- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- This year TurboTax is forcing me to give a FEIN for 1099 INT which the foreign banks don't have/provide

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year TurboTax is forcing me to give a FEIN for 1099 INT which the foreign banks don't have/provide

I suspect it is the IRS that is requiring the number in order to accept the return in e-file format.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year TurboTax is forcing me to give a FEIN for 1099 INT which the foreign banks don't have/provide

I faced the same issue. This edit was not there till last year. When i called Turbo Tax help they advised me to put all 9's. I moved forward with that and paid. It took the payment and then at the filing step it is forcing me to file only through paper. Filing through paper defeats the purpose of a going through an online platform. very frustrated. I opened a ticket for refund of the turbotax fee.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year TurboTax is forcing me to give a FEIN for 1099 INT which the foreign banks don't have/provide

If that is the case it should be made clear upfront and not after taking payment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year TurboTax is forcing me to give a FEIN for 1099 INT which the foreign banks don't have/provide

If leaving the FEIN blank keeps you from e-filing, delete the 1099-INT, and enter as Other Income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year TurboTax is forcing me to give a FEIN for 1099 INT which the foreign banks don't have/provide

That changes the calculation because I also have dividends from foregin stocks and they are from long term holding (qualified dividend) which is taxed at different rate. Entering them as other income will probably increase my tax. Secondly, by entering them as interest and dividend they appear on schedule B. I refer to the schedule B line 1 and line 5 in form 1116 (foreign tax credit). What will happen to that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year TurboTax is forcing me to give a FEIN for 1099 INT which the foreign banks don't have/provide

If you have foreign tax paid and want to claim a credit there is a work around for that. As posted above by LinaJ2020:

You can report it under Other Income so that you will be able to e-file. Here are the steps:

In TurboTax online,

- Sign in to your account, select Pick up where you left off

- To the right upper corner, in the search box, type in "other reportable income" and Enter

- Select Jump to other reportable income

- Next screen, Other Wages Received, select No to continue

- Next screen, scroll down all the way to the bottom, under Other reportable income, select Start

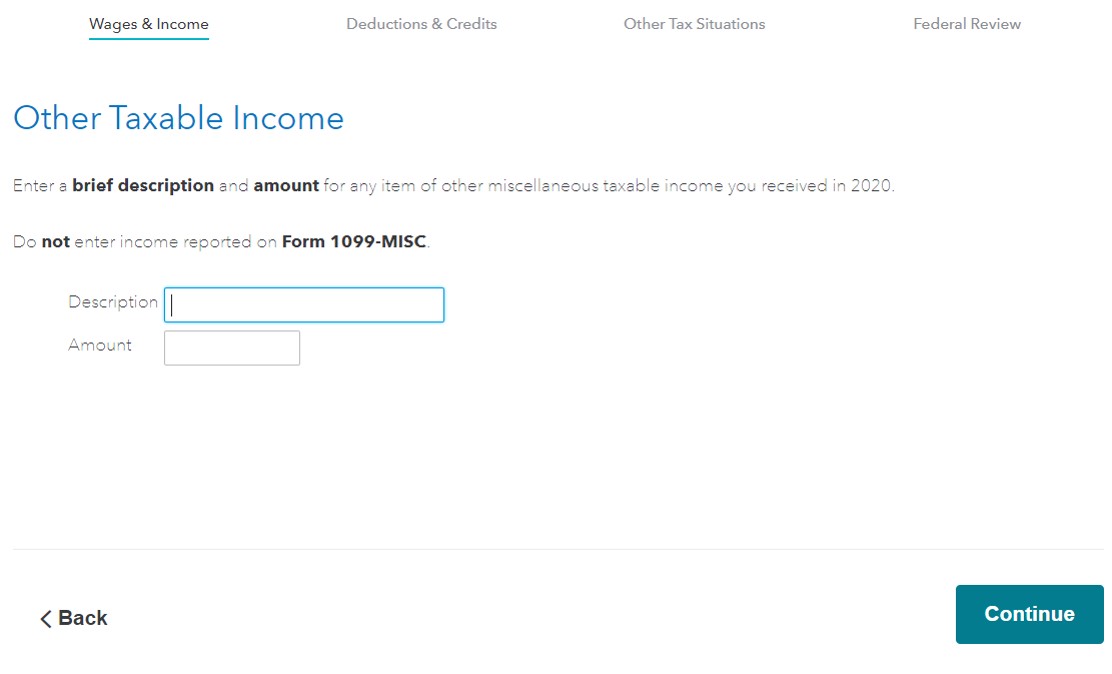

- Next screen, Any Other Taxable Income? select Yes to continue

- Enter a description and the amount.

Technically, you would enter a Form 1099 for interest, dividends to create a Schedule B that goes to the IRS. However, with a foreign entity, you would not have a US FEIN to qualify for the e-file. For the workaround, follow the instructions from above. To the IRS, as long as the total amount is reported on your taxes as Other income on line 7a Form 1040, you should be Okay.

If you have also paid taxes to a foreign country, you can claim a foreign tax credit on your US return. Here are the steps:

In TurboTax online,

- Open up your TurboTax account and select Pick up where you left off

- At the right upper corner, in the search box, type in "foreign tax credit" and Enter

- Select Jump to foreign tax credit

- Follow prompts

- On-screen, Tell Us About Your Foreign Taxes, select None of these apply and Continue

- Follow prompts

- On-screen, Choose the Income Type, check Passive Income

- Follow prompts

- On-screen, Other Gross Income-Foreign country, enter description and amount

- Follow prompts,

- On-screen, Foreign Taxes Paid-foreign country

- Under Foreign Taxes on Other Income, enter the amount

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year TurboTax is forcing me to give a FEIN for 1099 INT which the foreign banks don't have/provide

Hello....I was just wondering if anyone got a straight answer on how to enter the FEIN on the 1099 for Foreign Banks. This is really silly because it won't let you file. I did see the fix that you just add the interest income to "other taxable income" which I started to do but wanted to check to see if there was a solution. Thanks!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year TurboTax is forcing me to give a FEIN for 1099 INT which the foreign banks don't have/provide

Since you don't actually have Form 1099-INT, the interest should not be reported in the section "Interest reported on a 1099-INT" where the FEIN is required by the program.

When you enter data into this section, it needs to match the 1099-INT that is on file at the IRS. In your case, there is no file to match.

You will need to enter the income in other taxable income when using the online version of TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year TurboTax is forcing me to give a FEIN for 1099 INT which the foreign banks don't have/provide

I tried all zeroes and all nines and both failed. What worked for me was to just put nothing in there (just blank text) and that seemed to work and allowed me to file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year TurboTax is forcing me to give a FEIN for 1099 INT which the foreign banks don't have/provide

Hi,

Where is this "Other Taxable Income" section that you speak of???

It is clearly stated in other income areas that interest income should not be added there, but should be under 1099-Int.

This is not a IRS rule change, it is a bug in this this year's version of Turbo tax. Who do we reach out to fix this, because all the responses here are just giving the go arounds!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year TurboTax is forcing me to give a FEIN for 1099 INT which the foreign banks don't have/provide

Other Taxable Income is under Wages and income, Less Common Income, Miscellaneous Income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year TurboTax is forcing me to give a FEIN for 1099 INT which the foreign banks don't have/provide

It’s 2021 and this is still broken.

The instructions are clear “Report the foreign income as though you received tax forms 1099-INT/1099-DIV/1099-B/etc.”. Instead of parroting the same “file as other income” nonsense, perhaps the employees here might like to report this matter so that it actually gets fixed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year TurboTax is forcing me to give a FEIN for 1099 INT which the foreign banks don't have/provide

In TurboTax report this using these steps:

- Federal

- Wages and Income

- Less Common Income

- Miscellaneous Income 1099-A, 1099-C\

- Other reportable income

You will enter a Description and the amount of the interest received.

Federal law requires U.S. citizens and resident aliens to report any worldwide income, including income from foreign trusts and foreign bank and securities accounts

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year TurboTax is forcing me to give a FEIN for 1099 INT which the foreign banks don't have/provide

So I can enter the foreign dividend income that is not reported on a 1099-DIV under "other income", but I cannot get the foreign tax credit. Since one of my US investments also has foreign income, it will let me take that tax credit but I never get an opportunity to claim to foreign tax credit for the "other income." Am I doing something wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year TurboTax is forcing me to give a FEIN for 1099 INT which the foreign banks don't have/provide

Although you enter the foreign income under "Other Income", you can still take the foreign tax credit if you answer the interview questions correctly.

Here are the steps:

- Sign in to your account, select Pick up where you left off

- At the right upper corner, in the search box, type in "foreign tax credit" and Enter

- Select Jump to foreign tax credit

- Follow prompts

- On screen, "Tell Us About Your Foreign Taxes", uncheck the first box ( You have no more foreign taxes to enter other than the 1099-DIV, 1099-INT, 1099-OID or a Schedule K-1) and others that apply

- Follow prompts

- Choose the Income Type, select "Passive Income"

- On screen, "Country Summary", add a country to continue

- On screen, "Foreign Taxes Paid", under foreign taxes on Other Income, enter the amount

@kbcm1

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DavidRaz

New Member

jjon12346

New Member

user26879

Level 1

StirFry

Level 2

ajm2281

Level 1