- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-Div box 8 for US only divideds

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div box 8 for US only divideds

I have a US brokerage 1099 with US and multiple international dividends. In the Turbo Tax desk top version I created a 1099 form for each international country and one for US dividends. In running smart check it says I need to enter a response other than ""not applicable" in box 8 for the US only dividends.. Cannot figure out how to fix?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div box 8 for US only divideds

You don't need to create 'dummy' 1099-DIV forms for your foreign dividends that are reported on a 1099-DIV from your US broker.

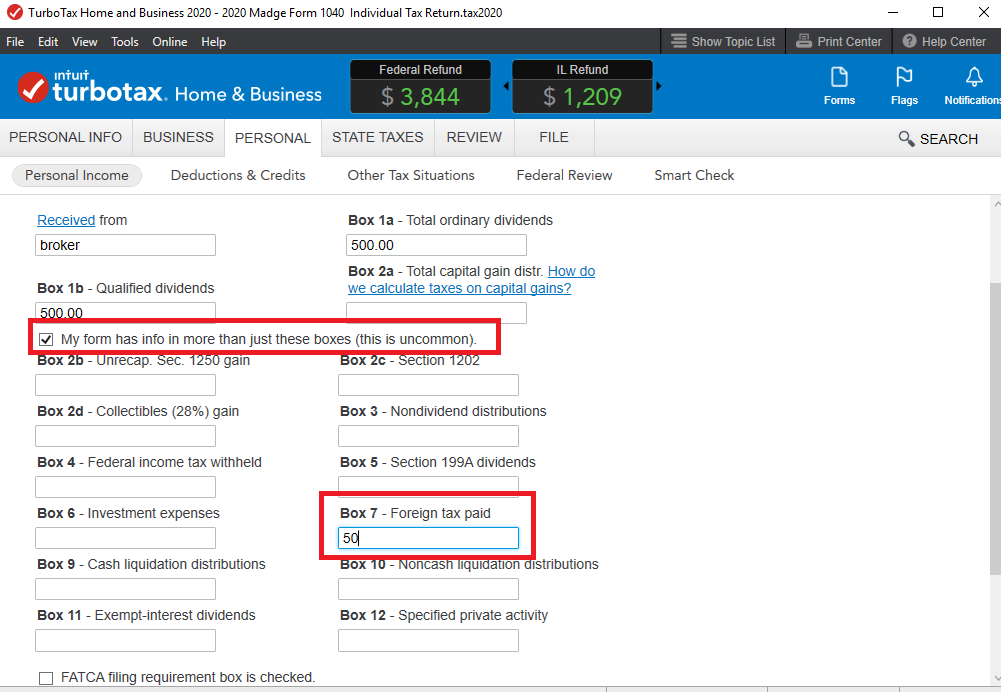

When entering your 1099-DIV, check the box to indicate 'I have more info..' and enter the amount of Foreign Tax reported on your 1099-DIV in Box 7 (screenshot).

This info will transfer for you to the Foreign Tax Credit section.

Click this link for info on How to Claim a Foreign Tax Credit.

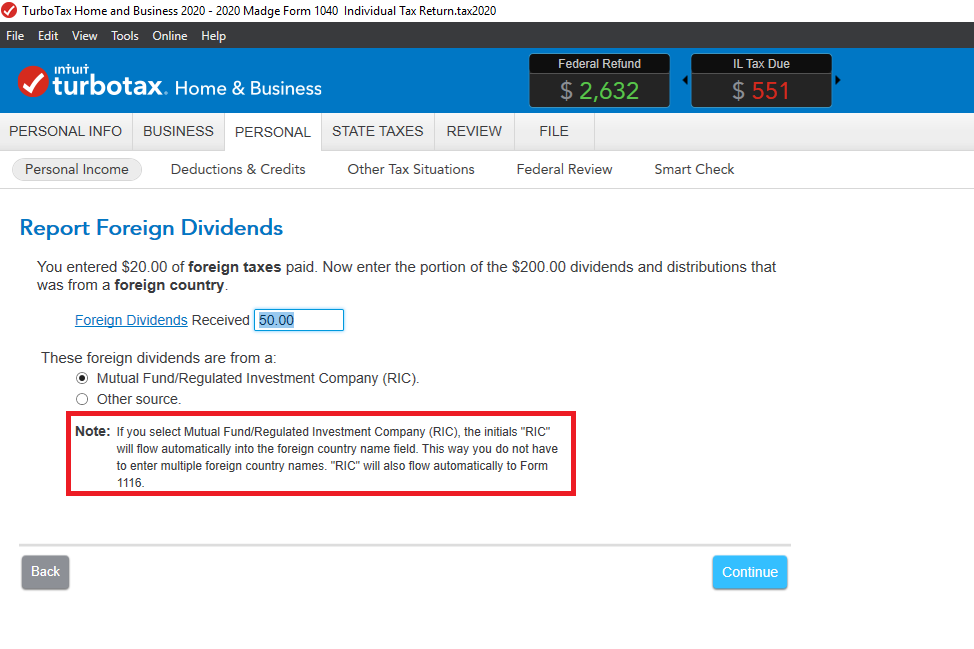

In the Foreign Tax Credit section, you enter the total amount of your Foreign Dividends and use one country 'RIC' to report this amount (screenshot).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

eric6688

Level 2

trock69

New Member

acowley1990

New Member

naejay32

New Member

kduckles

New Member