- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Tax law changes

- :

- Do I need to file FBAR with 1 foreign bank account having a balance of less than $1000?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to file FBAR with 1 foreign bank account having a balance of less than $1000?

I have only 1 foreign bank account having a balance of less than $1000.

I read on this forum that FBAR is required only of foreign account(s) have a total of over $10000.

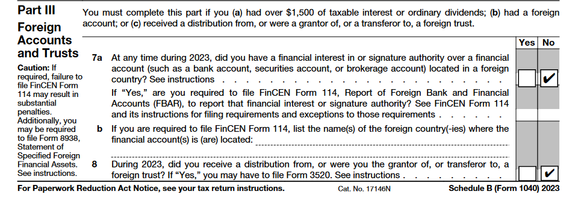

But I see the form 1040 has this section:

Q1) So here do I say Yes or No ?

If I say 'Yes' here, do I file FBAR ?

Q2) Is there any difference between FBAR and FinCEN Form 114 ?

Q3) Am I required to file 8938 (FACTA) ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to file FBAR with 1 foreign bank account having a balance of less than $1000?

If you are referring to the question about FinCen Form 114, this would be a no answer. FinCEN 114 and FBAR is same thing. FinCEN 114 is the name of the REPORT that the Dept of Treasury uses to report Foreign Bank and Financial Accounts (FBAR) with a financial interest in, or signature or other authority over, one or more foreign financial accounts with an aggregate value greater than $10,000 at any time during a calendar year.

You are not required to file 8938 if your account balances below $10K. The reporting thresholds are much higher than the FBAR reporting requirements.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to file FBAR with 1 foreign bank account having a balance of less than $1000?

I closed such a foreign account last year and received just under $1700 in my US bank account. I don't know if I should report or how to report it. Your thoughts?

SingerHiker

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to file FBAR with 1 foreign bank account having a balance of less than $1000?

@SingerHiker You must file if the aggregate value of your foreign accounts exceeded $10,000 at any time during the calendar year. Check out this IRS link Report of Foreign Bank and Financial Accounts (FBAR) for details on who must file, when to file, and other requirements. And here are the instructions from TurboTax on How to File an FBAR report (FinCEN 114).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

smith-zaneta

New Member

gracierocks35

New Member

Byrdzs

New Member

SSEXTON2

New Member

nikki-lincoln22

New Member