- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

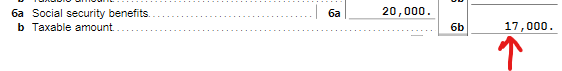

TurboTax Premier Desktop enters $17,000 under Social Security / Railroad Retirement Benefits at the screen Social Security / Railroad Retirement Benefits in the Georgia state tax return.

This is also the Taxable amount on line 6b of the Federal 1040 tax return.

This is also the amount recorded on line 9 of the Georgia form 500 Individual Income Tax Return.

As @DMarkM1 states, you should allow the software to enter the figure under Social Security / Railroad Retirement Benefits at the screen Social Security / Railroad Retirement Benefits in the Georgia state tax return.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 7, 2024

12:06 PM