- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- W2G Feeding to Wrong State

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2G Feeding to Wrong State

I'm plugging in earnings from a W2G and I'm using the correct address, ID #'s etc, but its sending income to the wrong state. I've tried a few different methods to trouble shoot and can't fix it. Any advice?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2G Feeding to Wrong State

If the Form W2G is from a different state than where you live and work and the state where it is sourced requires a state return, it will need to be filed on a Non-Resident return. The information will need to be entered in a particular order.

- First, please check My Info in the federal return and be sure the box is checked for Made money in another state

- Make sure the Form W2G is entered in the federal return

- Then go to the States section and click on the delete trashcan icon for both states

- Then, add the Non-Resident state first, and be sure it is designated Non-Resident state

- Allocate the federal income for the Form W2G to the Non-Resident state

- Next, add your Resident state and be sure it is designated Resident State

- Allocate all of the federal income except the Form W2G to your Resident state

- Answer the question in your Resident return that you paid taxes to another state

If this does not completely answer your question, please let us know which states are involved and we can better assist.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2G Feeding to Wrong State

I'm a Connecticut resident and the income was from CT (resident state). Income is feeding to Georgia where I'm not a resident but have income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2G Feeding to Wrong State

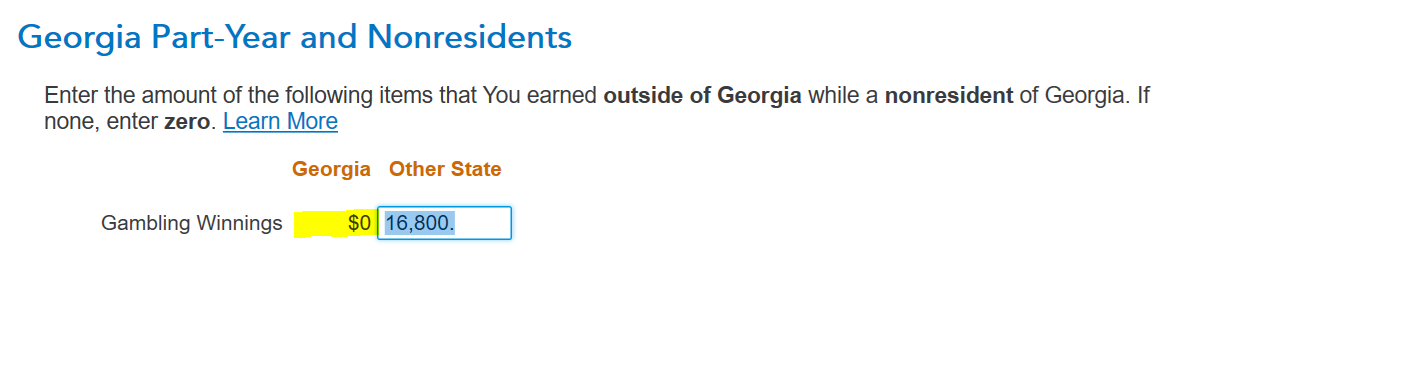

When you work through the Georgia return, you should see a screen that says Georgia Part-Year and Nonresidents, on which you need to enter the non-Georgia gambling winnings in the Other State column:

Then, it will not be included in your Georgia taxable income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pilotman1

Returning Member

sbarsik1187

New Member

bayssmsp

Returning Member

KarenL

Employee Tax Expert

loopless

Level 3