- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1042-S MA State Question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1042-S MA State Question

Hi

My spouse is on F1 visa and have got 1042-S(form for income tax treaty).

We are filling taxes jointly, so he might be considered resident alien for tax purposes.

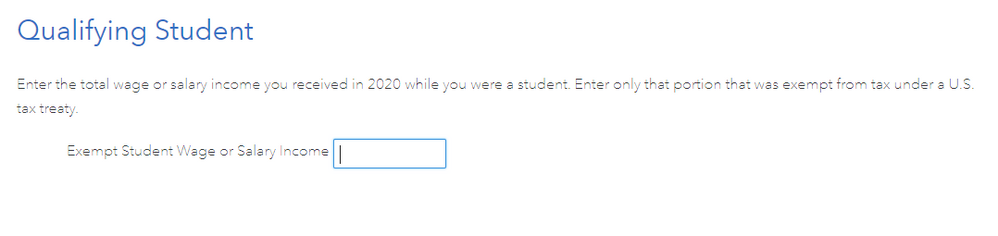

While filling the MA state taxes , Can we enter the amount on the 1042-S in the Qualifying Student or not

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1042-S MA State Question

No, Form1042-S, Foreign Person's U.S. Source Income Subject to Withholding, is not meant to report a qualifying student.

The purpose of this form is to advise the IRS that income paid to a Foreign Person is U.S. sourced.

Whether your income is subject to a reduced rate of withholding (due to claim of tax treaty benefits on form W-8) isn't relevant. It can be confusing because it is possible to claim a treaty and not withhold. It might be easier to think of the 1042S as a 1099 MISC.

To report form 1042S on TurboTax, you'll have to enter the information as miscellaneous income based on income code in Box1.

For more details on how to do it, view this step by step TurboTax article. Be sure that you enter it correctly on the Federal Side and then move to MA state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1042-S MA State Question

we have entered 1042-S as other reportable income as mentioned in the link.

what about we have to enter in the qualifying student?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1042-S MA State Question

For Qualifying Student, the amount should be $0 because it refers to wages and salary income. If the income received by your spouse is reported on a 1042-S, then like a 1099-MISC, it is paid independently and not as an employee. Wages / salary do not apply.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

yingmin

Level 1

VAer

Level 4

Kh52

Level 2

rajasekhar-madugula

New Member

srobinet1

Returning Member