- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Request Assistance with figuring out number of years of Education Credits claimed for my dependent

Background:

Used TT last year and that file was used as the base file for the current year so information from previous year could be imported in for the current filing by Apr, 2024 (tax year 2023).

Issue:

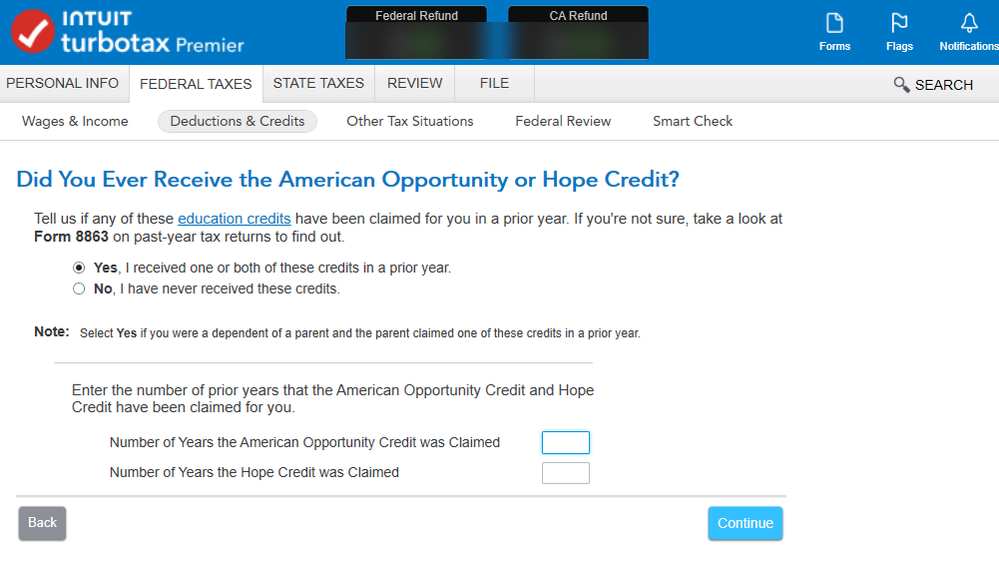

Need assistance with figuring out Education Credits (seems like TT should have had this information already as it has previous filing for tax year 2022) for the last 10 plus years.

The Number of Years American Opportunity Credit and Hope Credit have been claimed?

The software guides user to review From 8863 on past year's (2022) tax returns. I have looked at prior year's tax return Form 8863. I don't see anywhere (unless I am overlooking the obvious) any statement that states this is the number of years you have used. No line# provides guidance.

What am I missing? On a separate but related concern, why on earth can't TurboTax figure this info up as it used 2022 tax file to build the 2023 tax return.

Anyway, your assistance is greatly appreciated.