- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Second time posted I sold Two pieces vacant land for investment in 2019, held both well over 2 yrs. Premiere doesn't allow me to put in my cost basis on vacant land sold.

Announcements

Attend our Ask the Experts event about Tax Law Changes - One Big Beautiful Bill on Aug 6! >> RSVP NOW!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Second time posted I sold Two pieces vacant land for investment in 2019, held both well over 2 yrs. Premiere doesn't allow me to put in my cost basis on vacant land sold.

The land was held for investment both well over 2-3 yrs. Got 1099 for one but not the other. Do I need to upgrade? or with the new tax laws is this cost basis write-off now gone?

Topics:

posted

February 2, 2020

10:28 AM

last updated

February 02, 2020

10:28 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Best answer

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Second time posted I sold Two pieces vacant land for investment in 2019, held both well over 2 yrs. Premiere doesn't allow me to put in my cost basis on vacant land sold.

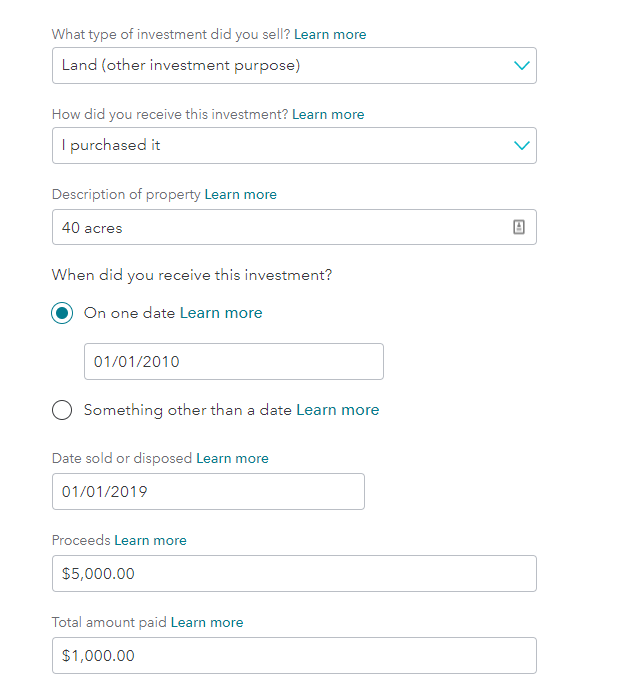

I am including a screen shot of the entry page. Enter your basis in the last box.

February 2, 2020

10:50 AM

640

3 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Second time posted I sold Two pieces vacant land for investment in 2019, held both well over 2 yrs. Premiere doesn't allow me to put in my cost basis on vacant land sold.

I am including a screen shot of the entry page. Enter your basis in the last box.

February 2, 2020

10:50 AM

641

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Second time posted I sold Two pieces vacant land for investment in 2019, held both well over 2 yrs. Premiere doesn't allow me to put in my cost basis on vacant land sold.

I have the same problem. I keep asking but no reply is relevant

February 28, 2021

12:37 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Second time posted I sold Two pieces vacant land for investment in 2019, held both well over 2 yrs. Premiere doesn't allow me to put in my cost basis on vacant land sold.

it might be the way you report it. May I suggest a solution to your dilemma? Since this is vacant land.

- Log or open Turbo Tax

- Go to federal>income and expenses>investment income

- Stocks, Mutual Funds, Bonds, Other (1099-B)>start. Even though this isn't a stock transaction, you can still report it here.

- Answer yes to the first screen and for the second, select other. this includes land.

- The next screen will asked who brokered the deal. if you brokered it, you can say self-brokered.

- the next screen will say Now we’ll walk you through entering your sale details. Make sure you select land in the drop down box.

- Now start entering the details of your land sales. You may need to enter these sales as two separate sales so after you enter the first sale and come to a summary screen, there is an option to add another sale.

- Take not on the sale detail screen, there is an option to add your basis.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 28, 2021

1:00 PM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

LMS61

New Member

loyal-but---user

Level 3

mxcolin

New Member

c_davidson

New Member

BillTn

Level 1