- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Rental Property Sale

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Sale

Sold rental property 11/1/2021. Acquired via inheritance 1/14/2000. Basis is 140314 with gross proceeds of the sale at 235000. There was rent received during the first 10 months of 2021 before the sale. There were expenses associated with the sale including an engineering survey pre-sale, realtor commissions, title insurance and closing costs. Are any of these deductible and if so, where do I record those and the sale in Turbo Tax Premier?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Sale

Follow these directions for the sale of a rental property.

- Click the magnifying glass at the upper right hand corner of the screen and enter 'rental property'. Enter.

- Click the link 'Jump to rental property'.

- At the screen Your property assets, click on Edit for the rental property.

- At the screen Did You Stop Using This Asset in 2021?, click Yes.

- At the subsequent screens, you will answer questions about the income, costs and dates of sale.

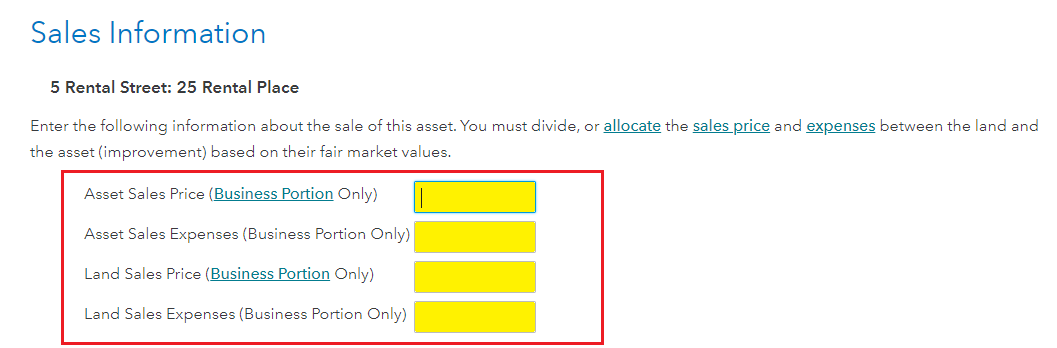

- At the screen Sales Information, you can enter numbers for expenses of sale.

At the screen Results, you may find that there will be two sale entries, one for the rental structure and one for the land the structure sits on.

See this TurboTax Help .

The costs you specified are deductible or reported as basis for the property sold. IRS Publication 527 page 7 Settlement fees and other costs lists which costs are added to basis and which costs are reported as selling costs.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Sale

The instructions do not flow as you stated. After the asset EDIT, bullet 3, bullet 4 does not come up or in subsequent screens. Bullet 5 never comes up. I do get to screens asking about rental costs however, not sale. Confused.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Sale

Also, Publication 527 page 7 talks of purchase deductions, not selling. Another reference?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Sale

First, the expenses of sale that should be entered when asked are the engineering survey pre-sale, realtor commissions, title insurance and some closing costs.

Next the closing costs that are deductible as rental expenses are the prorated share of real estate taxes for the year of sale and any mortgage interest you might have paid. Recording fees and all other closing costs will be part of the sales expense. Think of the rental expenses as ordinary and necessary to continue the ongoing use and ownership of the property.

Once you indicate the property is sold then the sales information screen will populate for you to enter the sales price both for land and building as well as the sales expenses.

- Start with the Federal tab

- Click on Income and Expenses

- Under Your income and expenses, scroll down to

- Rental properties and royalties, click Edit/Add

- Do you want to review your rental?, click Yes

- Under Rent and Royalty Summary, click Edit

- Click Update to the right of Assets/Depreciation.

- Click Edit to the right of the assets to be disposed

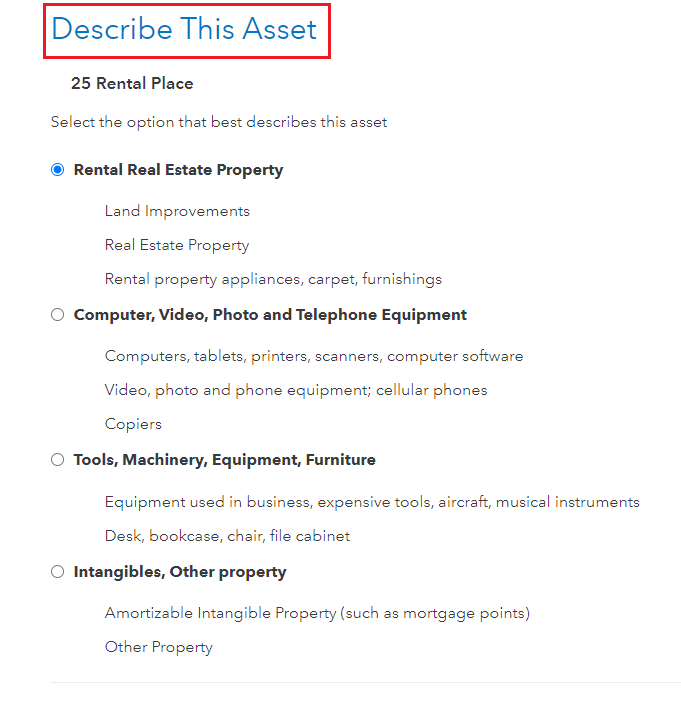

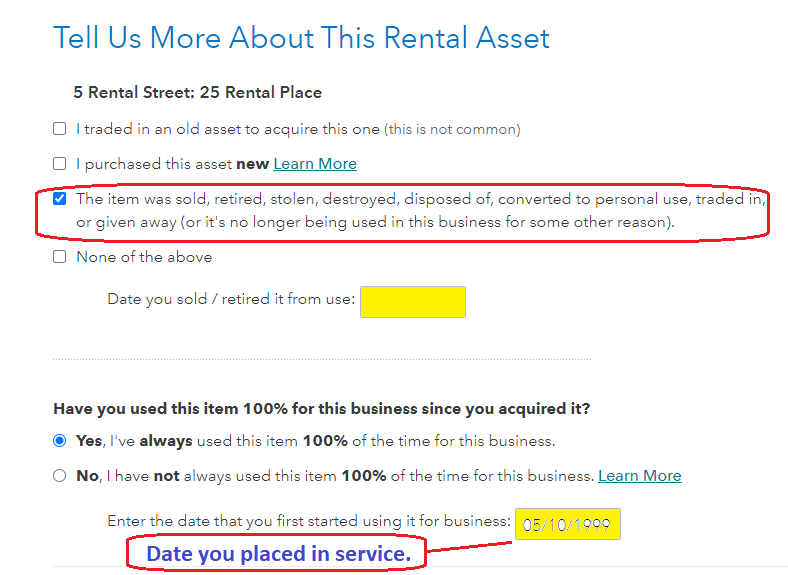

- Go through several screens until you get to Tell Us More About This Rental Asset

- Click on This item was sold…….

- And continue to answer the questions

- See the screen images below for assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Sale

Here's the general guidance on reporting the sale of rental property. It is assumed that you "READ THE SMALL PRINT" on each and every screen. Seems I can't stress that enough.

Reporting the Sale of Rental Property

If you qualify for the "lived in 2 of last 5 years" capital gains exclusion, then when prompted you WILL indicate that this sale DOES INCLUDE the sale of your main home. For AD MIL personnel who don't qualify because of PCS orders, select this option anyway, because you "MIGHT" qualify for at last a partial exclusion.

Start working through Rental & Royalty Income (SCH E) "AS IF" you did not sell the property. One of the screens near the start will have a selection on it for "I sold or otherwise disposed of this property in 2021". Select it. After you select the "I sold or otherwise disposed of this property in 2021" you continue working it through "as if" you still own it. When you come to the summary screen you will enter all of your rental income and expenses, even if it's zero. Then you MUST work through the "Sale of Property/Depreciation" section. You must work through each individual asset one at a time to report its disposition (in your case, all your rental assets were sold).

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset. Then if you sold this rental at a gain, you must show a gain on all assets, even if that gain is $1 on some assets. Likewise, if you sold at a loss then you must show a loss on all assets, even if that loss is $1 on some assets.

Basically, when working through an asset you select the option for "I stopped using this asset in 2021" and go from there. Note that you MUST do this for EACH AND EVERY asset listed.

When you finish working through everything listed in the assets section, if you ever at any time you owned this rental you claimed vehicle expenses, then you must also work through the vehicle section and show the disposition of the vehicle. Most likely, your vehicle disposition will be "removed for personal use", as I seriously doubt you sold your vehicle as a part of this rental sale.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

ramseym

New Member

DallasHoosFan

New Member

eric6688

Level 2

William--Riley

New Member