- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Should the child tax credit payment amount be listed all on one parent or both (they are separate lines). I'm worried about it doubling up the paid amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the child tax credit payment amount be listed all on one parent or both (they are separate lines). I'm worried about it doubling up the paid amount.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the child tax credit payment amount be listed all on one parent or both (they are separate lines). I'm worried about it doubling up the paid amount.

Perhaps. The IRS will send letters this month to each person who received the Advance Child Tax Credit. To help taxpayers reconcile and receive all the 2021 child tax credits to which they are entitled, the IRS started sending Letter 6419, 2021 advance CTC, in late December 2021 and will continue into January.

If you are filing a joint return for the current year and you filed a joint return for the prior year then you should split the payments between you if the IRS Portal shows the same amount for each of you. Use the link above to view your advance payments.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the child tax credit payment amount be listed all on one parent or both (they are separate lines). I'm worried about it doubling up the paid amount.

The IRS letter should show 1/2 for each parent ... wait for the notice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the child tax credit payment amount be listed all on one parent or both (they are separate lines). I'm worried about it doubling up the paid amount.

"The IRS letter should show 1/2 for each parent "

you're guessing, right?

It could say 100% to Taxpayer and 0% to Spouse.

Why not ?

In cases of MFS or divorce, it all depends on who claims the dependent(s) in 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the child tax credit payment amount be listed all on one parent or both (they are separate lines). I'm worried about it doubling up the paid amount.

The 6419 was posted earlier and another poster said that his & the wife's each had 1/2 the advance on each notice so that confirms our suspicions.

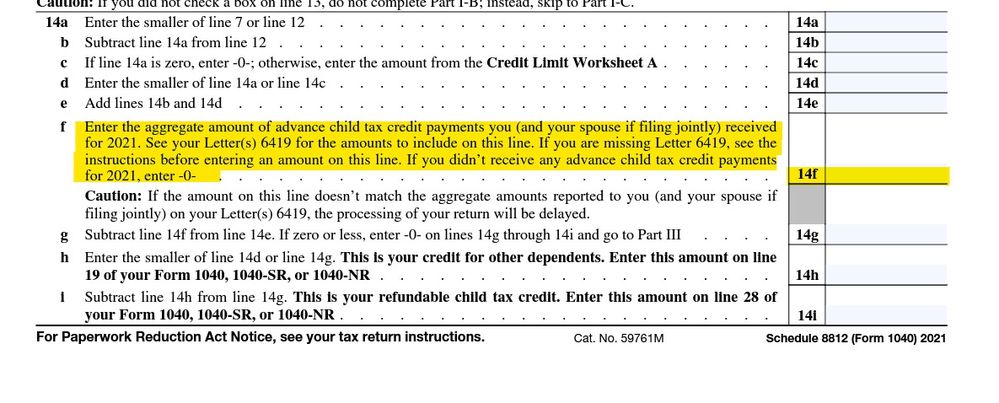

As far as what/how to enter it in the TT program ... if you are filing a joint return it doesn't matter how much you enter under each spouse as long as the total adds up to the advance payment received. On the IRS form 8812 only the total is on line 14F.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

audreyrosemary11

Level 2

jbunyard50

New Member

jbunyard50

New Member

DebbyW

New Member

lsen

New Member