- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A total premium is not matching with the amount of self employed health insurance deduction on Schedule-1

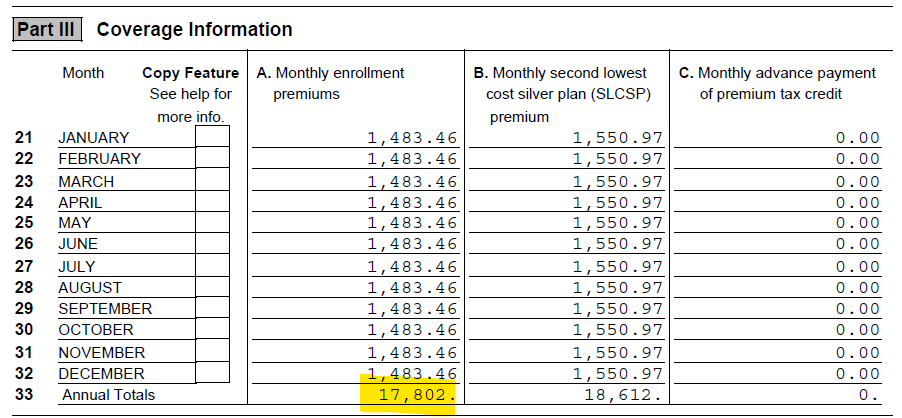

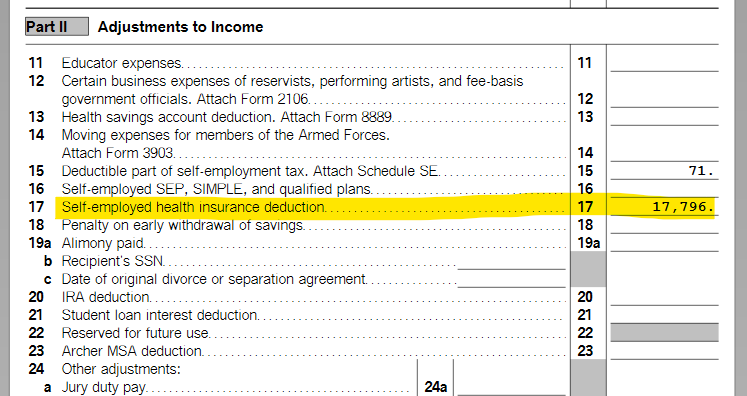

I am a self employed individual and purchased health insurance from NJ market place. Received 1095-A and entered the same in personal deductions under Medical. At the end of entering 1095-A, I selected the check box that says "I am self employed and bought a Marketplace plan". The total amount for 2023 in column A of 1095-A is $17801.52. However, the amount shown on Schedule-1, "Adjustments to Income" section (Line 17) "Self employed health insurance deduction" is $17796. The difference is not that big, but I am trying to understand how TurboTax arrived at a smaller number than what is shown in 1095-A. No-where Turbo Tax is showing the calculation amount.

Anyone aware of what Turbo Tax doing behind the scenes?

Attaching the 2 screenshots for your reference. And I am using TurboTax Home & Business Desktop on Windows.

Thanks

1095A

Schedule-1 is below