- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Request Assistance with figuring out number of years of Education Credits claimed for my dependent

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Request Assistance with figuring out number of years of Education Credits claimed for my dependent

Background:

Used TT last year and that file was used as the base file for the current year so information from previous year could be imported in for the current filing by Apr, 2024 (tax year 2023).

Issue:

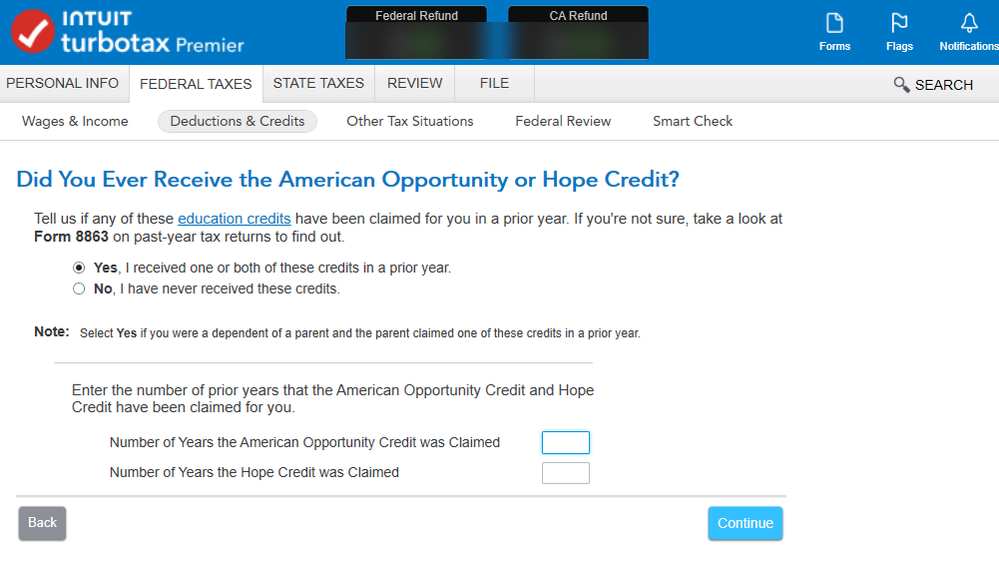

Need assistance with figuring out Education Credits (seems like TT should have had this information already as it has previous filing for tax year 2022) for the last 10 plus years.

The Number of Years American Opportunity Credit and Hope Credit have been claimed?

The software guides user to review From 8863 on past year's (2022) tax returns. I have looked at prior year's tax return Form 8863. I don't see anywhere (unless I am overlooking the obvious) any statement that states this is the number of years you have used. No line# provides guidance.

What am I missing? On a separate but related concern, why on earth can't TurboTax figure this info up as it used 2022 tax file to build the 2023 tax return.

Anyway, your assistance is greatly appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Request Assistance with figuring out number of years of Education Credits claimed for my dependent

TT does not track how many times you used the American Opportunity Tax Credit because there are too many variables that could affect its use or by whom it was used. It can be used for up to four times for a specific undergraduate student, but that student may have been claimed by one parent or another parent in different years; the student may have attended school for a couple of years and was claimed as a dependent but went back to school as an older adult no longer being claimed, etc. etc. etc. TT cannot track all of that since it could have appeared on multiple user's tax returns or on tax returns filed using other software, etc. etc. etc. So....sorry...you have to do your own homework on this and look at your old tax returns and see how many times you used the credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Request Assistance with figuring out number of years of Education Credits claimed for my dependent

Thank you for your response. Some of your points are valid. However, TT should be able to track when it was used for prior years and it could spit out a disclaimer, using what you stated. However, providing no guidance at all is a cop out, like the prepared explanation one gets from overseas hired help by Intuit (they are experts in copy and paste responses). The form 8863 itself provides no guidance on the number of years used. I'd be happy to look at the Line# that would show when and how many times used...maybe I am overlooking it...the dependent only started attending college in August/September 2022, so prior to it they were in high school so that would not be applicable.

In terms of other software, I have only used TT and have been using it for 20 years plus. If they would just hire American programmers who know US taxes as a user and filer, we would not have half the incompetent programming issues with it. But that's a different beef all together.

Anyway, thank you for your response.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Request Assistance with figuring out number of years of Education Credits claimed for my dependent

When you look at a previous year's tax return, if you have an amount on Line 3 of Schedule 3 (education credits), you have a Form 8863 that you can view to see which credit you took. If there is no amount on Line 3, Schedule 3, the American Opportunity Tax Credit was not taken. You need to check the returns the student filed or the parental returns that included the student as a dependent. And you only need to check a couple of returns. In fact, if the student did not start college until 2022, there is no way she could have taken the credit 4 times already.

What transfers in when you start a return using last year's tax file? TurboTax keeps payer information for forms used on the transferred in return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Request Assistance with figuring out number of years of Education Credits claimed for my dependent

By your second post when you included that the student began school in 2022---it got easier. But in the beginning, we had no way to know if you were referring to a student who was older, attended for a year or two a long time ago, went back to school, was claimed by mom, then by dad in another year.....etc. etc. etc. Details matter.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ualdriver

Level 3

Linhall

New Member

apple33

New Member

chelsea23320

New Member

mak96_sam

New Member