- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Why does my Infant son not count on the earned income credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my Infant son not count on the earned income credit

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my Infant son not count on the earned income credit

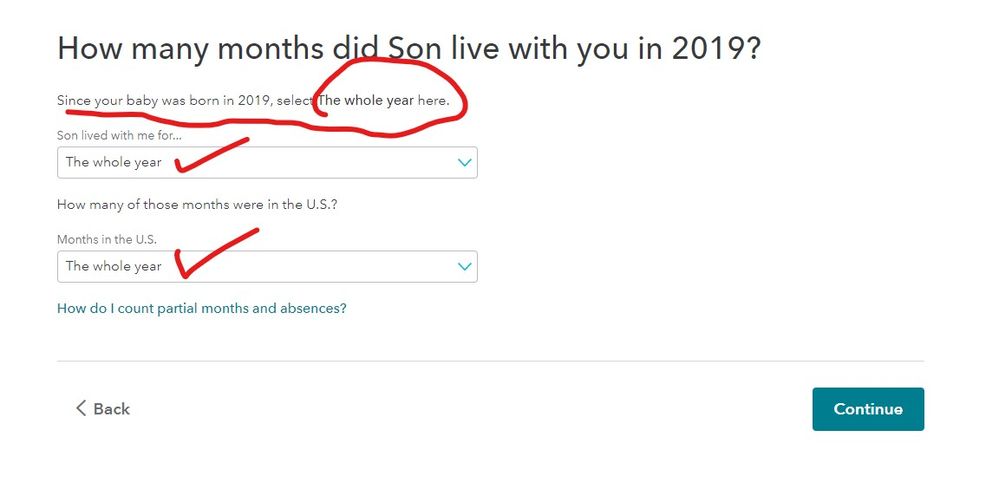

Probably because you did not indicate that he lived with you for the entire year. On the screen for entering how long he lived in your home was information on how to report if the child was born in 2019.

Go back to the My Info section and edit the dependent section to correct the mistake.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my Infant son not count on the earned income credit

Sadly many people fail to read the screen that tells you exactly what to do ... pay attention to all the words on the screen ... take your time and read them all on every screen ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my Infant son not count on the earned income credit

And--have you entered your income earned from working yet? Unless you have entered your W-2, you are not going to see any child-related credits. Employers have until January 31 to issue your W-2.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

KarenL

Employee Tax Expert

Sarmis

New Member

chiroman11

New Member

ed 49

Returning Member

meltonyus

Level 1