- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B

Having a challenge entering 1099-B info. 1a = "Property is shares - 0005401.58" A box 5 is X'd "If checked, noncovered security. TT does not ask or show a box 5 question. TT will not allow me to proceed because box 1e regarding cost or basis is blank. I can send to a JPEG pic of my 1099-B to a TT Expert if that is allowd.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B

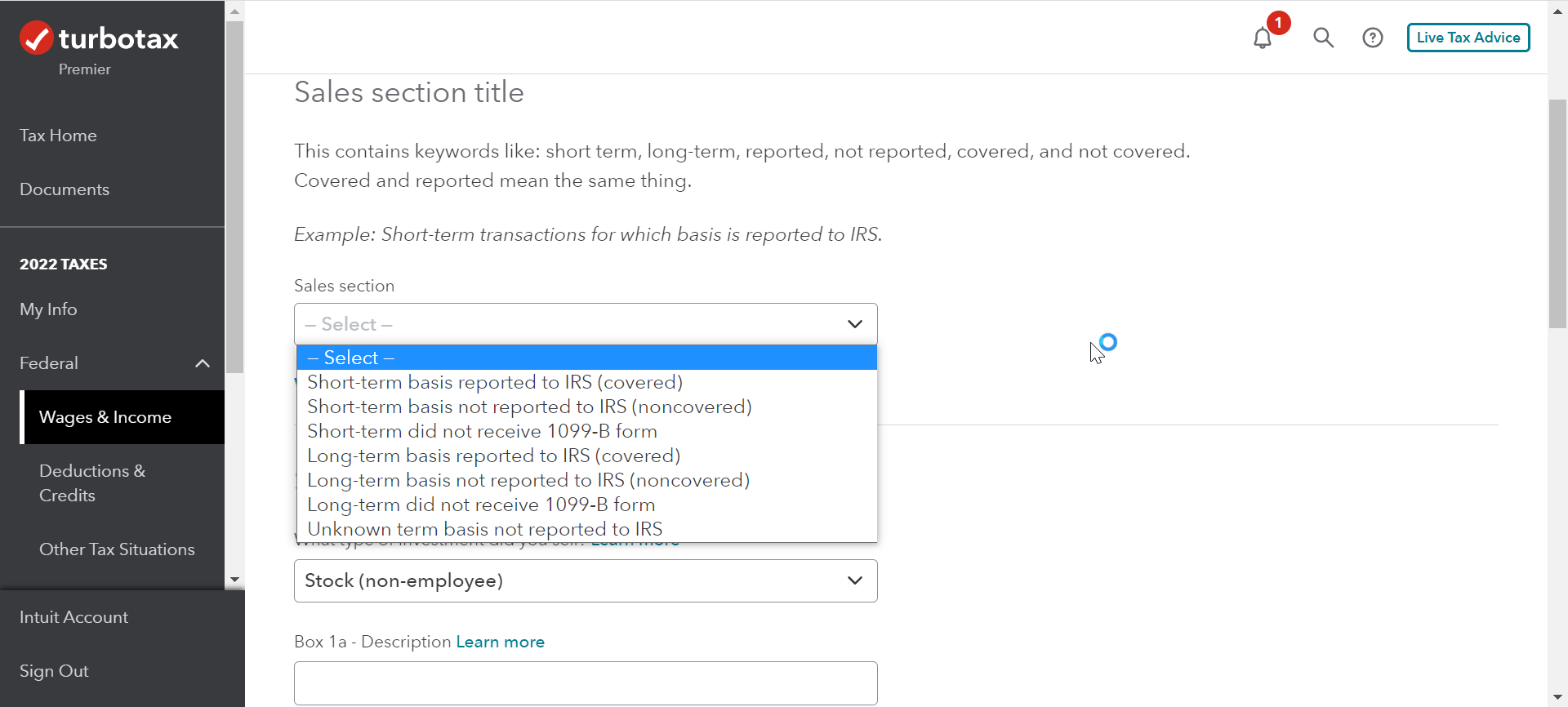

To clarify, did you enter information in the sales section in your program? There is a drop-down in the sales section in your program where you make the selection that it is either a long/short term non-covered security if you are using Turbo Tax Online. Here is a picture on what this would look like. Please let us know if you are using the online version or the software.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B

Using TT Delux software on PC. I pulled down and selected"Unknown term basis not reported to the IRS". This 1099-B is related to an inheritance in the proceeds was distributed among 4 persons of which I am one. 1099-B boxes: 1a = "Property is Shares"; 1b = blank; 1c = 02/01/2022; 1d = $86,833.61; 1e = blank; 1f = blank; 1g = blank; 1g = blank; 2 = all blank; 3 = all blank; 4 (FWH) = $8,683.36; 5 = checked box "non covered security"; 6 = "Gross proceeds" box checked; 7, 8, 9, 10, 11, 12, 13 = all blank. SWH = yes, MI, but no state ID #.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B

Since this is an inheritance you should contact the executor of the estate to find out what the basis is in order to enter it here. If there is no way to do that then you can enter a zero for the basis but that will result in the full amount being taxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

brentharm

New Member

kherder1

Returning Member

tbs7184

New Member

DAVE1610

Level 2

starkyfubbs

Level 4