- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: SS benefits

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SS benefits

There is a section on my GA state side that has me confused on what to enter. I received 20K in social security benefits. I put that amount in my Federal taxes, no issues. On the Georgia side, there is a section that says "Social Security/Railroad retirement benefits"

"Confirm or enter the amount of the social security/railroad retirement benefits that is NOT SUBJECT to Georgia income tax but was included in income on your federal return."

I'm not sure what to enter in here, is it the 20K that I received and entered into federal? I'm not sure what amount is subject to GA income tax but from everything I've read, no SS income is subject to GA income tax.

Anyone from GA that can help?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SS benefits

You are correct GA does not tax Social Security or Railroad Retirement benefits. You will only need to verify the social security benefits that were taxable on your federal return.

The box in the GA state interview should populate automatically with the taxable amount from line 6b on your federal form 1040.

If you put your cursor in the box and backspace to delete the entries that you may have accidentally made and then "Continue" at the bottom of the page the box will populate correctly.

If none of your social security was taxable, then the box will be blank.

If you wish, you can check line 6b on your form 1040 in TurboTax online versions using these steps.

1. Select "Tax Tools" in the left hand menu

2. Select "Tools"

3. Select "View Tax Summary"

4. Select "Preview My 1040" in the left hand menu

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SS benefits

Appreciate the response, still not sure I understand. If I keep the box 0/unpopulated, there is an amount I owe to the state. If I populate the amount that I entered in on the federal side then I owe nothing. It does not look like the amount of 20K carried over so I assume I just manually populate? The wording is a bit odd and I just don't want to enter an amount that should not be there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SS benefits

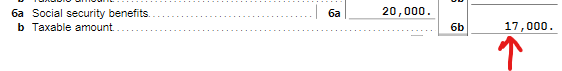

TurboTax Premier Desktop enters $17,000 under Social Security / Railroad Retirement Benefits at the screen Social Security / Railroad Retirement Benefits in the Georgia state tax return.

This is also the Taxable amount on line 6b of the Federal 1040 tax return.

This is also the amount recorded on line 9 of the Georgia form 500 Individual Income Tax Return.

As @DMarkM1 states, you should allow the software to enter the figure under Social Security / Railroad Retirement Benefits at the screen Social Security / Railroad Retirement Benefits in the Georgia state tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

wallisrr

New Member

jlf_spain

Returning Member

TXW

Returning Member

AnyTP

New Member

ColoRock

Level 1