the website. I asked about why, in the software itself, it previously said it that it be available for e-file on 02/16/2023 and now it says that form 8915F-T will only be able to be filed by mail.

I think your response just confuse the issue, has little credibility, and might lead someone to think that the question was answered when it was not.

"Just wait." Why? until when? based on what information?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbotax Form 8915F-T - Cannot e-file

hello, that form needs to be filed e-filled, I've done it since 2020. Will it or will it not?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbotax Form 8915F-T - Cannot e-file

Now it says to me this form is available to file on 2/23/2023. When it has been stated 2/16/23. It still says I can't e-file either!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbotax Form 8915F-T - Cannot e-file

While I am disappointed about the date being pushed back, that has happened with this form in the past, if I remember correctly this form it wasn't available until 03/14/2022 last year. If it's pushed back you can thank the IRS and not TurboTax, it just means the IRS is taking longer to certify Intuit as far as the validity of it's generation of the form.

My real concern is about the changes in the software stating that Form 8915F-T won't be able to be e-filed. And my annoyance is with Intuit for not stepping into this thread and giving an answer with as much information as currently available.

MER

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbotax Form 8915F-T - Cannot e-file

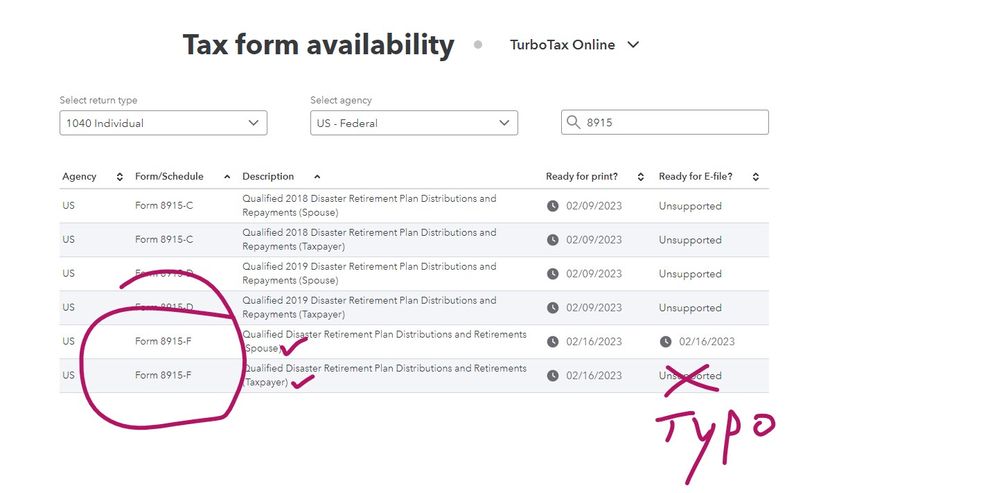

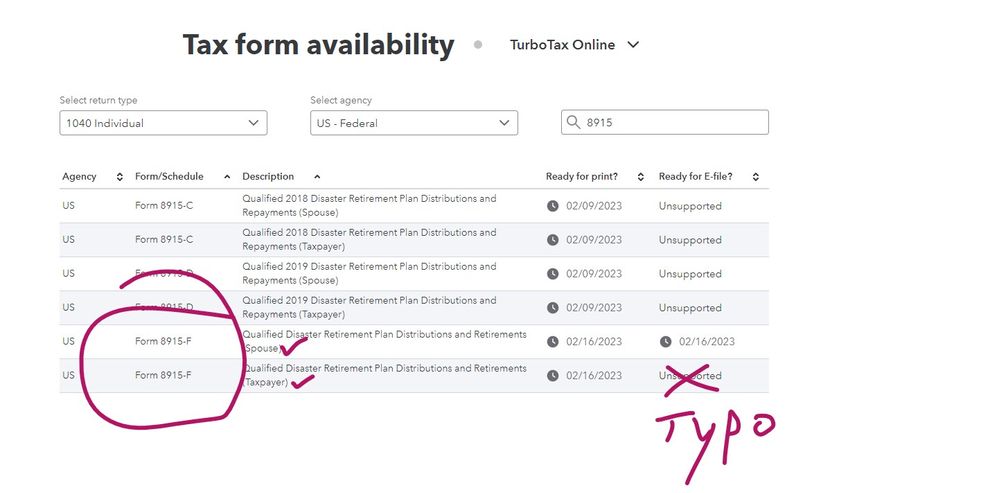

Agreed MER, and disappointed that they marked this question as solved. Also, why does the IRS form page say that the 8915-F (spouse) Will be able to be e-filed, but the other 8915-F listed wont? It would be nice to actually here from someone from Intuit on this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbotax Form 8915F-T - Cannot e-file

Agreed! The original question asked has NOT been solved. It should not be marked as such. The only thing on TurboTax that is confirmed as of now is that, on Feb 23 it will be available to File by Mail, and it still states that, re: 'Available to E-file' that 'Cannot e-file'.

I understand it may be delayed; as mentioned, it was delayed last year. But it's the means of filing that is up for discussion right now.

So I'd really like TurboTax to provide an answer to the actual question that was originally asked.

WILL Form 8715F-T (ever) BE AVAILABLE FOR E-FILE?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbotax Form 8915F-T - Cannot e-file

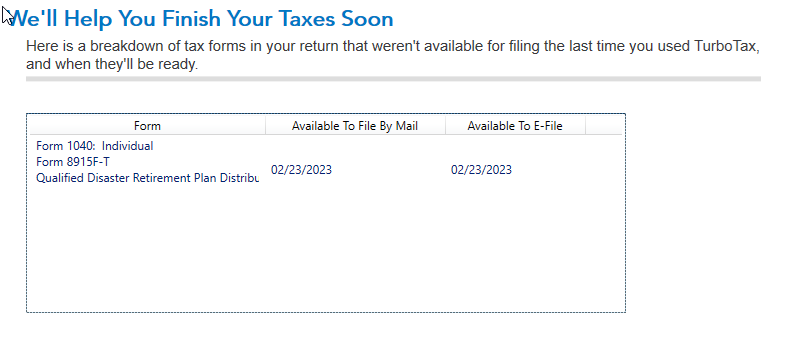

I am certain if the spouse's form will efile then the taxpayer's form will as well ... this must be typo on the chart ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbotax Form 8915F-T - Cannot e-file

Well your hunch may indeed have been correct. This is what the software just displayed (which is a change since just this morning.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbotax Form 8915F-T - Cannot e-file

correct! it has been updated now!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbotax Form 8915F-T - Cannot e-file

Now the date has been pushed back into March. Does anyone know how to seek a refund from TurboTax for their defective product?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbotax Form 8915F-T - Cannot e-file

Yes, that is disappointing. Looks like 03/02/2023 now. To be honest, this is exactly what happened last year, and it effected all e-file providers equally. As far as I understand it, all e-file forms have to be approved by the IRS, so even though the form is on the IRS website, each individual tax service has to go through a validation process.

So as far as getting a refund for TurboTax Desktop being defective, well it's not defective. It just won't have the form ready as fast as you like. My free advice is to transition to the online web version if you can. The online version is pay when you file and not before, so no locked in feeling. Then you can go to anyone you'd like and file your taxes at the earliest possible moment.

That's what I am doing next year after this CARES retirement distribution nonsense is finally over. I will start using TurboTax online TY 2023.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbotax Form 8915F-T - Cannot e-file

My issue with this is, I've never taken a Disaster Relief Distribution, so I can't figure out why I would even need this form. I answered NO to that question, that I have never taken one yet still I cannot e-file because this form is not finalized. Why would I need to file this form? Does anyone know if this is a glitch or if this form is required for all e-filed returns?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

johnsonmaixe

New Member

randerson053

New Member

user17714250349

New Member

rmhoff1976

New Member

richardkersey99

New Member