- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B

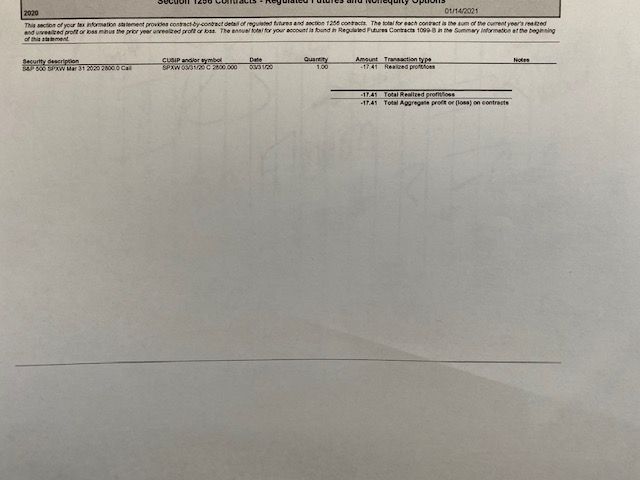

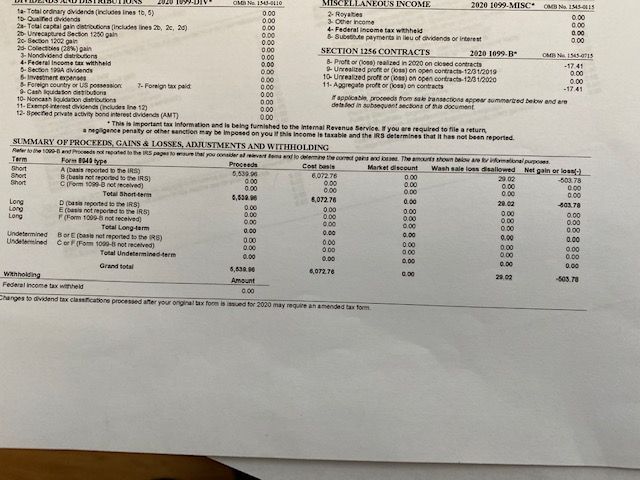

I received a 1099 from Ameritrade and I am unsure of how to enter it on my taxes. I have a summary of gains and losses, showing the following = Proceeds $5,539.93, Cost $6072.76, Wash sale $29.02, Loss $503.78. On the detail section it says option sale. Do these get reported on my tax return? If so where and on what form?

Also, on that summary page it says 1099-B Section 1256 contracts realized in 2020 on closed contracts Loss ($17.41) and then is says Aggregate loss on contracts ($17.41) - Does this get reported on my taxes and if so where and what form?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B

yes the activity gets reported on your taxes. Turbotax should be able to import the security trades or enter them on the 1099-B worksheet. Not sure if you can import the 1256 info. that info gets enter on form 6781 broker name and the net loss. use search box enter 6781 and jump to form. certain versions of Turbotax online do not handle security transactions. you would have to upgrade.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B

That is the problem I cannot get it to import,

- So I was trying to determine if the 1099B that shows my losses for option sales goes on the Schedule D and if so, do I just treat them as regular sales of stock? (I attached the first page and one of the several pages that show the detail)

- And how to enter the Section 1256 Contracts (what form they appeared on).I also showed the first page and then the detail)

The Form is odd, it shows Summary of proceeds, but it really isn't listed as 1099-B for the option sales.

And then there is a section that shows 1256 Contracts (2020 - 1099B). So was hesitant on what gets entered and what does not and where they go.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

kelly48577

New Member

sacosta11

New Member

confusedmeghan

Returning Member

yamoinca

Level 2

Tammiefosdick

New Member