- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- We will be claiming a failed adoption for expenses paid can we use turbo tax when claiming a failed adoption? If so can we file electronically or must it be mailed in?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We will be claiming a failed adoption for expenses paid can we use turbo tax when claiming a failed adoption? If so can we file electronically or must it be mailed in?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We will be claiming a failed adoption for expenses paid can we use turbo tax when claiming a failed adoption? If so can we file electronically or must it be mailed in?

Yes, TurboTax Deluxe or higher will allow you to record your adoption expenses for a failed adoption and this form is allowed to be filed electronically. TurboTax will walk you through the upgrade and retain your data.

Unsuccessful adoption. If you paid qualified adoption

expenses in an attempt to adopt a U.S. child and the attempt

was unsuccessful, treat those expenses in the same manner as

expenses you paid for adoptions not final by the end of the year.

Example. You paid $3,000 of qualified adoption expenses in

2016 in an attempt to adopt a U.S. child. You paid $2,000 in

qualified adoption expenses early in 2017. However, the

adoption attempt was unsuccessful. Enter $3,000 on line 5. The

$2,000 paid in 2017 may qualify in 2018.

To complete this section of your return you can use these steps in TurboTax Deluxe (online).

- In the search box (upper right) type adoption credit > jump to adoption credit (click screenshot attached to enlarge and view)

- Follow the prompts to enter your expenses

The TurboTax FAQ is also quite helpful so I included it here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We will be claiming a failed adoption for expenses paid can we use turbo tax when claiming a failed adoption? If so can we file electronically or must it be mailed in?

How do you claim failed/unsuccessful adoption expenses that occurred in 2019 and 2020? The TurboTax Deluxe 2020 questionnaire asks for a child's name, but doesn't give an option for failed adoption expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We will be claiming a failed adoption for expenses paid can we use turbo tax when claiming a failed adoption? If so can we file electronically or must it be mailed in?

You will make your entries into the Federal section of the program.

- Select Deductions & Credits

- Scroll down to All Tax Breaks and select You and Your Family

- Select Adoption Credit

- You will be able to add your adoptive child information in this section.

- On the screen titled Tell us about your child, enter as much information as you have available to you.

- Continue through the screens and answer the questions as applicable

- When you see the following screen titled Let us know which one applies to your adoption, be sure to select the box saying Our adoption was unsuccessful.

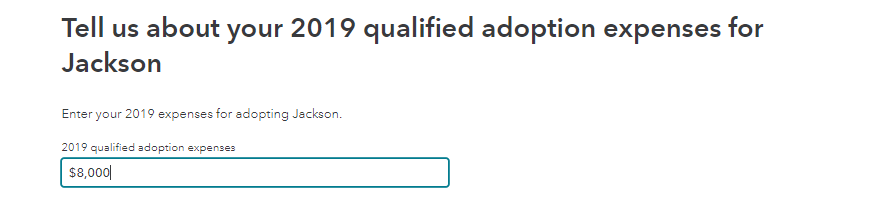

You will also need to enter the adoption expenses your paid in 2019. Those will be the expenses that are deductible on your 2020 income tax return.

If you are eligible for the credit, TurboTax will let you know at the end of this section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We will be claiming a failed adoption for expenses paid can we use turbo tax when claiming a failed adoption? If so can we file electronically or must it be mailed in?

In my situation I do not know the name of the child and it will not let me go past the screen titled 'Information About This Adopted Child' unless I enter a name. Should I enter something like N/A or is there a way to skip this part and still enter in the amount of my 2019 expenses?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We will be claiming a failed adoption for expenses paid can we use turbo tax when claiming a failed adoption? If so can we file electronically or must it be mailed in?

You can enter N/A or child name unknown to allow you to go past this screen. This will ensure you receive the credit you are entitled to as you paid the adoption expenses even though the adoption did not go through.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We will be claiming a failed adoption for expenses paid can we use turbo tax when claiming a failed adoption? If so can we file electronically or must it be mailed in?

I keep getting rejected by the IRS for this reason...can anyone help? This is for an unsuccessful adoption. I was able to go back and select no for disabled, but it was trying to force me to put in a birth year. I got past it somehow, but then when I re-submitted I got rejected by the IRS a second time.

Description of error:

For each child who is born before 2002 per the 'ChildBirthYr' on Form 8839, the corresponding checkox 'DisabledChildOver18Ind' must be checked.

What needs to be done:

Review Form 8839, Qualified Adoption Expenses. The child's year of birth must be a valid 4 digit year. After reviewing and making corrections, resubmit this return for electronic filing. If the reject continues you may want to print this return and file by mail.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We will be claiming a failed adoption for expenses paid can we use turbo tax when claiming a failed adoption? If so can we file electronically or must it be mailed in?

You have to type Unknown into the name boxes...has to be a capital U.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We will be claiming a failed adoption for expenses paid can we use turbo tax when claiming a failed adoption? If so can we file electronically or must it be mailed in?

You are correct, in order to claim the expenses for a failed adoption, you do not need a name for the child when the adoption has not yet occurred. Enter Unknown for the first and last name, and an [approximate] intended birth date. The software will not require an ITIN/SSN.

Keep in mind that one year must pass after the incur the expenses are incurred, even if the child was not yet found. If you have paid the expenses in 2019, you can claim them on your 2020 tax return.

Here is IRS Topic No. 607, Adoption Credit

Please keep in mind, the credit applies to a US adoption.

@hawks1861

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We will be claiming a failed adoption for expenses paid can we use turbo tax when claiming a failed adoption? If so can we file electronically or must it be mailed in?

I'm having exactly the same problem, and I already have Unknown entered in the first and last name fields. My return is still being rejected with this error, which doesn't make sense:

For each child who is born before 2002 per the 'ChildBirthYr' on Form 8839, the corresponding checkox 'DisabledChildOver18Ind' must be checked.

What needs to be done:

Review Form 8839, Qualified Adoption Expenses. The child's year of birth must be a valid 4 digit year.

I've left the birth year blank per the IRS instructions for form 8839, because the adoption hasn't happened, but TurboTax seems to be treating it as if I've entered a value there. I've done this exact thing the past two years without any trouble, as my wife and I have been trying to adopt for several years now, so I don't understand why it's suddenly not working this year. I've checked the PDFs for my previous returns and confirmed that everything matches.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We will be claiming a failed adoption for expenses paid can we use turbo tax when claiming a failed adoption? If so can we file electronically or must it be mailed in?

Ugh yah I tried calling TurboTax and both the people who called me back told me to make up a birth year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We will be claiming a failed adoption for expenses paid can we use turbo tax when claiming a failed adoption? If so can we file electronically or must it be mailed in?

I've started my own thread, just to see if I get a direct response from Turbotax. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We will be claiming a failed adoption for expenses paid can we use turbo tax when claiming a failed adoption? If so can we file electronically or must it be mailed in?

Yes, you can claim expenses for a failed adoption. Keep in mind that one year must pass after the expenses are incurred, even if the child was not yet found. Since you have paid the expenses in 2019, you can claim them on your 2020 tax return.

You do not need a name for the child. Enter Unknown for the first and last name, and an [approximate] intended birth date. The software will not require an ITIN/SSN.

Here is IRS Topic No. 607, Adoption Credit

Please keep in mind, the credit applies to a US adoption.

@NotThatGuy242

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We will be claiming a failed adoption for expenses paid can we use turbo tax when claiming a failed adoption? If so can we file electronically or must it be mailed in?

Thank you; my return was successfully filed. It seems a little odd that all of the error checking doesn't catch that beforehand, though.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We will be claiming a failed adoption for expenses paid can we use turbo tax when claiming a failed adoption? If so can we file electronically or must it be mailed in?

I was getting the same error as you. We had to put the estimated birth year and state that it was failed adoption since it didn't go through. Once we corrected those errors, the federal was accepted.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ehloughlin

New Member

rlktt

Returning Member

lindas1211

New Member

dve0704

New Member

gilbertm

Level 1