- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-NEC Legal Settlement Problem "Missing Info!"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Legal Settlement Problem "Missing Info!"

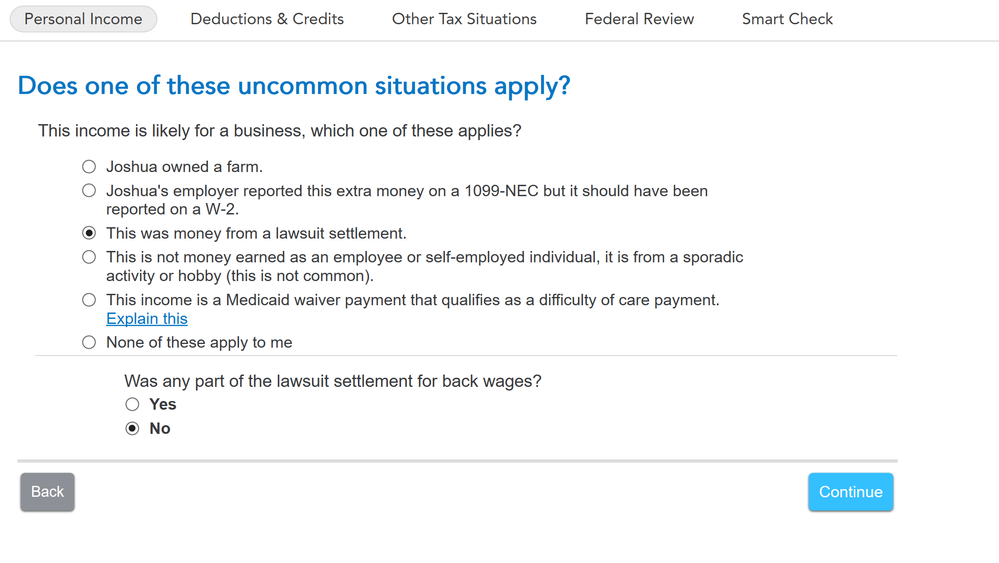

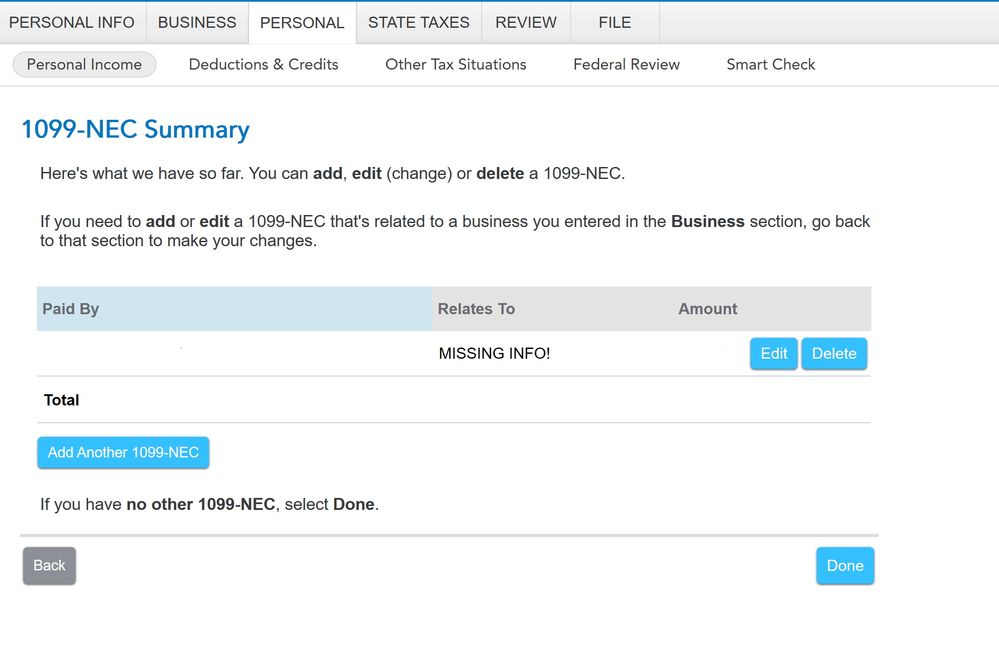

I am running into a problem where TurboTax Home and Business want to report a 1099-NEC for my wife as "self-employment." However, it is not self-employment. They are two lawsuit settlements. I understand they are taxable. When I step through the process, Turbo Tax has an error that wants to keep reporting it as sell employment income. Which it is not.

When I select a settlement, it does not let you do anything else. It says it is "Missing Info"

I need to get a fix for this problem.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Legal Settlement Problem "Missing Info!"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Legal Settlement Problem "Missing Info!"

Yes, unfortunately reporting a 1099 NEC through proper channels in the program does lead to a Schedule C. There is a better way to report but before you do this, delete your 1099 NEC entry first and get that dreaded Schedule C out of your program.

Once this is deleted, go to tax tools>tools>delete a form>delete Schedule C and all of its worksheets if these are still there.

Now log out of your program and then back in to see if this annoying schedule appear again. Now let's enter this so that it doesn't appear like it's self-employed income.

- Log into your account

- Select Wages and income

- Less Common income

- Miscellaneous Income, 1099-A, 1099>start

- Scroll to the bottom of the page to Other Reportable Income

- Other taxable income, answer yes

- Then give a brief description of the income and the amount listed. For the description, enter this as "Lawsuit Settlement Reported on a 1099 NEC and the amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Legal Settlement Problem "Missing Info!"

The problem is I do need the Sch C. for some work I do do on my own.

I did find a solution.

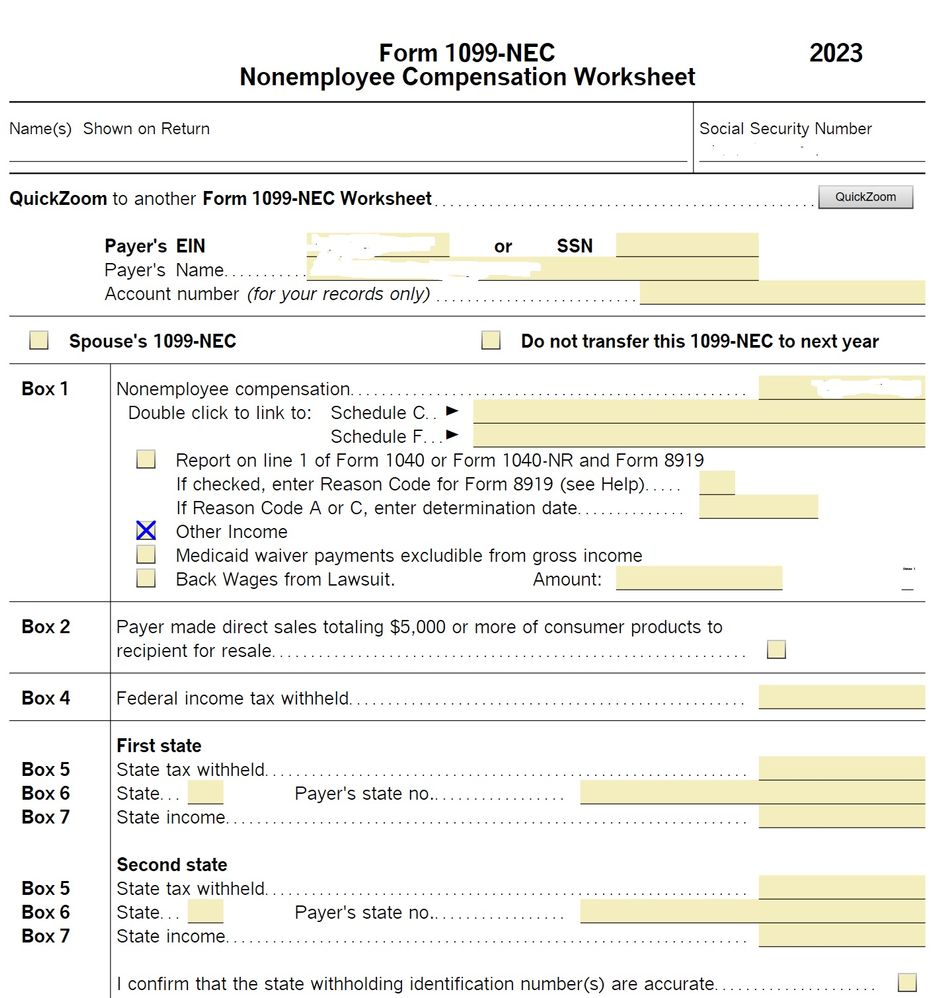

If you go to the 1099-NEC form, you can select other income.

That solves the problem, it also does not have it reporting on the Sch C.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ARJ428

Returning Member

rosariodasal7

New Member

DonnaTahoe1

New Member

sandyreynolds

Level 1

Tdevs

Level 1