- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Rental Income question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Income question

Background:

I have been using TT for over a decade plus and each year I import my information from the previous year's tax file to pre-populate information.

Issue:

In 2022, I had rented my property in Nevada while I was living in California. Around August/September 2022 I ended the rental as I moved to Nevada and to ownership of the property as my primary residence.

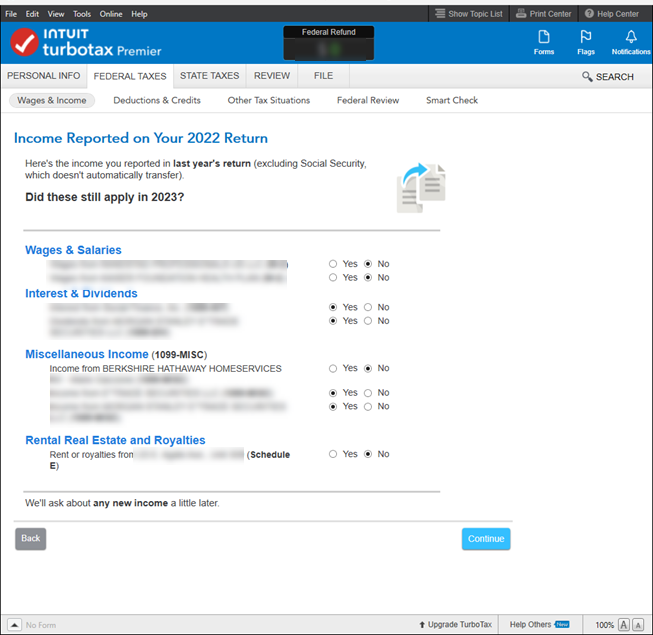

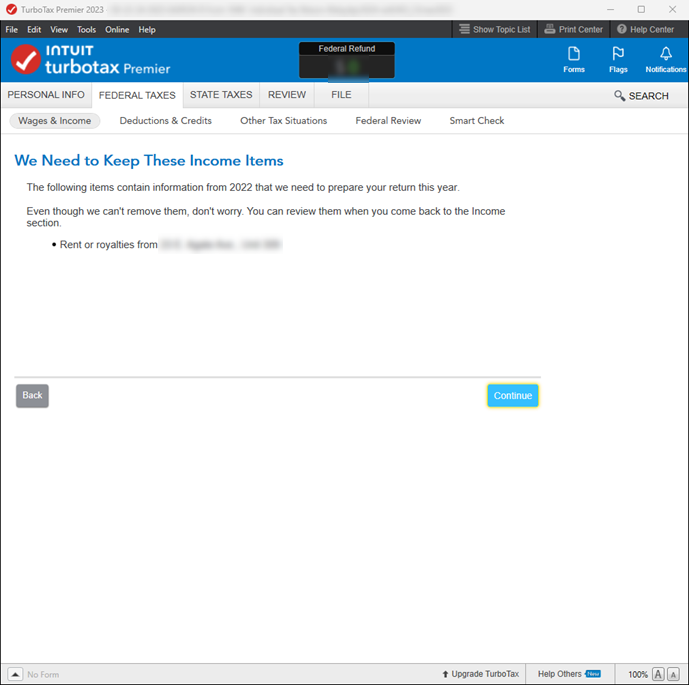

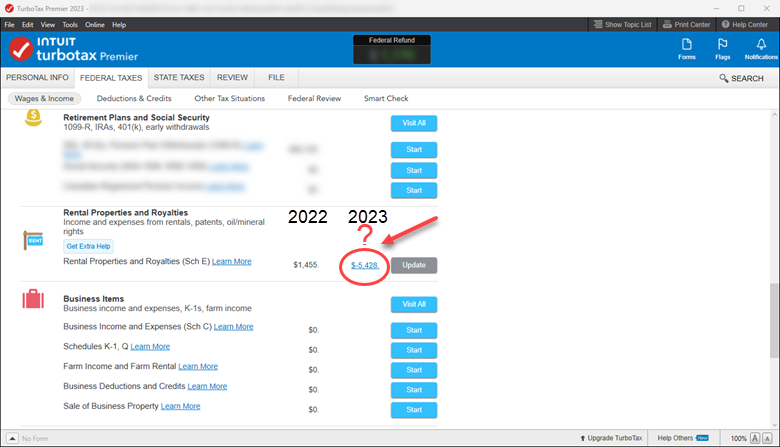

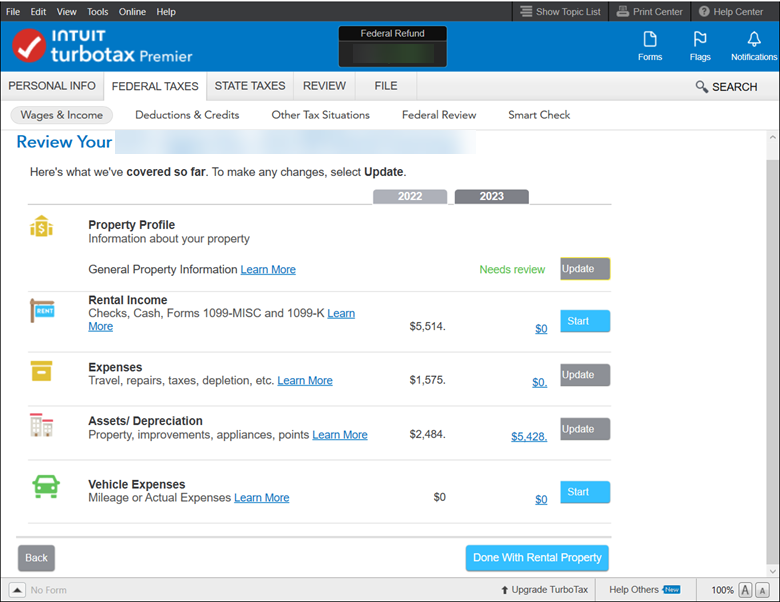

While doing current year (2023 tax year to be filed by April 15, 2024), I am noticing for whatever reason, there is rental amounts displaying and I am at a loss as for the entire 2023, the property was NOT RENTED, it was owner occupied.

Not sure what to do with the Rental Income (delete it?) even though I have indicated in the software that I had no rental income, but yet the software is inserting a figure of (negative) $-5428.

Thank you in advance for your assistance.

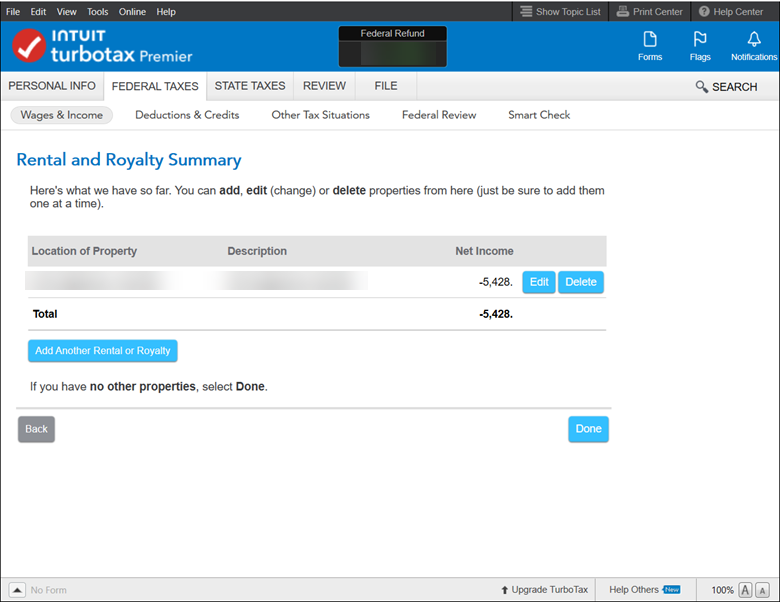

Below are the screens I come across when dealing with this issue:

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Income question

This figure is likely coming from the rental asset(s) depreciation. For 2023, you must go through each asset, indicate it was converted to personal use and enter a date of January 1st, 2023. There will still be a small amount of depreciation for 2023 (half a month) and then the property will be completely removed for your 2024 tax return.

When you are in the rental activity for 2022, you must select the 'Assets' section, then in each asset you must go to the screen titled 'Tell Us More About This Rental Asset'.

- Once you reach this screen for each asset, you must select 'This item was sold, retired, stolen, destroyed, disposed of, converted to personal use....'

- Next enter the date you stopped using the asset for rental purposes. And answer 'Yes' you always used this asset 100% of the time for business. (The percentage of use doesn't change until after conversion from rental to personal use.)

- Select 'Yes' for Special Handling due to 'You converted the asset to 100% personal use.'

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Income question

Thank you, Dianne.

Would you be kind enough to look at one more inquiry please.... turns out I was informed yesterday, there was a 1099-MISC that was received by the kid (I know 19...but still my kid) previously not known to me. So entered it and have some questions pertaining to it. I just posted it on the Forum.

(1) Questions pertaining to 1099 Misc (intuit.com)

or

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Income question

Your questions about the Form 1099-MISC have been answered by VanessaA , on the thread you referenced above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Income question

So I did not see the Tell Us More About This Rental Asset'. anywhere on the screen. These are steps I took:

- Navigated back to the section of Wages and Income

- Selected No for the Rental and Royalties and clicked on Continue

- Rental and Royalty Screen is displayed with options to Edit or Delete

- Clicked on Edit

NOTE: So far no Tell Us More About This Rental Asset - Review your Rental Summary screen is displayed.

Stopped here...and didn't know which way to proceed further. Essentially, the property was rented in 2022 from Feb to 10/22/22. That's it.

For entire 2023 it was not rented. To make things easy, I would be okay with letting it stay a Rental till 12/31/22 so long as it saves me the headache, but I do need to stop the rental information from stopping to display so when I do sell the property, I want to make sure it only accounts for rental for 2022 and not any time beyond that and I have it owner occupied for 2 out of the 5 years so I can get sale proceeds tax free for up to $250,000 (I think that is how it works)

Appreciate your assistance. I even tried the FORM View and am at a loss. I hope TurboTax works on this feature to make it easy for users. Thank you and I look forward to the Experts to chime in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Income question

From the Rental Property summary page (Review Your [property name]), click Update beside the notice "Needs Review" for the Property Profile.

- Follow the interview (click Continue) until you come to the page "Do any of these situations apply to this property?"

- Check the box for "I converted this property from a rental to personal use in 20XX."

- Make note of the additional information that is displayed then click Continue.

- On the page "Was this property rented for all of 20XX?", click "No, the property was not rented all year."

- Lines will pop-up for the number of days it was rented and personal use days. If the property was not available to be rented all year, check the box for "I did not rent, nor attempt to rent, this property at all in 20XX."

- Make note of the additional information that appears. TurboTax will remove this rental from your return.

At this point, be sure you have copies of all the schedules from last year, especially the depreciation report.

Then click Continue. - Answer any remaining questions until you arrive again on the Rental Property summary page.

If these steps don't remove your rental property from your return, you can use Forms Mode to manually delete the related forms. Go to Forms and find "Schedule E Wks" in the forms list - you will delete this one LAST. Delete all forms under that name (indented, because they relate to this property). The delete button is at the bottom of the open form. Then use Step-by-Step and return to the list of your rental properties to confirm the property is no longer listed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

air1erb

Returning Member

chinths

New Member

RShaunSmith

New Member

temperaturesealion

Level 1

gracefulcrayfish

New Member