- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-MISC Worksheet Robinhood

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Worksheet Robinhood

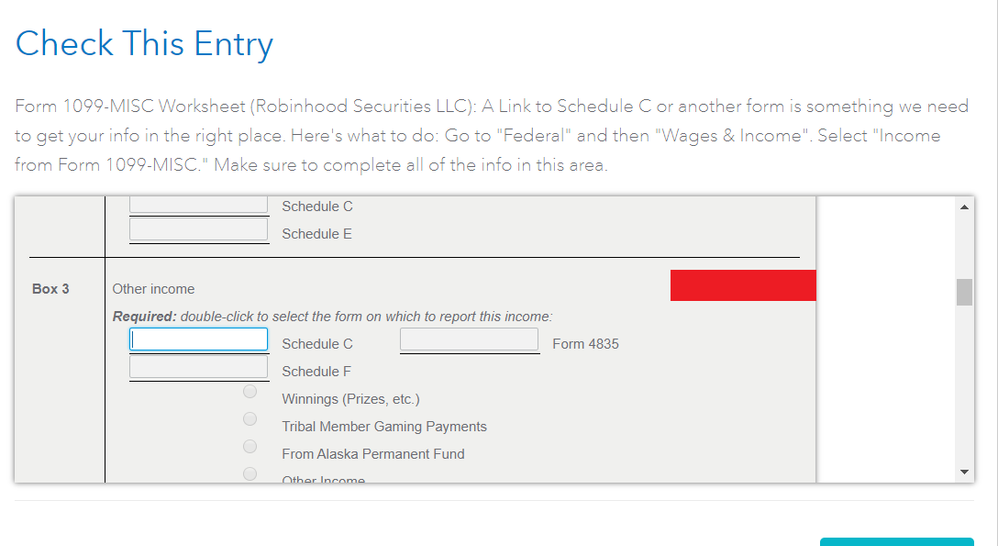

I'm getting this review error before submitting my taxes. It says I need to review my 1099-MISC worksheet from Robinhood and add something to line Schedule C. Anytime I enter something and save it, it keeps telling me I have to review it and won't let me submit my taxes. (See screenshots below)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Worksheet Robinhood

TurboTax is trying to figure out how to treat the income from the 1099-MISC. If it is associated with a Schedule C (self-employment income for a trader business you operate) you could double-click that box and you should be able to select your Schedule C.

If on the other hand it is a promotional payment associated with personal investing, it is not self-employment income, and when you enter the 1099-MISC you should designate it a "Robinhood incentive", and on the next screen designate it as either "prize winnings" or "manufacturer's incentive" depending on which you consider it to be.

You should be able to go back to the Wages and Income>>Income from Form 1099-MISC section to designate the payment accordingly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Worksheet Robinhood

TurboTax is trying to figure out how to treat the income from the 1099-MISC. If it is associated with a Schedule C (self-employment income for a trader business you operate) you could double-click that box and you should be able to select your Schedule C.

If on the other hand it is a promotional payment associated with personal investing, it is not self-employment income, and when you enter the 1099-MISC you should designate it a "Robinhood incentive", and on the next screen designate it as either "prize winnings" or "manufacturer's incentive" depending on which you consider it to be.

You should be able to go back to the Wages and Income>>Income from Form 1099-MISC section to designate the payment accordingly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Worksheet Robinhood

Thanks for thorough explanation!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Worksheet Robinhood

I have the same problem.I am using online version and purchase TURBOTAX PLUS BENEFITS 2.0 TAX YEAR W/REFUND PROCESS SVC R2019 .It is still saying I am on Free version.Double click does not do anything.I have entered all possible values and it keeps saying review is not completed!!!!Please fix this glitch .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Worksheet Robinhood

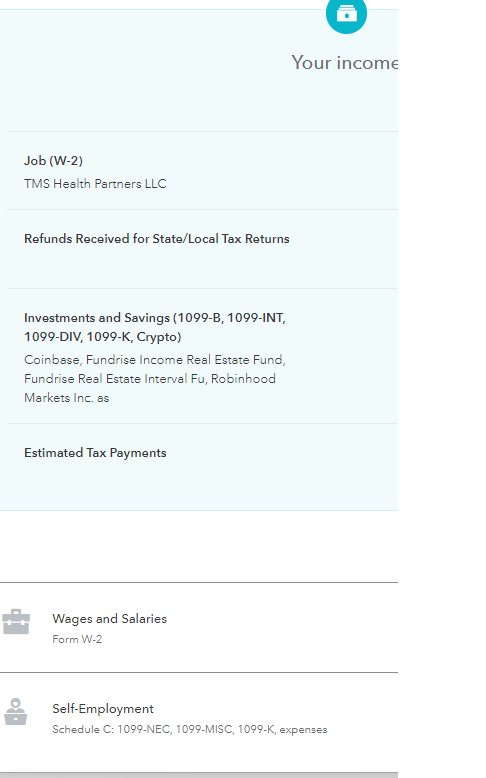

I'm getting a similar error however, I cannot find my 1099-MISC under the Robinhood form. Do I need to create another 1099-misc?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Worksheet Robinhood

Maybe. But first, click on the button to the right of the Investments section (with Robinhood and Coinbase in your ss) - The button will say Edit or Update, or Review. Then you should see a full list of your entries and be able to edit each one. Your picture is just a short summary of that section. Expand it by editing that section. If you don't see the transaction 1099-B you are looking for, then you can click on Add Investments and add it. @medandrewdhfoo

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Worksheet Robinhood

Thanks! Was struggling with this since sometime 🙏

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Worksheet Robinhood

If you go back to the 1099-misc entry under federal, make sure the 0.00 in box 2 is deleted and try again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Worksheet Robinhood

Any fix for the app? I can't seem to double click, it always just opens my keyboard.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Worksheet Robinhood

If you imported a 1099-Misc, you could also choose to enter it manually if you're getting errors.

If the income is associated with Self-Employment, in the Income section, under Self-Employment Income, set up your Business if you have not done so. Then you're asked to enter income for this business, which is where you can enter the 1099-Misc.

If you're using TurboTax Desktop, and you've imported the 1099-Misc, go to Forms, Open Form, type in 1099-Misc and double-click to open the form. Then at the box next to Schedule C, click the arrow to link the form to Schedule C.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

katalitik_tax

New Member

PJhiker

Level 3

optimusa5

Level 1

wqtclaire

Level 2

lawells135

New Member