- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- What fees can you deduct on you car registration in the state of nevada? I have a technology fee, basic gov svc tax fee, registration fee, supplemental gov svc tax fee

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What fees can you deduct on you car registration in the state of nevada? I have a technology fee, basic gov svc tax fee, registration fee, supplemental gov svc tax fee

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What fees can you deduct on you car registration in the state of nevada? I have a technology fee, basic gov svc tax fee, registration fee, supplemental gov svc tax fee

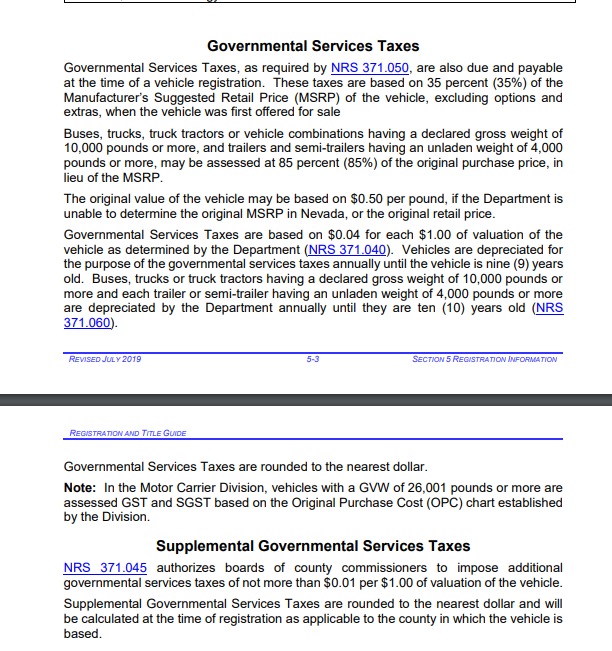

The short answer to your question is that, in Nevada, you can deduct the "Governmental Services Tax" and the "Supplemental Governmental Services Tax" portion of your vehicle registration fees. The long answer to your question is discussed below.

In general, there is no actual tax deduction for vehicle registration fees on a personal tax return. However, if you live in a state that imposes an excise tax amount, based on the value of the vehicle and not some other factor, and that excise tax is paid as part of the registration process, then the excise tax portion can be deducted, but not the whole amount of the cost of registration.

The legal reasoning is as follows. The IRS only allows that portion of a state registration fee that is based on the value of the vehicle to be included toward your other itemized deductions. Any flat fee portion doesn't count. This is why there are some 20+ states whose residents can potentially benefit from the deduction; but the remainder cannot: their states do not charge vehicle registration fees by value, and instead charge flat fees only.

There is a list of these qualifying states built-into the TurboTax software. A graphical image of this chart of states is also shown in one of the screen-capture images at the bottom of this answer (simply click to enlarge). The other image shows a sample Nevada registration receipt and where to look on it for the tax-deductible amounts.

Since Nevada is on the list of eligible states, then you can enter the vehicle excise tax amount in TurboTax. To do so, you will want to have your tax return open and locate the Search / Find box on your screen. Next, type in the exact search string "vehicle registration fees" and then click on the Jump To link that should appear beneath. This will take you to the appropriate data entry place in the program.

You may additionally find the following Nevada webpage helpful, where the MSRP value-based calculations for the vehicle excise taxes collected by the Nevada Department of Motor Vehicles are discussed:

http://www.dmvnv.com/regfees.htm

Finally, it is also important to keep in mind that you (or anyone claiming this deduction) may or may not actually see any net tax benefit from including these items on your tax return. The reason for this is that you must have enough itemized deductions (in total) to exceed the standard deduction available to all taxpayers. Since more than 2 in 3 taxpayers do not, most people end up taking the (more valuable) standard deduction, rather than itemizing deductions. If you input all your data carefully, however, the TurboTax software will make that determination for you.

Thank you for asking this question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What fees can you deduct on you car registration in the state of nevada? I have a technology fee, basic gov svc tax fee, registration fee, supplemental gov svc tax fee

Where do I find those amounts?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What fees can you deduct on you car registration in the state of nevada? I have a technology fee, basic gov svc tax fee, registration fee, supplemental gov svc tax fee

It depends.

The amount deductible in Nevada should be shown as Motor Vehicle Tax as you mentioned above.

Auto registration fees deductible by state

It may also be listed as Governmental Services Taxes or Supplemental Governmental Services Taxes on your registration form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Khan3855

New Member

user17558059681

New Member

mbdisbrow

New Member

sbansban

Level 2

user17519301369

New Member