- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Total Paid to Care Provider

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

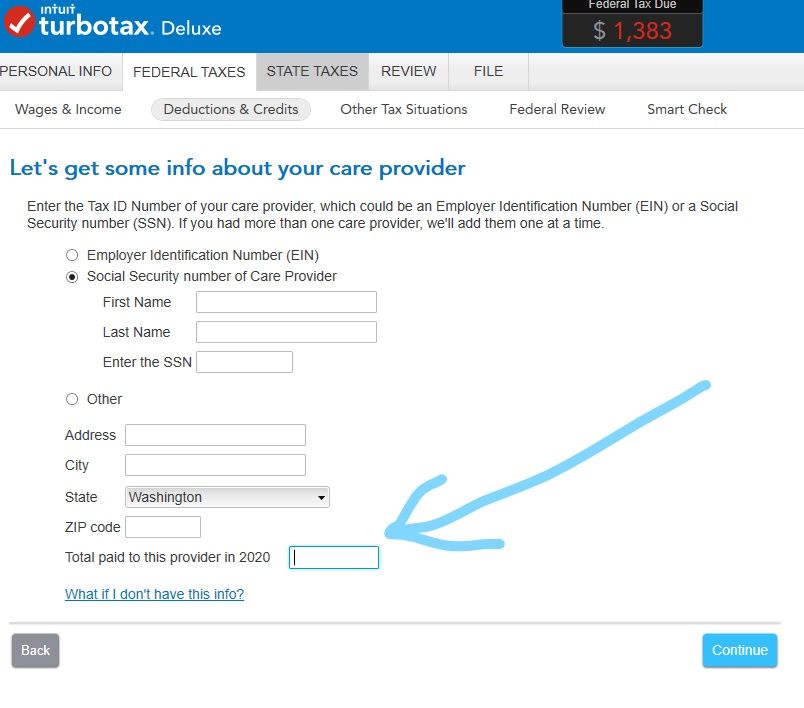

Total Paid to Care Provider

Should the total amount paid to care provider include social security tax and medicare tax if I paid those taxes on their behalf? For example: The gross wage figure I paid to the college student to watch my kids includes those tax amounts, that I then paid to the IRS on her behalf. The net wage figure that she took home as pay does not include those tax amounts.

Which figure do I use when completing TurboTax as the "total amount paid to care provider in 2020?"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Total Paid to Care Provider

Enter the total amount of money tat went out of your pocket for the care.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Total Paid to Care Provider

Thanks!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chapmandebra3

New Member

cjr2025

New Member

Lewlew

Level 2

brawlav

New Member

Stevecoh1

Level 2