- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Still getting Error - Deductible Home Mortgage Interest Worksheet

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

me too! Thanks for the heads up.

No need to clear cache or anything.

Just file now. It works for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Downloading the update worked for me! Thanks to Max_Tax_Guy for all your hard work!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

I just tried to file again and was able to e-file without issue. I did not change any of my 1098's, just submitted again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Confirming that the browser portal works as well now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Thanks for confirming the glitch has been fixed! Just filed - and will probably never use TT again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

I had this same issue (error with Home Mortgage Deduction worksheet because of two 1098s), and was finally able to e-file today without an issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

We are happy to see your issue was resolved. If you have any more questions, please feel free to reach out again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

@turbo Tax Team: The issue is NOT resolved for anyone with the Turbo Tax client installed on their computers. Please advise of a release date for the fix to this ongoing issue.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

It was resolved on TT Premier for my Mac OS...you have to save, close and reopen...TT then installs an update and you should be good to file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Was able to file last night online via Premier Live. Thank you Max_Tax_Guy! Honestly this fix would not have happened so quickly, if at all without you and everyone on this message fee giving this issue visibility on here and social media.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Thanks all. This update cleared the "form available on 2/17 error".

However, Is anyone else having this issue:

After I enter both 1098's, TT is asking for clarification about the outstanding loan balance as of 1/1/22. When I enter "0" on the first loan since I technically paid it off last year, I get an error "Outstanding Loan Balance is Missing a Value" in red.

If I enter any other number in the field, my refund is reduced.

Why won't it let me enter zero? I did not have a loan balance on 1/1/22.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Did you try leaving it blank? (not sure if it will allow that but I thought I recall the original instructions on the screen prompts to leave blank if paid off (or maybe there was another field to indicate that the loan was paid off that needs to be checked?)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

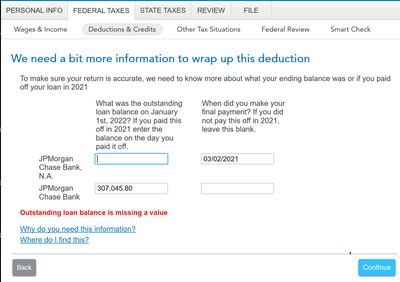

It was another field you are thinking of (see screenshot).

I technically can bypass the error by hitting continue a couple times. But not sure which is legally correct. Perhaps I'm just confused about the question. I have zero balance on the loan as of 1/1/2022 (since it sold in 2021), so I naturally want to enter "zero" or "blank" as the answer.

But the second part of the question says to enter "last balance from 2021" which clears the error, but it wasn't the balance I had as of 1/1/2022 (and significantly reduces my return)".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

It phrased it differently for me, making it clear that if your loan was paid off in 2021, you should enter the final balance on the day it was paid off - which should either be on your 1098 (some banks include it as additional information) or can be found in your closing documents. Yes, it may reduce your refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Hi All,

Is it now calculating correctly for everyone else? For me the error is gone, but based on the interest deduction TT is calculating, it appears TT is doing it incorrectly. Specifically:

I sold house A in May 2021, and bought house B in May 2021. House A had been bought before the change to 750k. My loan balance for house A was less than 750k. My loan balance for house B was more than 750k. It appears TT is taking my total interest paid (the sum of the interest on the two loans) and multiplying by 750k/(LoanBalanceB). This is not my understanding of how it should be calculated.

If others are getting a correct calculation, I will keep trying to re-enter information and see if I can get it to recalculate.

Thanks

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17558084446

New Member

user17539892623

Returning Member

TechieGal

Level 3

JBogs

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

TEAMBERA

New Member