- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: What exactly are "Nondeductuble expenses from prior years"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What exactly are "Nondeductuble expenses from prior years"?

I'm moving from years of my accountant doing my taxes to my first time with TT. On my 2017 return's Schedule E, she showed no profit or gain by, it appears, not taking the full depreciation expense for the year. To me that looks like a loss that I'm not going to be able to "keep" going forward. And this approach of hers appears to go back for years.

1) Is it likely that this loss being kept track of elsewhere?

2) Would these fields be a good place to try to do some "catch-up" on my prior year loss tracking, or are they meant for something else. If so, what?

Thanks.

Dave

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What exactly are "Nondeductuble expenses from prior years"?

That information should be in the packet the account gave you from last year ... if it is not there then ask him for that info.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What exactly are "Nondeductuble expenses from prior years"?

Thanks. And as for question 2?

I would like to know what this page of the TT walk-through is for ("Nondeductuble expenses from prior years"). I can find no explanation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What exactly are "Nondeductuble expenses from prior years"?

They are scattered throughout the program depending on what you have to report ... as you complete the interview there will be places for that info.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What exactly are "Nondeductuble expenses from prior years"?

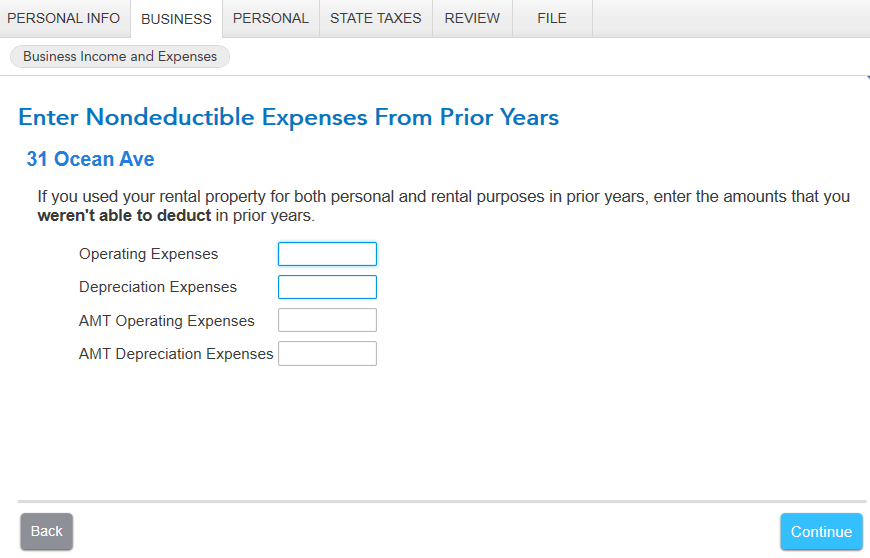

Actually, the page I'm referring to is a place for that info. That's why I'm wondering what it has in mind. As I mentioned it has fields for Operating Expenses and Depreciation Expenses. Also, two more fields with "AMT" in front of those same terms.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What exactly are "Nondeductuble expenses from prior years"?

Which form is giving you issue ? You still have not said.

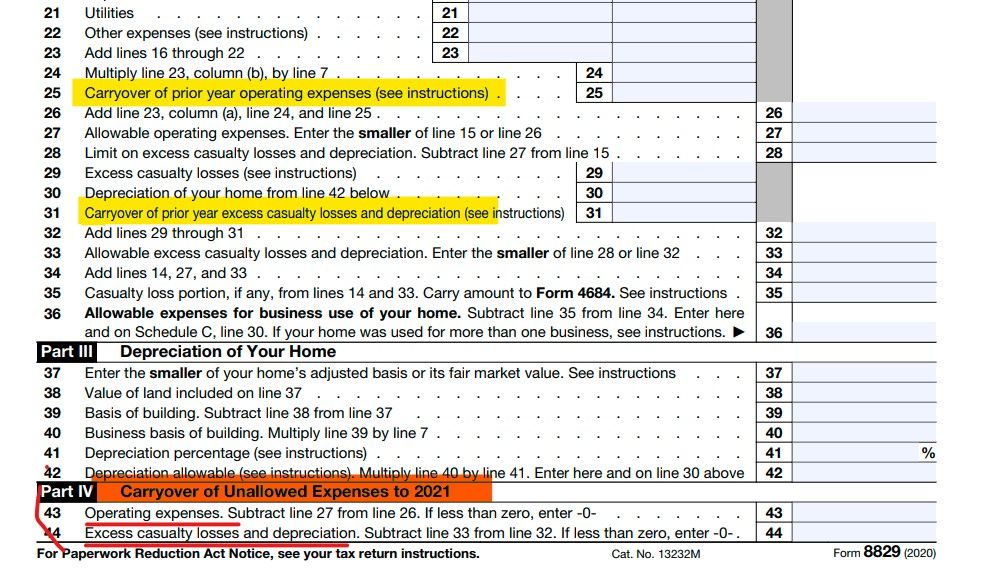

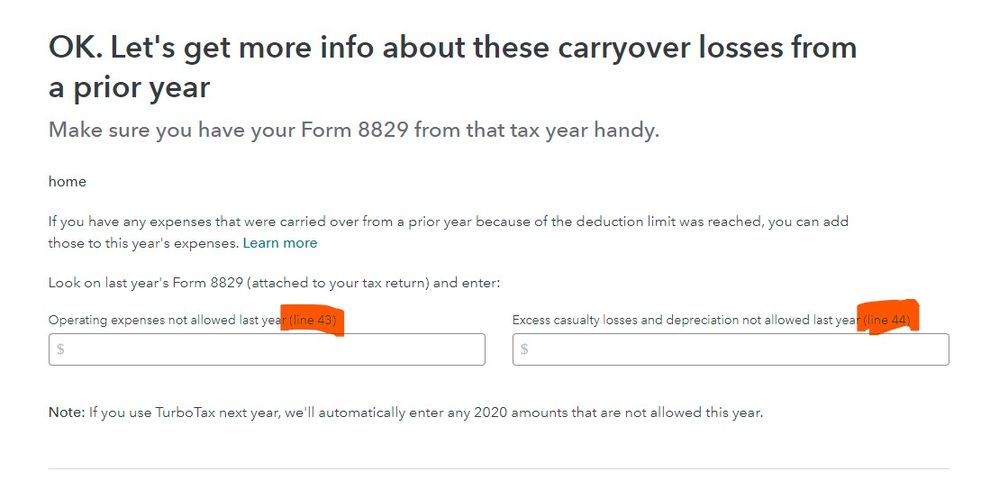

Is it the 8829 ? Look at last year's form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What exactly are "Nondeductuble expenses from prior years"?

No, it's a walk-through page under Business Income and Expenses. Looks like this:

BTW, this is in TT Home and Business 2018. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What exactly are "Nondeductuble expenses from prior years"?

Once again you need that info from the accountant if they did not include all the worksheets showing the carryover information in your original packet. Many professionals withhold these pages on purpose to force you to return however it is not ethical so contact them for the missing pages. They may be willing to email you a PDF.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What exactly are "Nondeductuble expenses from prior years"?

For a rental property, non-deductible amounts that you can carry forward to the next tax year are indicated on IRS Form 8582. If any "at risk" losses are involved (not typical for me) then IRS Form 6198 will also be used in calculating the carry forward loss.

Now-a-days it's becoming not all that common for a residential rental property owner to actually have carry forward losses. A few years back things were changed to where if you meet certain criteria, you can deduct up to $25K of your passive losses from other ordinary income. The TTX program deals with this automatically just fine, in my experience.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What exactly are "Nondeductuble expenses from prior years"?

So this is for manual entry of carryovers?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What exactly are "Nondeductuble expenses from prior years"?

I'm having trouble getting my head around the meaning of at-risk. From what I've read it sounds like anything you own that's not protected from seizure is at-risk. Like the rental property.

Would you be so kind as to put it in layman's terms for me?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What exactly are "Nondeductuble expenses from prior years"?

The program is asking for the amount of carryover from the prior year so all you have to do is go get those figures off last year's worksheets so yes this is a direct manual entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What exactly are "Nondeductuble expenses from prior years"?

At Risk ... simply this means if the property was wiped off the face of the earth would you still be liable for the mortgage after any insurance payments ? If you say yes then you are at risk.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What exactly are "Nondeductuble expenses from prior years"?

Hmmm... We own the house outright. No mortgage. Does this mean none of our rental business is at-risk?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What exactly are "Nondeductuble expenses from prior years"?

Heard back from my account the same day. On a Sunday, no less. She sent me the worksheet I needed, and I entered the number in the fields on that screen, and all seems right with the world. 🙂

Thanks very much for walking the newbie through this.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Agately

New Member

margomustang

New Member

KarenL

Employee Tax Expert

nex

Level 2

Viking99

Level 2