- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Recovery Rebate Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit

I qualified for the Recovery Rebate Credit. I didn’t receive any stimulus help in 2020. It said I qualified for the full $1800 in Recovery Rebate Credit. I sent in my taxes but only received like less than $190 for fed/state back. Anyone know why this is or can offer help?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit

Did you have any taxes on Line 16 of your Form 1040? As explained by lenaH above, you would only get a refund if the credit exceeded all or some of your income taxes due. If the credit did not exist, you might have owed taxes when filing your tax return. But instead, the credit was used to offset your total tax liability.

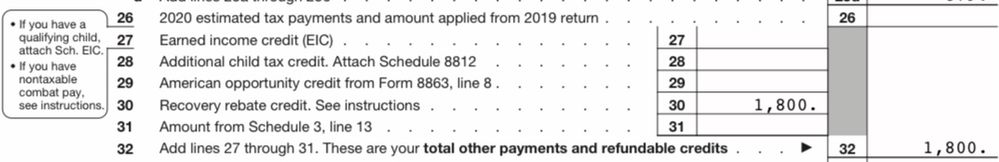

Please see the screen shot below. If the total amount on line 16 is close to the amount on line 33, you would only be refunded the difference between these values.

If the IRS did make any adjustments, you will receive a notice from them to let you know any adjustments were made. They will contact you by mailing you a notice of adjustment, if applicable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit

It depends. The Recovery Rebate Credit is calculated into your overall tax refund and will either increase a refund or decrease the amount of tax owed. For example - if you owed $1,610 in federal income taxes, then the offset of the $1,800 credit will equal a $190 refund on your 1040. Please look at your 1040, page 2, Line 30 to determine if you get the Recovery Rebate Credit.

If you did not receive the Recovery Rebate Credit, it is important to keep in mind that your 2020 income determined whether you are entitled to the credit to recapture any stimulus payments not received. It is likely that you qualified for the Recovery Rebate Credit and subsequently entered additional income into your return that then disqualified you due to your adjusted gross income being over the limit.

Per the IRS, your Recovery Rebate Credit amount will be phased out if your adjusted gross income for 2020 exceeds $150,000 if you are married filing a joint return or filing as a qualifying widow or widower, $112,500 if you are using the head of household filing status, or $75,000 if you are using any other filing status.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit

I did qualify for it. I didn’t owe any taxes and I didn’t exceed the gross income that would cancel me out for it. So I am still a little confused.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit

Did you have any taxes on Line 16 of your Form 1040? As explained by lenaH above, you would only get a refund if the credit exceeded all or some of your income taxes due. If the credit did not exist, you might have owed taxes when filing your tax return. But instead, the credit was used to offset your total tax liability.

Please see the screen shot below. If the total amount on line 16 is close to the amount on line 33, you would only be refunded the difference between these values.

If the IRS did make any adjustments, you will receive a notice from them to let you know any adjustments were made. They will contact you by mailing you a notice of adjustment, if applicable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit

@JotikaT2 I understand now and figured it out. Thank you so much for your help!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

elliottulik

New Member

Garyb3262

New Member

nalee5

New Member

johnpickle306

New Member

theresavanhoose

New Member