- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- TurboTax is showing me that my Alternative Vehicle Refueling Property Credit is currently $0 after entering my EV charger ($400). I know I qualify for the credit. Ideas?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is showing me that my Alternative Vehicle Refueling Property Credit is currently $0 after entering my EV charger ($400). I know I qualify for the credit. Ideas?

Home use

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is showing me that my Alternative Vehicle Refueling Property Credit is currently $0 after entering my EV charger ($400). I know I qualify for the credit. Ideas?

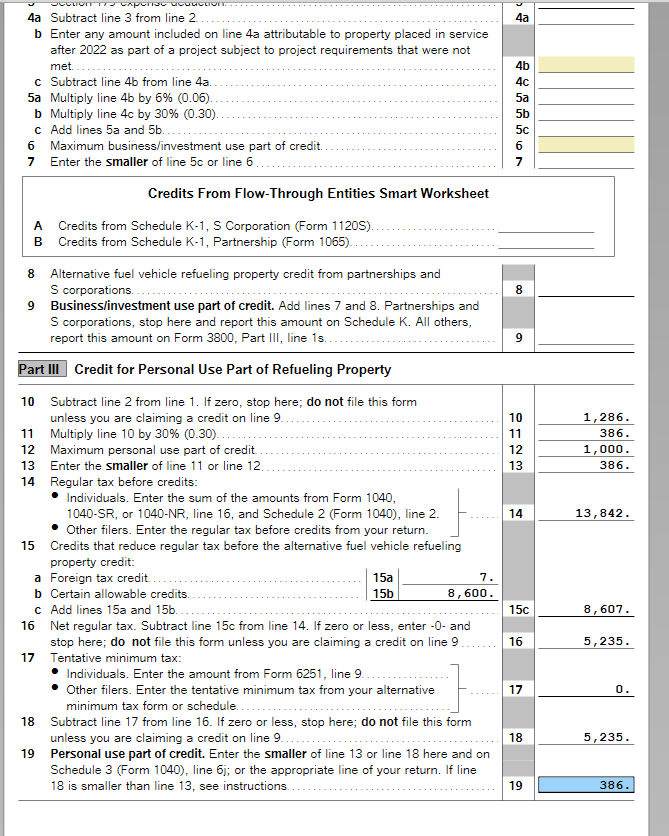

Form 8911 is generated properly in TurboTax desktop (screenshot).

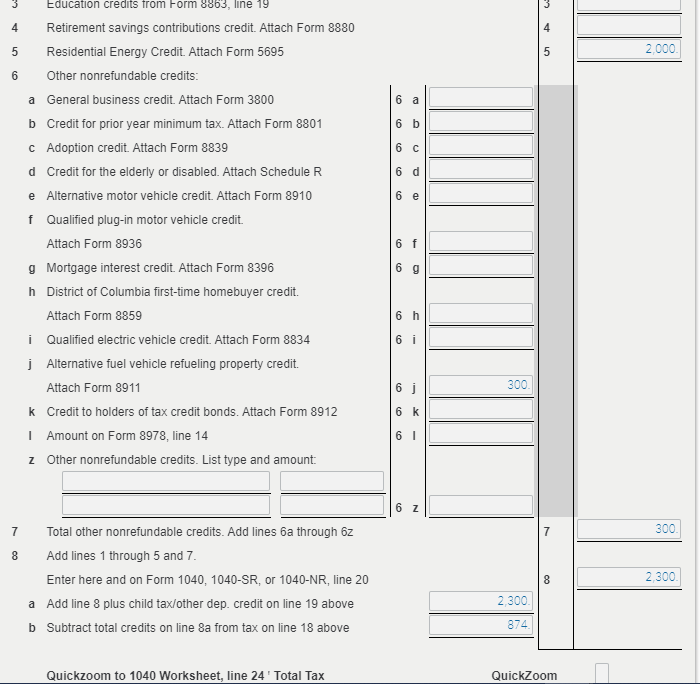

In my TTO test return, under Tax Tools > Tools, click 'View Tax Summary' then in the left-side menu, choose 'Preview my 1040'. Scroll down to Schedule 3, Line 6j to see the credit (screenshot). So it appears the credit is calculating, even though I can't actually see Form 8911 (haven't paid for test return).

Here's more info on Alternative Fuel Vehicle Refueling Property Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is showing me that my Alternative Vehicle Refueling Property Credit is currently $0 after entering my EV charger ($400). I know I qualify for the credit. Ideas?

Interesting. I'm am using TTO, and I'm not seeing the credit on the 1040 (just blank). In fact, I'm not even getting a 8911 form generated, even though I enter all the details on the appropriate screen (and the details show up when I go back to the screen). I really have no idea what is going on here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is showing me that my Alternative Vehicle Refueling Property Credit is currently $0 after entering my EV charger ($400). I know I qualify for the credit. Ideas?

When you say you have a tax liability, are you subtracting credits listed on schedule 3?

So looking at your 1040, it would be line 16 less line 20, although there could also be some other adjustments.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is showing me that my Alternative Vehicle Refueling Property Credit is currently $0 after entering my EV charger ($400). I know I qualify for the credit. Ideas?

Yes, if I understand what you are asking, my line 16 is much larger than line 20. So I have a tax liability. I'm trying to reduce it with this credit 😉

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is showing me that my Alternative Vehicle Refueling Property Credit is currently $0 after entering my EV charger ($400). I know I qualify for the credit. Ideas?

You mentioned that there is no Form 6251 for Alternative Minimum Tax included with your return. However, there is a tentative AMT number that is calculated in the background and will be shown on Form 8911 where the Alternative Vehicle Refueling Property Credit is calculated.

Take a look at Form 8911, lines 16, 17, and 18. If line 17 is greater than line 16, then your credit is disallowed.

If you find that this is not the problem and you need further assistance to understand why the credit is being disallowed, you can provide us with a diagnostic copy of your tax file. The diagnostic file will not contain personally identifiable information, only numbers related to your tax forms. To do so, follow the instructions below and post the token number along with which version of TurboTax you are using in a follow-up thread.

Use these steps if you are using TurboTax Online:

- Sign in to your account and be sure you are in your tax return.

- Select Tax Tools in the menu to the left.

- Select Tools.

- Select Share my file with agent.

- A pop-up message will appear, select OK to send the sanitized diagnostic copy to us.

- Post the token number here.

If you are using a CD/downloaded version of TurboTax, use these steps:

- Select Online at the top of the screen.

- Select Send Tax File to Agent.

- Click OK.

- Post the token number here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is showing me that my Alternative Vehicle Refueling Property Credit is currently $0 after entering my EV charger ($400). I know I qualify for the credit. Ideas?

Hi,

I am not even seeing a Form 8911, that's part of my issue. I'm entering the data for the credit but no form is even being created.

I have followed your instructions regarding the diagnostic copy. I am using TurboTax Online and the token number is: 1060021.

Thanks again for your assistance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is showing me that my Alternative Vehicle Refueling Property Credit is currently $0 after entering my EV charger ($400). I know I qualify for the credit. Ideas?

Hello.

1060033 is my code.

Could you explain why i'm not able to get any personal credit on my EV charging station? I'm having the same problem as everyone else, thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is showing me that my Alternative Vehicle Refueling Property Credit is currently $0 after entering my EV charger ($400). I know I qualify for the credit. Ideas?

Thank you for providing your token numbers. I was able to take a closer look at your returns using a CD/downloaded version of TurboTax. There are some additional tools available in those versions of TurboTax that are not available when using TurboTax Online. There is an ability to look at forms that may have been filled out, but will not be included as part of the tax return because they are not needed.

That is exactly the case for Form 8911 on both of your returns. When looking at Form 8911, the amounts reported on lines 16 and 17 explain why you are not eligible to claim the credit. Line 17 (tentative minimum tax) is greater than line 16 (net regular tax). As mentioned before, when this is the case, the credit is disallowed regardless of whether you are subject to Alternative Minimum Tax or not.

This situation is outlined in the IRS Instructions for Form 8911 if you care to read more.

Even though Form 8911 will not be included as part of your tax return because the credit is disallowed, you should be able to specify Form 8911 to be printed or previewed from the Print Center using TurboTax Online to take a look at the details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is showing me that my Alternative Vehicle Refueling Property Credit is currently $0 after entering my EV charger ($400). I know I qualify for the credit. Ideas?

I'm seeing the exact same issue the $7500 credit shows, but this charger credit says zero.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is showing me that my Alternative Vehicle Refueling Property Credit is currently $0 after entering my EV charger ($400). I know I qualify for the credit. Ideas?

Just got to page 2 and read through form 8911 and see that it says on line 18 if zero or less do not file this form. Seems like I'm ineligible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is showing me that my Alternative Vehicle Refueling Property Credit is currently $0 after entering my EV charger ($400). I know I qualify for the credit. Ideas?

Yes, if line 18 is zero that means that the tentative minimum tax was greater than your net regular tax regardless of whether you are subject to Alternative Minimum Tax (AMT). This is a common reason to be ineligible to claim the Alternative Vehicle Refueling Property Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is showing me that my Alternative Vehicle Refueling Property Credit is currently $0 after entering my EV charger ($400). I know I qualify for the credit. Ideas?

Hello.

I've been following this thread and am seeing the same issue. I am using TTO and cannot see my forms yet. I did run an AMT calc and I am showing my regular tax higher than my tentative min tax, so I should be eligible. I completed a paper 8911 form and am showing a credit.

My token is 1077002.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is showing me that my Alternative Vehicle Refueling Property Credit is currently $0 after entering my EV charger ($400). I know I qualify for the credit. Ideas?

Thank you for providing your token number. Taking a closer look at your return, like many others the tentative minimum tax calculation is causing the Form 8911 credit to be disallowed.

Without giving any specific numbers from your return, Form 8911 line 17 is about $3800 greater than line 16. Therefore, the credit is disallowed due to the tentative minimum tax.

Even though Form 8911 will not be included as part of your tax return because the credit is disallowed, you should be able to specify Form 8911 to be printed or previewed from the Print Center using TurboTax Online to take a look at the details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is showing me that my Alternative Vehicle Refueling Property Credit is currently $0 after entering my EV charger ($400). I know I qualify for the credit. Ideas?

I'm running into this same issue this year. Line 17 is << Line 16, but form 8911 is still not populating. After entering the charger costs, it shows "Alternative Vehicle Refueling Property Credit $0". My token is 1206912. Can you share any insight?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

granitegator

New Member

donnguyen

New Member

kare2k13

Level 4

Bill_the_Scrooge

Level 1

ajayka

Level 2