- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Simplified Limitation Election for AMT

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Simplified Limitation Election for AMT

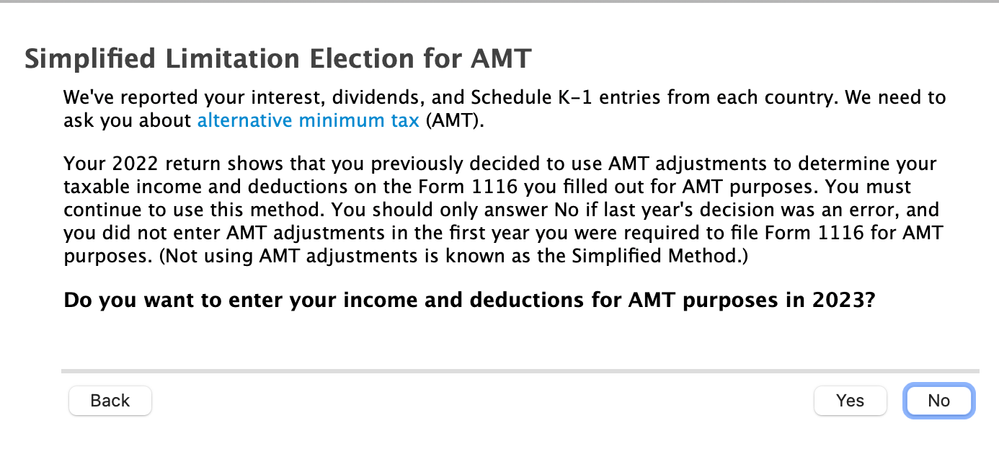

My salary is below $100k. I have some investments (ISHARES TR CORE MSCI TOTAL) with foreign tax paid of $460. I had submitted form 1116 last year and will be doing so this year as well. Turbo Tax asks me this question below. I checked my previous tax form which shows "AMT Carryover to 2023" as $740. Please advise if I should choose yes or no for this year for the question below. Thank you.

Simplified Limitation

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Simplified Limitation Election for AMT

based on the TT message you did not elect the simplified method for 2022. This locks you in to not using the SM method for all future years unless you obtain IRS approval to change unless that was in error and you did not enter AMT adjustments for the AMT FTC calculation and 2022 was the first year you were require to file form 1116 for AMT purposes.

if you can elect the SM for 2023 be warned 1) this locks in that method for all future year 2) loss of any FTC carryover - these affect the calculation of your AMT liability only.

under the complex method form 1116 is completed for the FTC to be used for AMT tax purposes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Simplified Limitation Election for AMT

Thank you so much Mike. Please confirm my understanding that your recommendation is to choose Yes. Please confirm if I misunderstood that part. Thanks again.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

girigiri

Level 3

izw0411

New Member

Lorob11

Level 1

VandB

Level 1

MJ23Bulls

Level 1