- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Why am I getting asked about Simplified Limitation election for AMT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I getting asked about Simplified Limitation election for AMT?

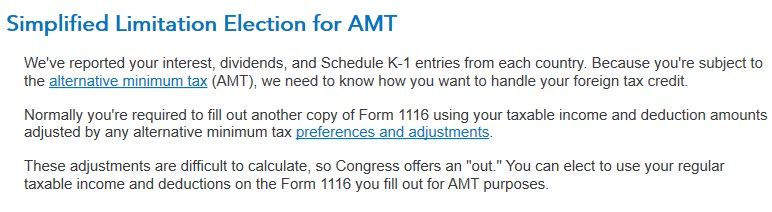

I was filling out the foreign tax credit info, and got to this screen:

I'm not subject to AMT. I've tried deleting forms 1116 and 6251, but when I fill out the foreign tax info again, it creates a new 6251 and I get to this screen shot shown above. What else can I do? Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I getting asked about Simplified Limitation election for AMT?

You may have not been asked this question in previous years but the program is asking you the question in case if you do have an AMT reporting requirement. If this is the case, if you have one just one category of foreign income to report, you can elect to choose the AMT Simplified reporting requirement. If you have several categories, do not choose the simplified election.

Make a selection when it asks so you can move on with your return without delays.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I getting asked about Simplified Limitation election for AMT?

Go ahead and answer the question and select Simplified Limitation election for AMT. If you never claimed this before, select that this is a first year election. This is the only thing that you can do so you can move on in your return. It will not impact your return if you do not have an AMT reporting requirement in the first place.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I getting asked about Simplified Limitation election for AMT?

Ok thanks Dave. So, to be sure, making this election now won't "lock in" the election in future years when I might be subject to AMT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I getting asked about Simplified Limitation election for AMT?

No, if you take the AMT Simplified Election this year, you must stick to it in the following years unless you obtain the IRS consent to change it. For the first year's election, if you have only one category of foreign income to report, then choose the Amt Simplified Election. If you have several categories, don't make this election.

If you aren't sure how may categories of foreign income you report in the future, don't choose AMT Simplified Election.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I getting asked about Simplified Limitation election for AMT?

I messed around with it some more, and it seems I'm only getting that screen about AMT and simplified election if I have a carryover of foreign tax credit. If I enter less than $600 in foreign taxes, I don't get the screen I attached above. Why would having a carryover trigger it? Even with the carryover credit, I'm not subject to AMT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I getting asked about Simplified Limitation election for AMT?

To clarify, is this your first year in claiming the foreign tax credit?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I getting asked about Simplified Limitation election for AMT?

No, but it is the 1st year that my foreign tax credit resulted in a carryover to next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I getting asked about Simplified Limitation election for AMT?

You may have not been asked this question in previous years but the program is asking you the question in case if you do have an AMT reporting requirement. If this is the case, if you have one just one category of foreign income to report, you can elect to choose the AMT Simplified reporting requirement. If you have several categories, do not choose the simplified election.

Make a selection when it asks so you can move on with your return without delays.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I getting asked about Simplified Limitation election for AMT?

Hi Dave,

I am also being asked about the AMT.

Does the AMT only apply to foreign income categories or also domestic income categories?

If I have income from domestic rental property, (I am not a full time real estate professional) would this count as needing to choose the Complicated Method?

Also, if we ever need to contact the IRS for changing the elected method how would we do that? Do they have an email? About how long would it take?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I getting asked about Simplified Limitation election for AMT?

Yes, the AMT applies to domestic income. Some reasons for being assessed AMT include:

- Exercising or selling ISOs (incentive stock options)

- Deducting interest from a large second mortgage for a house, boat or recreational vehicle

- Realizing a large capital gain (for example, when you sell a home or other investments for a profit)

- Having a household income greater than the phase-out thresholds (while also having a significant amount of itemized deductions)

Click this link for more detailed info on AMT (Alternative Minimum Tax).

If you are claiming a Foreign Tax Credit (maybe for foreign tax reported on a 1099-Div) and are subject to AMT, you are asked about the Simplified Method.

If you are not subject to AMT this year, you can Delete Form 6251 from your return and you will not get the question. By choosing the Simplified Method, you are saying that you want to use the same calculation for foreign tax credit for AMT as used for regular tax.

In all likelihood, you would not want to revoke the election, since AMT is a higher tax.

@hellotax1111

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I getting asked about Simplified Limitation election for AMT?

For some reason I am being asked the same. For 2021 I have reported 107 Foreign tax credit, and for this year i have like 800. All this triggers the AMT.

However, I chose itemized deduction instead of Taking a credit i am not hit with AMT. I lose the credit, but I don't have to deal with AMT.

Why should AMT be triggered by such small amount? It looks like it is better to take Itemized Deduction at the end

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I getting asked about Simplified Limitation election for AMT?

To clarify, did you elect to take the simplified limitation election last year and this year?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

girigiri

Level 3

izw0411

New Member

Lorob11

Level 1

VandB

Level 1

MJ23Bulls

Level 1