- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Why is turbotax recommending the standard deduction for me?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbotax recommending the standard deduction for me?

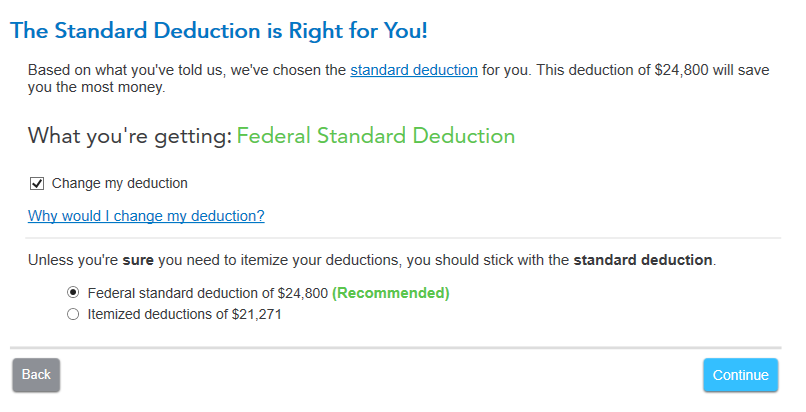

Turbotax is saying that the best option is for me to take the Standard Deduction this year...

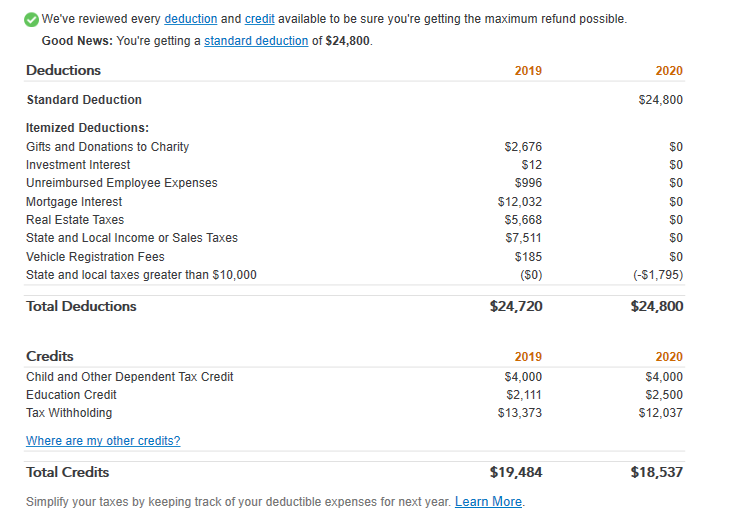

When I go back and look at my deduction categories for 2020, here is what I find:

Gifts to Donations and Charity: $2,992

Unreimbursed Employee Expenses: $1,141

Mortgage Interest: $14,084

Real Estate Taxes: $5,575

State and Local Income: $6,113

Vehicle Registration Fees: $107

State and Local Taxes Greater than $10,000: ($1,795)

TOTAL $28,217

When I go to the next page where it gives me the option to change my deduction to the Itemized approach, it is saying that my total is only $21,271:

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbotax recommending the standard deduction for me?

Property/state/local taxes are subject to a $10,000 cap. Unreimbursed employee expenses are no longer allowed under law for Federal, but may be for some states. But, in general, if the Standard Deduction already lowers your taxable income to zero, then that is used.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbotax recommending the standard deduction for me?

just to tease that out a little more, the $28,217 has to be reduced by $1141, which is not tax deductible, so it really adds up to $27076.

what is on Line 11 of your Form 1040? Is is $21, 271?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

KarenL

Employee Tax Expert

tbduvall

Level 4

cj5

Level 2

wilsonbrokl

New Member

v8899

Returning Member