- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- work at home accounting method

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

work at home accounting method

I work for the federal government from home. I go into the office only when my laptop fails or some administrative need calls. I'm trying to take a standard deduction for using a portion of my home as a home office. The smart check is saying there is an error, please provide the accounting method. I have no idea what to put in this field. There isn't any accounting going on. Any ideas? Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

work at home accounting method

Job-related expenses for employees are no longer deductible on most people’s federal return in tax years 2018 through 2025 due to the Tax Cuts and Jobs Act (TCJA) that Congress signed into law on December 22, 2017. However, the deduction for job-related expenses is still available to people who work in one of these specific professions or situations:

- Armed Forces reservist

- Qualified performing artist

- Fee-basis state or local government official

- You're disabled and have impairment-related expenses

Additionally, job-related expenses may be deductible in your state. Enter your expenses and we’ll figure out if you can deduct them. Expenses that qualify for this deduction are those the IRS considers "ordinary and necessary" for work, like uniforms, tools, union dues, licenses, and travel between job sites.

_______________________________________________________________________________________

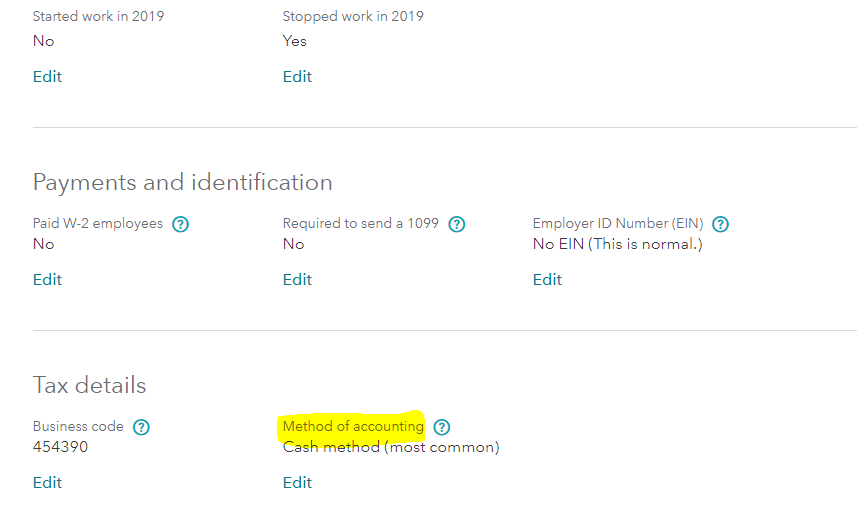

If you are self-employed, the home office expense is reported on your Schedule C. To edit your method of accounting, search for schedule c and select the Jump to schedule c link in the search results. Click on Review next to your business and then select Edit next to General Info. Scroll down to Method of Accounting and click Edit underneath. Use the blue links to see an explanation of the method of accounting options.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

work at home accounting method

Thanks so much for your reply. I'm still a little confused. It looks like you're suggesting I put "cash method" for the required "method of accounting" field. However, the beginning of your reply strongly suggests I shouldn't be trying to take a home office deduction at all. I work for the federal government. I am not a contractor. I am an employee of the Department of Veterans affairs. I work from home full time. I thought I got a deduction for that. Is that no longer the case? Please let me know what you think. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

work at home accounting method

There used to be a deduction for a home office for a salary worker, but it has been suspended for most taxpayers as a result of the new tax regulations implemented in 2018.

Only disabled individuals, military reservists, fee-based government officials and statutory employees can take the deduction in 2019 on their federal tax return.

However, some states still allow the deduction, so you can enter it in TurboTax, as it may benefit you on your state tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

work at home accounting method

I am a State licensed elevator inspector, working for a company. I do all of my work from my home and travel in my own vehicle. Can I deduct any expeense that I incur during the year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

work at home accounting method

It depends. If you are a subcontractor and receive your pay on form 1099-misc, then you are considered self-employed and you qualify to claim your expenses. If you are an employee of the company, then you do not.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

inkaddict1313

New Member

Dleopardi96

New Member

budlingle

New Member

hessey35

New Member

rlatrelleg

New Member