- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1095-A total premium is not matching with the amount of self employed health insurance deduction on Schedule-1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A total premium is not matching with the amount of self employed health insurance deduction on Schedule-1

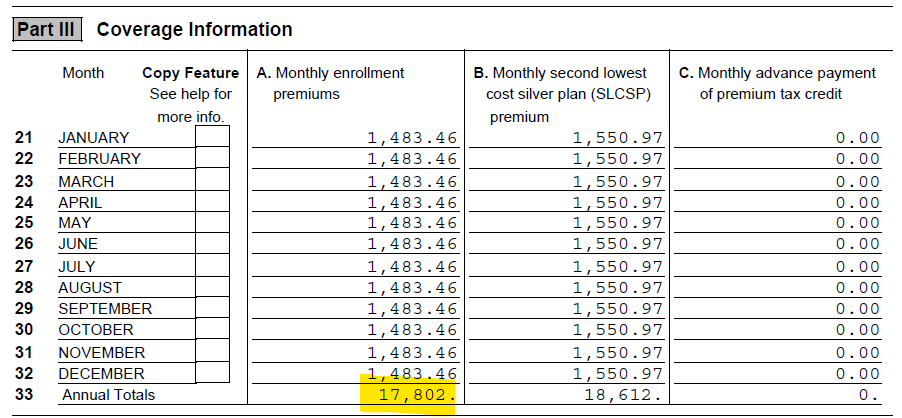

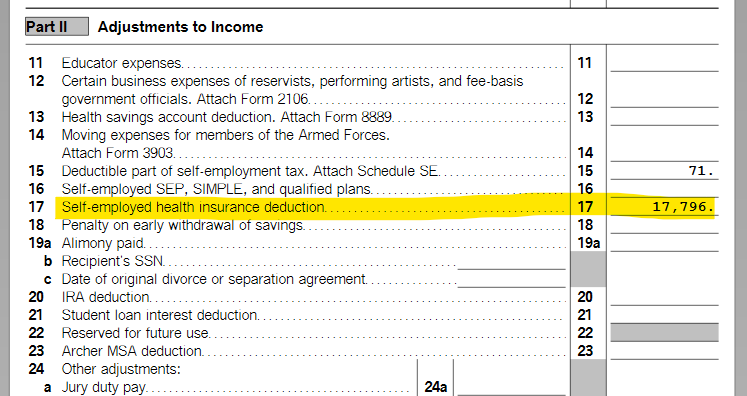

I am a self employed individual and purchased health insurance from NJ market place. Received 1095-A and entered the same in personal deductions under Medical. At the end of entering 1095-A, I selected the check box that says "I am self employed and bought a Marketplace plan". The total amount for 2023 in column A of 1095-A is $17801.52. However, the amount shown on Schedule-1, "Adjustments to Income" section (Line 17) "Self employed health insurance deduction" is $17796. The difference is not that big, but I am trying to understand how TurboTax arrived at a smaller number than what is shown in 1095-A. No-where Turbo Tax is showing the calculation amount.

Anyone aware of what Turbo Tax doing behind the scenes?

Attaching the 2 screenshots for your reference. And I am using TurboTax Home & Business Desktop on Windows.

Thanks

1095A

Schedule-1 is below

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A total premium is not matching with the amount of self employed health insurance deduction on Schedule-1

Is your profit $17,796 on Schedule 1? The Self-Employed Health Insurance deduction is limited to your earnings. Meaning, you cannot deduct more than you earned. It cannot create a loss on your return, so if your earnings were $17,796, then this would be the maximum deduction you would be able to take.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A total premium is not matching with the amount of self employed health insurance deduction on Schedule-1

Thanks for looking into this @Vanessa A . Answer to your question is No. My profit is little over 20K. There is no other number even close to this deduction amount, that makes me wonder if Turbo Tax is committing any error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A total premium is not matching with the amount of self employed health insurance deduction on Schedule-1

Did you take a home office deduction? This would also reduce the amount of the deduction you could take as would any retirement savings contributions or the 1/2 of your SE tax deduction.

Start by looking at Schedule 1 line 3. This will give you the starting point for your Business income. Then look at lines 15, 16 and 17. Since your SE Health Insurance deduction is limited, these 3 numbers will likely add up to line 3 of Schedule 1.

If you are using the desktop version just switch to forms mode to see your Schedule 1. If you are using the online version then On the menu bar on the left that shows.

- Select Tax Tools

- On the drop-down select Tools

- On the pop-up menu

- Select View Tax Summary

- On the left sidebar, select Preview my 1040

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A total premium is not matching with the amount of self employed health insurance deduction on Schedule-1

I never took home office deduction. Other boxes you mentioned are all looking good.

Thank you

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

zbchristy501

Returning Member

ycarreto17

New Member

shivasfeet

New Member

jlbusiness

New Member

bbbbgallant

New Member