- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

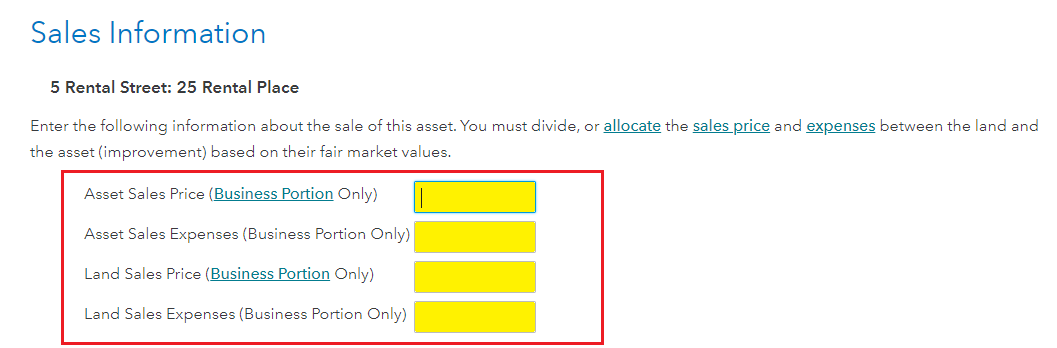

First, the expenses of sale that should be entered when asked are the engineering survey pre-sale, realtor commissions, title insurance and some closing costs.

Next the closing costs that are deductible as rental expenses are the prorated share of real estate taxes for the year of sale and any mortgage interest you might have paid. Recording fees and all other closing costs will be part of the sales expense. Think of the rental expenses as ordinary and necessary to continue the ongoing use and ownership of the property.

Once you indicate the property is sold then the sales information screen will populate for you to enter the sales price both for land and building as well as the sales expenses.

- Start with the Federal tab

- Click on Income and Expenses

- Under Your income and expenses, scroll down to

- Rental properties and royalties, click Edit/Add

- Do you want to review your rental?, click Yes

- Under Rent and Royalty Summary, click Edit

- Click Update to the right of Assets/Depreciation.

- Click Edit to the right of the assets to be disposed

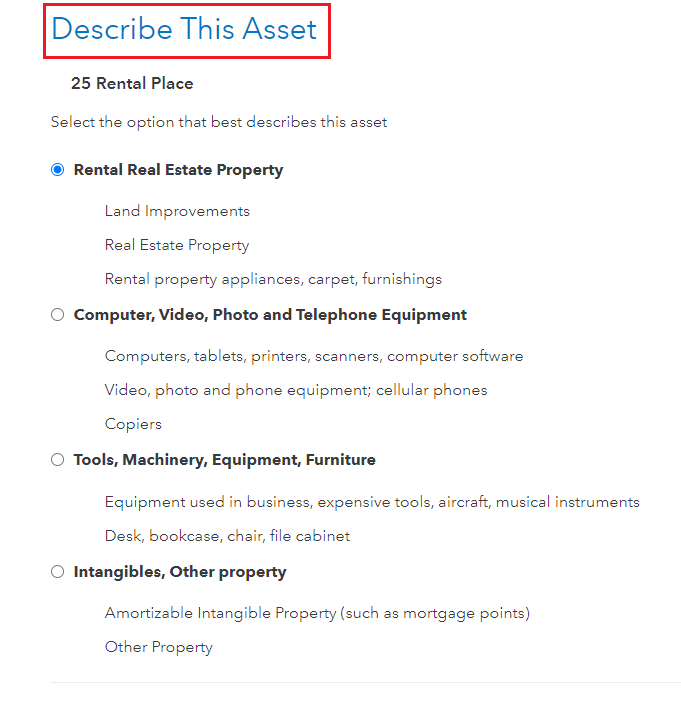

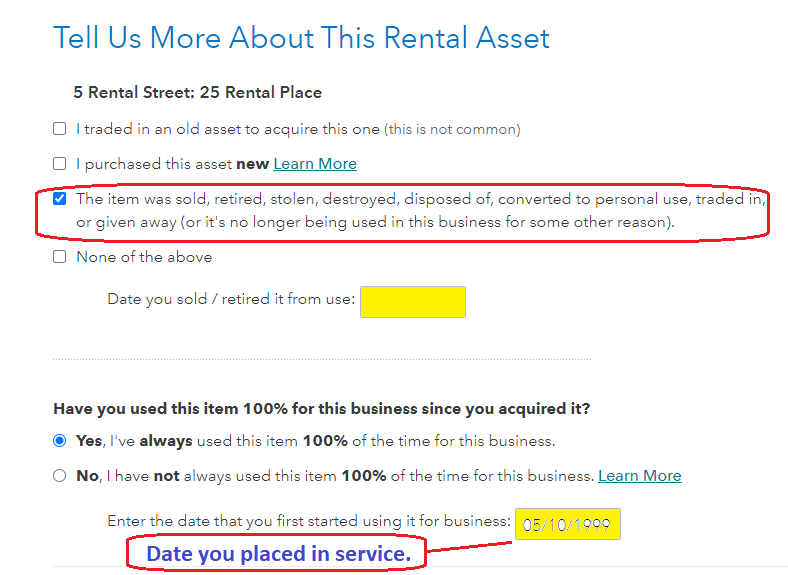

- Go through several screens until you get to Tell Us More About This Rental Asset

- Click on This item was sold…….

- And continue to answer the questions

- See the screen images below for assistance.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 20, 2022

6:30 AM