- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: The CARES act changed how charitable donations are deducted from income. Does turbo tax recog...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The CARES act changed how charitable donations are deducted from income. Does turbo tax recognize this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The CARES act changed how charitable donations are deducted from income. Does turbo tax recognize this?

Yes, TurboTax recognizes that the CARES Act changed how charitable donations are treated. If you do not have enough itemized deductions to use Schedule A, TurboTax will allow you to deduct the $300 cash deduction pursuant to the Act. TurboTax also recognizes that pursuant to the Act, you can deduct up to 100% of your adjusted gross income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The CARES act changed how charitable donations are deducted from income. Does turbo tax recognize this?

For me, the total of charitable deductions (schedule A) in Turbotax 2020 is correct, but only about 60% is used in 1040.

Why? And how to I fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The CARES act changed how charitable donations are deducted from income. Does turbo tax recognize this?

What is your AGI? Are your donations higher?

Individuals can elect to deduct cash contributions, up to 100% of their 2020 adjusted gross income, on itemized 2020 tax returns. This is up from the previous limit of 60%. Corporations may deduct up to 25% of taxable income, up from the previous limit of 10%.

I

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The CARES act changed how charitable donations are deducted from income. Does turbo tax recognize this?

The program is not using all of the charitable deductions. It is showing limited at 60% of AGI. The cares act allows 100% of AGI. Why is the program using 60%, last years percentage

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The CARES act changed how charitable donations are deducted from income. Does turbo tax recognize this?

MaryM428,

My deductions (charitable and others) do not exceed my AGI.

hwayner sees the same problem that I do.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The CARES act changed how charitable donations are deducted from income. Does turbo tax recognize this?

This is a known software issue. The workaround is to delete the $300 in the error check. Then go back to Deductions & Credits and enter the contribution there, in the Donations to Charity topic. Then click Done with Donations and proceed through the screens until you get to the screen that tells you that TurboTax has added in the contribution. The contribution should then appear on Form 1040 line 10b.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The CARES act changed how charitable donations are deducted from income. Does turbo tax recognize this?

This is not the issue. The issue is utilizing 100% of your contributions to write off against your AGI. Example,

$ 20,000 of contributions to write off on schedule A against an AGI of $20,000. The program is limiting the deduction to $ 12,000, or 60% of AGI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The CARES act changed how charitable donations are deducted from income. Does turbo tax recognize this?

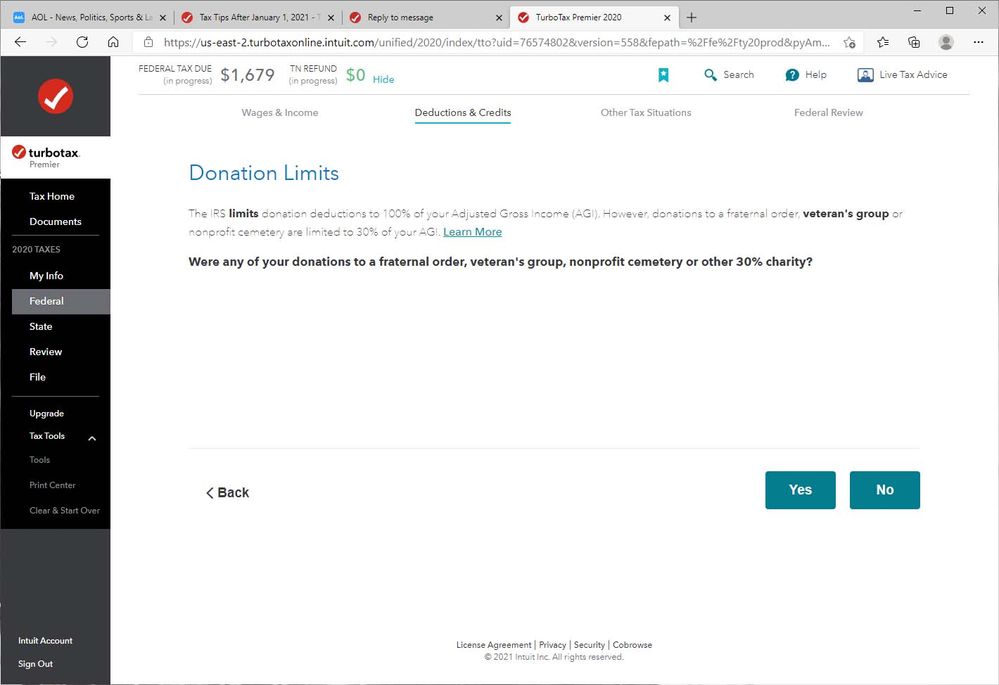

You did not take your donation reporting far enough. Once you entered your donation amounts and finished, there is a screen where you will indicate that this is a qualified 100%/50% qualified charity. I have included the screenshot below for your reference.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The CARES act changed how charitable donations are deducted from income. Does turbo tax recognize this?

DaveF1006,

Thanks for the info, but that screen does not show up in TurboTax Premier.

This screen shows up:

After answering "No", the next screen indicates "You've entered all required info for your charity contributions."

Now what???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The CARES act changed how charitable donations are deducted from income. Does turbo tax recognize this?

I did not have that screen come up either, I am using premier as well. I was able to edit the donation type to a

"C" category( 100%) on the contributions backup document from an "A"(50%) category. This had to be done manually on each donation listed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The CARES act changed how charitable donations are deducted from income. Does turbo tax recognize this?

Where is the contributions backup document?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The CARES act changed how charitable donations are deducted from income. Does turbo tax recognize this?

If the combined value of all property you donate is more than $500, you must prepare IRS Form 8283. When you print or preview your tax return, you have to option to choose all forms and worksheets so you can see the details of everything reported on your tax return. The printing options are found under Tax Tools if you are using the Online version and if you are using the desktop version, you already have access to all forms and worksheets - just click on Forms in the upper right corner of the screen. @canishel

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The CARES act changed how charitable donations are deducted from income. Does turbo tax recognize this?

Go to forms view and look for the form called Cash Contributions Worksheet. The first section lists all of your donations and there is a column called source with a letter in it. Highlight it and change to "C", a 100% donation. That will then flow to the schedule A and should allow all donations up to the AGI limit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The CARES act changed how charitable donations are deducted from income. Does turbo tax recognize this?

hwayner,

I'm using the online version which doesn't have access to those forms.

A tax expert is now trying to help me by phone.

Thanks for bringing this up.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

intuit

New Member

TRIBBIE

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

nnennak

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

ssolfest

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

user17524233574

Level 1