- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Where do I put the AZ families tax credit for 2023?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I put the AZ families tax credit for 2023?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I put the AZ families tax credit for 2023?

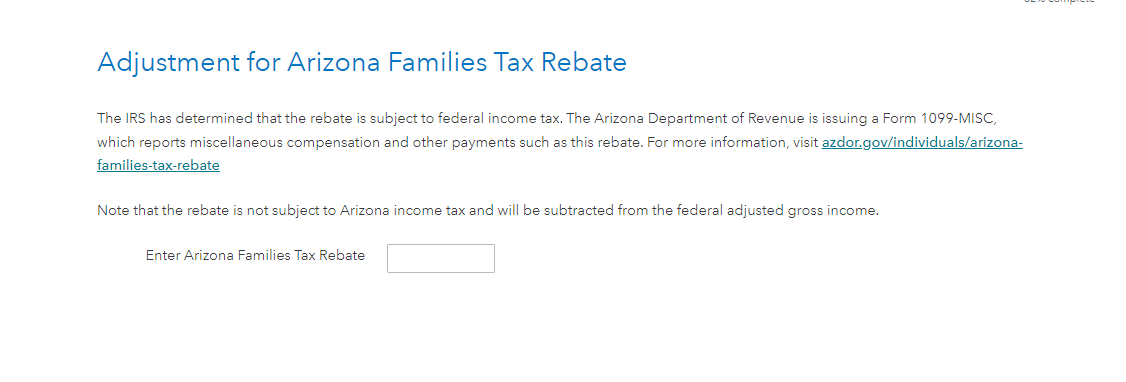

You will enter the information for the Arizona Families Tax Rebate in the state interview section of the program. To claim the credit, you must meet the requirements of filing a full-year Arizona resident tax return for 2021, claimed at least one dependent on your 2021 tax return, as well as having at least $1 in Arizona tax liability in 2019, 2020, or 2021.

To enter the information from your 1099-Misc., log into your TurboTax account.

- Select State Taxes

- Continue through the screens and select start/continue to the right of Arizona

- Proceed through the state interview section and answer the questions according to your situation.

- When you see the screen titled "Adjustment for Arizona Families Tax Rebate," enter the amount reported on your 1099-MISC in the box to the right of Enter Arizona Families Tax Rebate.

Continue through the screens and TurboTax will let you know if you qualify for the credit or not based upon your personal tax situation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jenrlo

New Member

rjazzqueen

New Member

mason-jennifer-a

New Member

user17515687217

New Member

colby-huddleston12

New Member