- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Where do I enter late tax payments on a late return - they were made without an extension?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter late tax payments on a late return - they were made without an extension?

TurboTax platform:

Desktop

Background info:

My bookkeeper failed to turn in my tax returns from 2018 to 2021. However, the IRS received check payments. They assigned tax years to the checks that didn't have a year written on them. I'm self-preparing for 2019 onwards.

Questions:

- Can I report these late payments on my tax returns?

- If I can report them, where do I enter them on the returns?

- If I can't, will the IRS credit them automatically or will I have to file and then amend?

Thank you all.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter late tax payments on a late return - they were made without an extension?

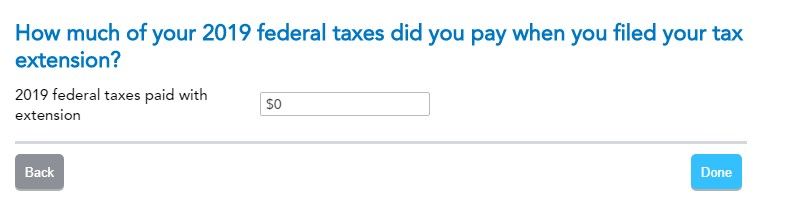

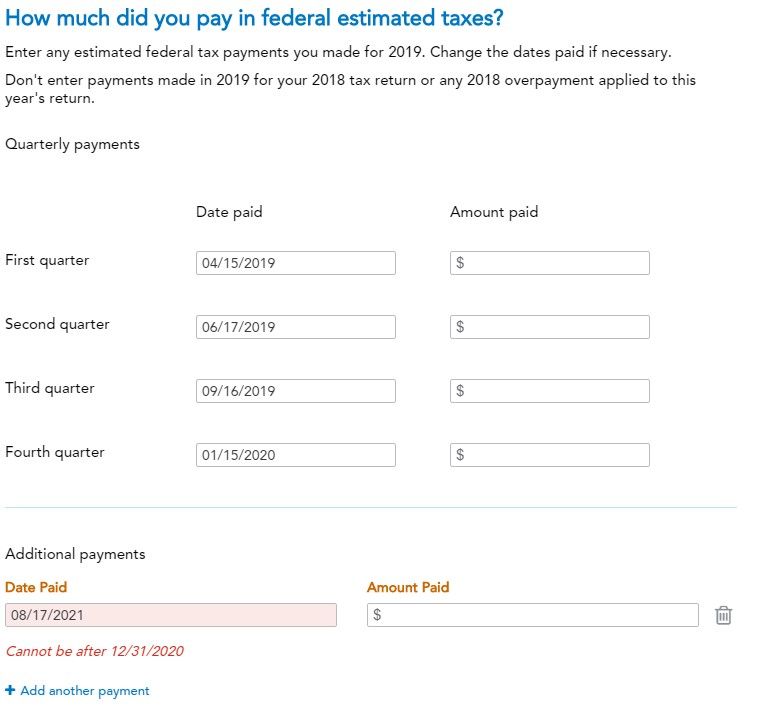

When entering into 2019 TurboTax as an additional estimated tax payment the payment made on 8/17/2021 and credited to 2019 by the IRS, simply ignore the error that TurboTax generates when you enter 8/17/2021 and jump to another part of TurboTax after clicking the Continue button to cause TurboTax to retain the amount entered. That "error" only prevents you from e-filing, which you can't do now with your 2019 tax return anyway. TurboTax will still apply the payment on Schedule 3 line 8. If TurboTax asks, tell TurboTax to let the IRS bill you later for any underpayment penalty.

Note that normally 2019 would be a closed tax year for obtaining a refund because the tax return is being filed more than 3 years after the April 15, 2020 filing deadline, but since you made a 2019 tax payment on August 17, 2021, the deadline to file a claim for refund is 2 years after that payment date, August, 17, 2023. However, under these circumstances your refund cannot exceed the amount paid within the 2 years preceding the date of the filing (which presumably is just the amount paid on August, 17, 2021).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter late tax payments on a late return - they were made without an extension?

1st you should go to your online account -

https://www.irs.gov/payments/your-online-account

Check if the payments sent are applied to the correct tax years.

You will need to provide a return for each year if they were never filed. So this will counter the IRS transcript. Showing the amounts originally owed, ect..

If you made Estimated payments in any of those years or in this tax year, you can add in those payments in Turbo Tax when preparing the return - https://ttlc.intuit.com/turbotax-support/en-us/help-article/tax-payments/enter-estimated-tax-payment...

You can use the Online Payment Agreement application on IRS.gov to request an installment agreement if you owe $50,000 or less in combined tax, penalties and interest and file all returns as required. An installment agreement allows you to make payments over time, rather than paying in one lump sum.

If you need to speak to the IRS about the mixed up payments, here is their link for telephone assistance -

https://www.irs.gov/help/telephone-assistance

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter late tax payments on a late return - they were made without an extension?

@AskTxBrenda Thank you for your quick reply.

I want to confirm I went to my online IRS account to see how the checks were allocated. I also used those amounts to get check copies from my bank. That's how I was able to determine my bookkeeper didn't write a year on some of them.

I want to make clear I made no prepayments. I didn't file any extensions either. I'm only speculating as to how to report the payments that were made in the returns I've yet to file. I can't find any Turbo Tax posts or IRS publications on how they handle late payments made without extensions and that were posted to the wrong year.

Unfortunately, I don't qualify for the installment agreement.

Sorry to ask again but can I report the payments I've made on my income tax even if I'm filing late AND the payments themselves were made late or not?

Do I have to wait for the IRS to adjust it for me?

I want to know for at least 2019 before I continue self-preparing 2020, 2021, and 2022.

Thank you again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter late tax payments on a late return - they were made without an extension?

Yes you can report any payments within/for that tax year, when preparing the return. so for 2019, just follow the link I sent and add in the payment that was sent, so you have an accurate return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter late tax payments on a late return - they were made without an extension?

Sorry for the late reply.

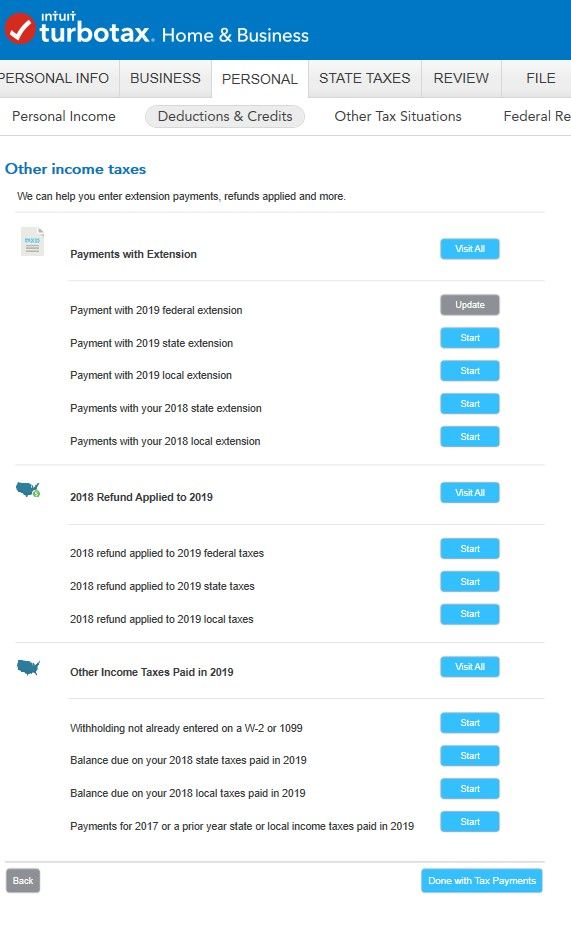

I went to the link you sent me to help me navigate to pre-payments in 2019. I get an error when entering Date Paid. It says it "Cannot be after 12/31/2020." My payment was made on 8/17/2021.

According to Turbo Tax, not only did I pay in full, but I overpaid.

Will I be able to use the balance left over for 2020?

Thank you so much for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter late tax payments on a late return - they were made without an extension?

@AskTxBrenda Thank you again for your help.

I followed the link you sent. It gave me this error because the payment was made too late.

The only other way it seems I can enter it is to put it under payments with extension. Because I didn't file an extension and there's nowhere to put when I made the payment to properly calculate the late fees, I don't know if this is the right place either.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter late tax payments on a late return - they were made without an extension?

The 2021 Form 1040 adds a line for taxes paid that were not Estimated Tax Payments.

It is Schedule 3 Line 13z.

Earlier versions of Form 1040 did not have such a line so you have to rely on the IRS to recognize and apply your account's prior payments for that tax year that are not marked "Estimated Tax"..

OR

look for the "Other" line on Schedule 3.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter late tax payments on a late return - they were made without an extension?

When entering into 2019 TurboTax as an additional estimated tax payment the payment made on 8/17/2021 and credited to 2019 by the IRS, simply ignore the error that TurboTax generates when you enter 8/17/2021 and jump to another part of TurboTax after clicking the Continue button to cause TurboTax to retain the amount entered. That "error" only prevents you from e-filing, which you can't do now with your 2019 tax return anyway. TurboTax will still apply the payment on Schedule 3 line 8. If TurboTax asks, tell TurboTax to let the IRS bill you later for any underpayment penalty.

Note that normally 2019 would be a closed tax year for obtaining a refund because the tax return is being filed more than 3 years after the April 15, 2020 filing deadline, but since you made a 2019 tax payment on August 17, 2021, the deadline to file a claim for refund is 2 years after that payment date, August, 17, 2023. However, under these circumstances your refund cannot exceed the amount paid within the 2 years preceding the date of the filing (which presumably is just the amount paid on August, 17, 2021).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter late tax payments on a late return - they were made without an extension?

Thank you. Turbo Tax 2019 desktop edition seems wonky. I'll enter one thing through the prompts but as I'm looking over the information in the Forms, not all of it gets transferred correctly. This is giving me a strong starting point. Worst case scenario I'll just file as is and hope the IRS allocates it as you mentioned.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter late tax payments on a late return - they were made without an extension?

Extra amounts paid after the fourth ES period should go on Schedule 3 Line 13z

type: "balance due paid <date>"

Not sure if TurboTax supports this line, but in Forms Mode, maybe you can do it.

P.S. Apologies for repeating myself.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pivotresidential

New Member

stays

New Member

teamely5

New Member

catoddenino

New Member

borenbears

New Member