- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Receiving Foreign Income - How to enter taxes deducted

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receiving Foreign Income - How to enter taxes deducted

We receive foreign income that is reported to the U.S.

The tax on the foreign income is reported and remitted to the foreign government and we receive the net amount.

In Turbo Tax, Federal Income, Income Category, there is a screen that says "Enter Common Expenses" and lists among other things Taxes, Depletion. We know depletion is entered here, but not sure about Taxes.

Under Deductions and Credit, we use the Foreign Tax Credit where we enter the Foreign Income and the Taxes Paid.

So, not sure if we enter the taxes under Income/Enter Common Expenses and also enter under Deductions and Credits/Foreign Tax Credit.

Thanks so much

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receiving Foreign Income - How to enter taxes deducted

Yes, you should enter your foreign rental income in the rental income section, but not the foreign income taxes.

If you paid foreign property tax, which is an annual tax on the value of your property, you can deduct that in the rental income and expense section too.

You can deduct, or take a credit for your foreign income taxes in the Foreign Tax Credit section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receiving Foreign Income - How to enter taxes deducted

Yes that is correct. It is a deduction and not claimed as a credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receiving Foreign Income - How to enter taxes deducted

If I remember correctly ,the program asks for the gross amount of foreign income so in this instance, report $50,000 as the gross income amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receiving Foreign Income - How to enter taxes deducted

No, you should enter your foreign income and foreign taxes in the Foreign Tax Credit section and no where else.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receiving Foreign Income - How to enter taxes deducted

Thanks JulieS. Are we not supposed to enter the Foreign Income under Rental Property and Royalties.

If not, and only under the FTC section, then the return shows no income which would be wrong since we received the income from the foreign source, but it was taxed in the other country.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receiving Foreign Income - How to enter taxes deducted

Yes, you should enter your foreign rental income in the rental income section, but not the foreign income taxes.

If you paid foreign property tax, which is an annual tax on the value of your property, you can deduct that in the rental income and expense section too.

You can deduct, or take a credit for your foreign income taxes in the Foreign Tax Credit section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receiving Foreign Income - How to enter taxes deducted

Thanks JulieS. Much appreciated.

For Depletion, since this is a mining property, I believe Depletion is take on the Income as a deduction and not on the FTC.

Correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receiving Foreign Income - How to enter taxes deducted

Yes that is correct. It is a deduction and not claimed as a credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receiving Foreign Income - How to enter taxes deducted

Thanks Dave for the response. I was working through various scenarios based on what you have said.

Couple of questions: example only below

Income Section: Gross of say $50,000

Depletion of 15%: $7,500

Net Income of $42,500

For the Foreign Tax Credit, is the Gross Income the $50,000 or the $42,500?

If $50,000, do we re-enter depletion of $7,500 as a deduction?

If $42,500, I assume the depletion is not re-entered as it was done in the Income section. Correct?

Thanks so much

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receiving Foreign Income - How to enter taxes deducted

It depends on the amount of income your Foreign Tax Credit was based from. if you receive a supplemental statement from your K1 trustee, it should list that somewhere. Without knowing this, I can't say for sure what income was reported to the foreign government and how the foreign taxes were assessed. Here is how you will enter the information.

- Assuming you received a 1099 MISC for your royalty, go to federal>wages and income>

- Rental properties and Royalties>rental properties and Royalties

- Answer all of the questions regarding the royalty. Be sure to indicate if this is a oil or gas royalty when it asks for this information.

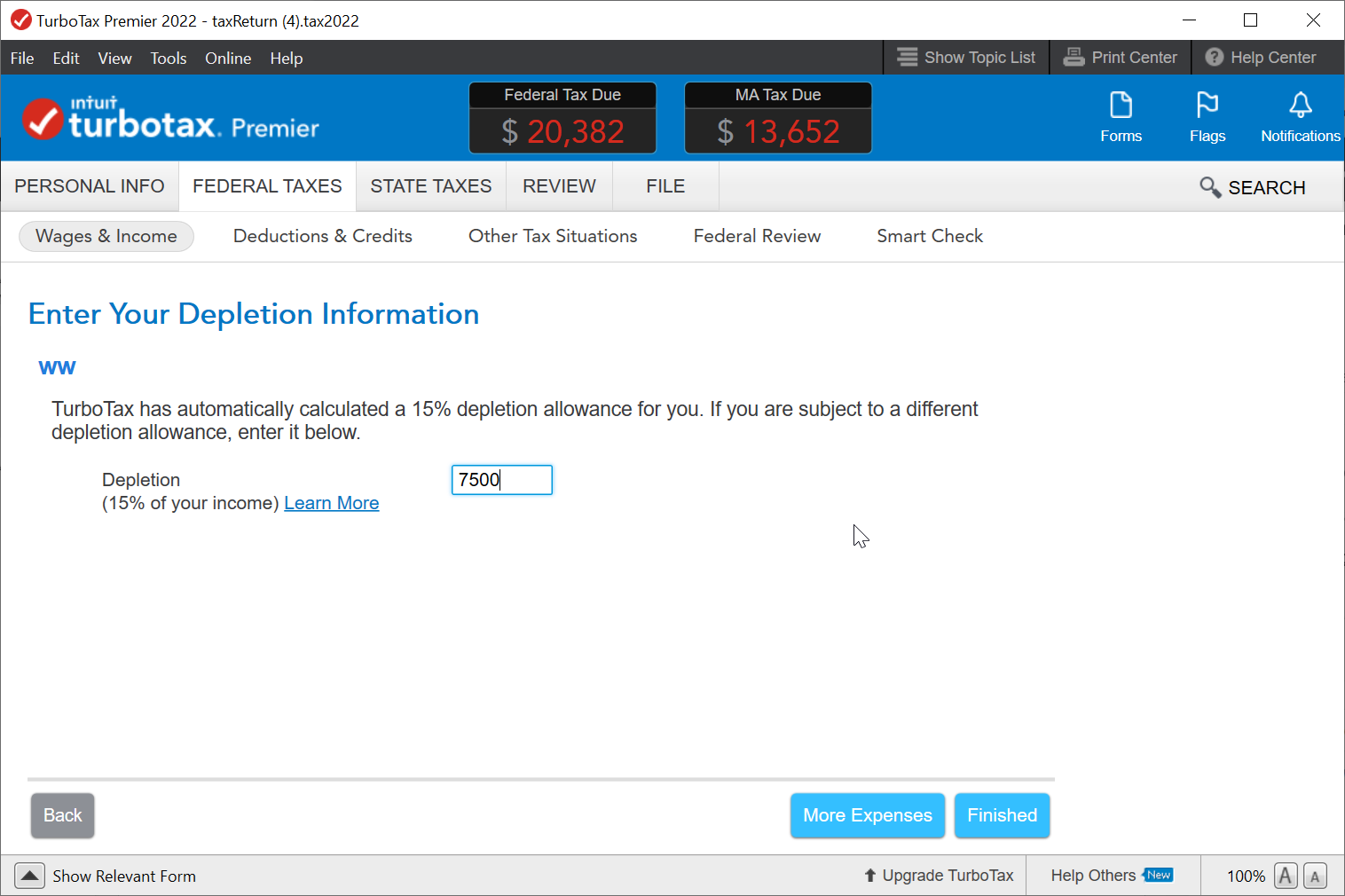

- After entering the income from the 1099 MISC, there is a page that will ask what the depletion allowance is. Here you will record $7500. Here is what that page looks like.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receiving Foreign Income - How to enter taxes deducted

Thank you. I understand what you said in your reply.

The question is really about the FTC.

When entering the information for the FTC, it asks about "Gross Income". In the example above, that would be $50,000.

BUT, the income was reduced by the amount of depletion. So, not sure if in the FTC, I enter the "Gross" of $50,000, or the Income of $42,500 which is the Gross less the depletion.

Is it also correct that depletion is NOT entered as a deduction in the FTC since it was taken from Income.

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receiving Foreign Income - How to enter taxes deducted

If I remember correctly ,the program asks for the gross amount of foreign income so in this instance, report $50,000 as the gross income amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receiving Foreign Income - How to enter taxes deducted

Thank you.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

snowy_al

New Member

Nka0002

New Member

briberglund123

Level 1

fpho16

New Member

pocampousa

New Member