- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Why does it say I can report my last year's income if it is more to earn more of the EIC credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does it say I can report my last year's income if it is more to earn more of the EIC credit?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does it say I can report my last year's income if it is more to earn more of the EIC credit?

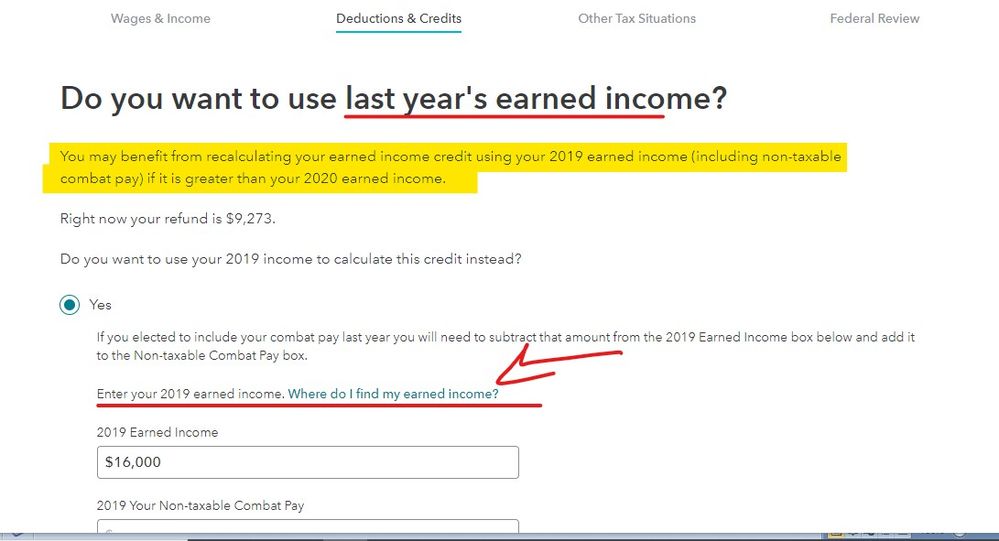

Many people had lower incomes during the pandemic in 2020 due to reduced work hours, layoffs, etc. Or they received unemployment benefits. These factors affect how much earned income credit and additional child tax credit you can get on your 2020 tax return and affect your 2020 refund.

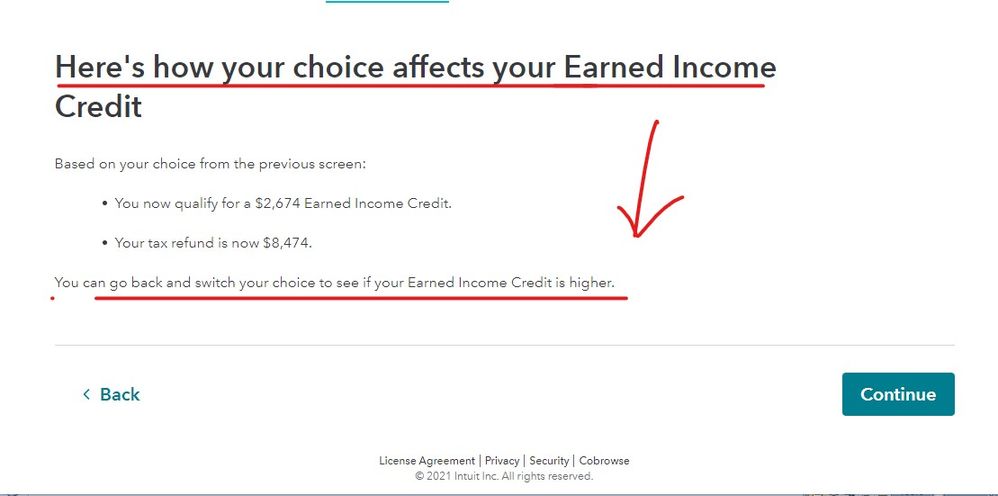

There is a “lookback” option that allows you to use your 2019 amounts for earned income credit or child tax credit. You can choose whether to use your 2019 amount or your 2020 amount. Choose whichever amount gives you a better tax refund for your 2020 refund.

You can see this and choose in the earned income credit section in Deductions and Credits.

You still MUST enter all of your 2020 income into your 2020 tax return, including any unemployment you received.

Please follow these steps in TurboTax:

- Login to your TurboTax Account

- Click on the Search box on the top and type "EIC"

- Click on “Jump to EIC”

- Answer the questions until you reach the screen "Do you want to use last year’s earned income?"

- Note your current refund amount using your 2020 earned income at the top of the screen.

- Click "Yes", enter your "2019 Earned Income" if the field is blank and click "continue".

- Compare the new refund amount using your 2019 earned income with the previously noted refund amount using your 2020 earned income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does it say I can report my last year's income if it is more to earn more of the EIC credit?

Hi,

I chose the “look back” option — to use my 2019 income for the EIC. I understand that I need to submit my 2020 income still, which I did. During the “complete check”, I notice that my income “needs to be reviewed”. All of the fields where my W-2 information should be, are blank. Should I leave it blank and still submit? I didn’t receive any 2020 W-2s for these jobs since I didn’t work for them during 2020. Do I enter my 2019 W-2 information in the blank fields?

KaiJana

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does it say I can report my last year's income if it is more to earn more of the EIC credit?

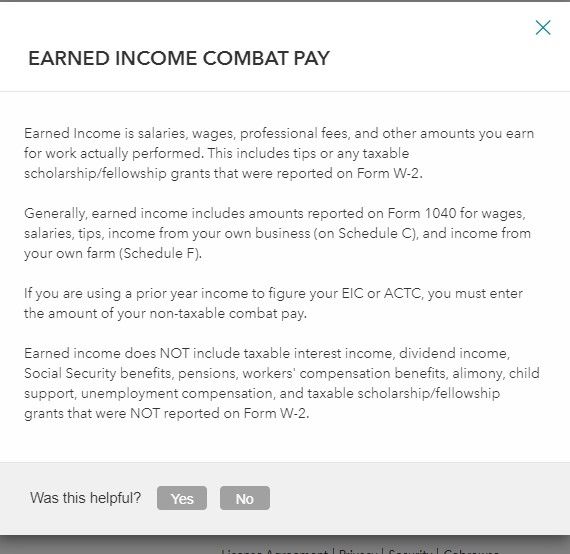

Yes, you do enter the 2019 earned income in the blank field using you W-2. Screenshot is provided by volvogirl.

When you get to the EIC section you will go slow and read the screens carefully ...

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ayubruin7777

Level 1

kishorchandra joshi

New Member

katik2123

Level 1

goodie

New Member

Taxes_Are_Fun

New Member