- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Sale of land

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of land

OK! since I couldn't upgrade to Premier I updated to harm & Business. Now I can't find the area I need.

Please HELP...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of land

Hi DavidF1006

I did a upgrade to Home & Business only because Premier wouldn't let me. but now I run into the same problem of how to enter the sale of the land.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of land

It depends. Try the following steps to enter this information.

- Open up your Turbo Tax Program

- Select Personal

- Personal Income

- Choose what you work on

- Select investment income on the next screen

- Stocks, Bonds, Mutual Funds>other

- Here is where you will enter information about the sale of your land.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of land

When I get tp #6 it aske for a 1099 - B. When I say no it brings up a input form but not form related to land sales. there is no place to enter original purchase price, related costs, sale price and related sales costs. this is what the holdup is.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of land

In the interview that follows the "No 1099-B" screen, you have a place to enter "Sale Proceeds" and "Cost or other Basis" - this is where you report the sale price and costs.

For "Cost or other basis", add up the original purchase price, related costs, and related sales costs.

See the attached screenshot for a sample on a land sale entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of land

So I paid the $30 to upgrade to Premier since all help answers said it was required. The screen is not one iota difference. This issue has held up my return for 2 days. I don't get the "other" screen which I feel I need. I sold inherited land and have no idea when it was acquired since my mom has been gone 20 years. I feel I have wasted hours and hours researching this, and $30 . Any suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of land

Updating the Premiere was necessary to report the sale of inherited land. The Deluxe package does not include this deduction. Now here is how to report the sale of inherited land:

You can enter this info in the investment section of TurboTax. Select the product you’re using for the right instructions.

Note: To report investment sales, you’ll have to use TurboTax Premier, TurboTax Self-Employed, or TurboTax Home & Business.

- Open or continue your return.

- In the search box, search for sold second home and select the Jump to link in the search results.

- Answer Yes on the Did you sell any stocks, mutual funds, bonds, or other investments in 2020? screen.

- If you land on the Your investment sales summary screen, select Add More Sales.

- On the OK, what type of investments did you sell? screen, select Other then Continue.

- On the Tell us more about this sale screen, enter the name of the person or institution that brokered the sale.

- On the next screen, select Second Home (choose this also for inherited homes) or Land and answer the questions to finish entering your sale.

For inherited property, your cost basis is the fair market value on the date of death of the person you inherited it from.

You may need to contact a real estate person to help determine the value of that property 20 years ago.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of land

land only

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of land

You must report the sale of vacant land as an investment sale. Form 8949, "Sales and Other Dispositions of Capital Assets," is used to figure the amount of gain or loss from the sale.

You cannot report it in the (Online) Deluxe version; you have to upgrade to Premier.

To report the sale :

- Select Federal Taxes tab,

- Go to Wages & Income

- scroll down to Investment Income

- Select Stocks, Mutual Funds, Bonds, Other.

- Respond "yes" to Did you sell any investments?

- You'll then be asked Did you get a 1099-B or brokerage statement?

- you'll answer "no." Then you'll be shown a list of various investment sales and you'll select "land."

- You'll be taken to the screen that says Enter Land Sale Information and you'll be able to enter your information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of land

I have tried several times and on the CD version, it never pops up where I can choose a second home nor report my 1099S.....I guess the CD version just isn't as good as the download. Too bad.

And then to fill out my sale with the 1099B type form was confusing. I input it a couple of times....after deleting the previous attempt, and got two different results for what I owe the Feds and CA!!! Will attempt once more and then choose the one that has come up twice with same amount!?????

Any idea why CD doesn't offer same choices? Had I known this before I bought the CD, I would have bought the online download instead!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of land

A land sale is considered a sale of an investment. To report this in TurboTax TurboTax CD/Download, please follow these steps:

- On the Wages & Income screen, in the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other. If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 20XX? Click the Yes box.

- On the screen, Did you get a 1099-B or brokerage statement... click the No box.

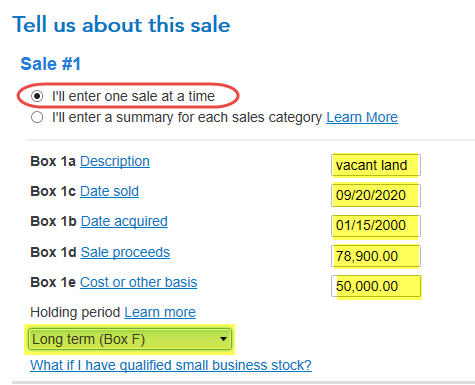

- On the screen, Tell us about this sale, mark the radio button, I'll enter one sale at a time.

- Enter the information in the boxes that appear. You will have to type in Land Sale in box 1a.

- Enter the total sales proceeds as well as the other information requested. [See Screenshot #1 below.]

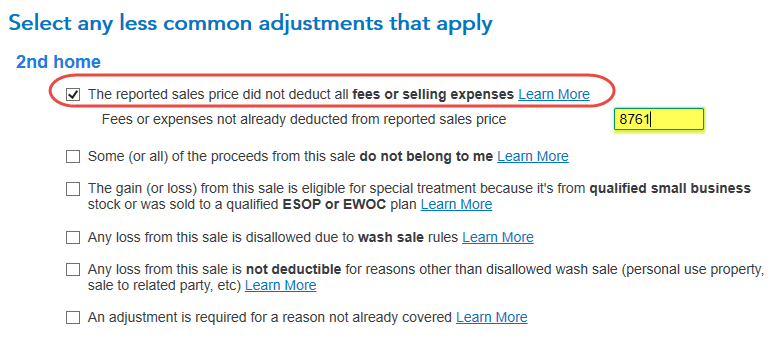

- Continue to the screen, Select any less common adjustments that apply.

- Mark the first box The reported sales price did not deduct all fees or selling expenses. [Screenshot #2]

- Enter the sales expenses not deducted from the sales price entered earlier.

Screenshot #1

Screenshot #2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of land

How do I report the sale of land. I have turbotax premier.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of land

A land sale is considered a sale of an investment. To report this in TurboTax, please follow these steps:

TurboTax Online

- Click on Federal > Wages & Income

- In the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other. If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 20XX? Click the Yes box.

- On the screen, OK, what type of investments did you sell? mark the Other box and click Continue.

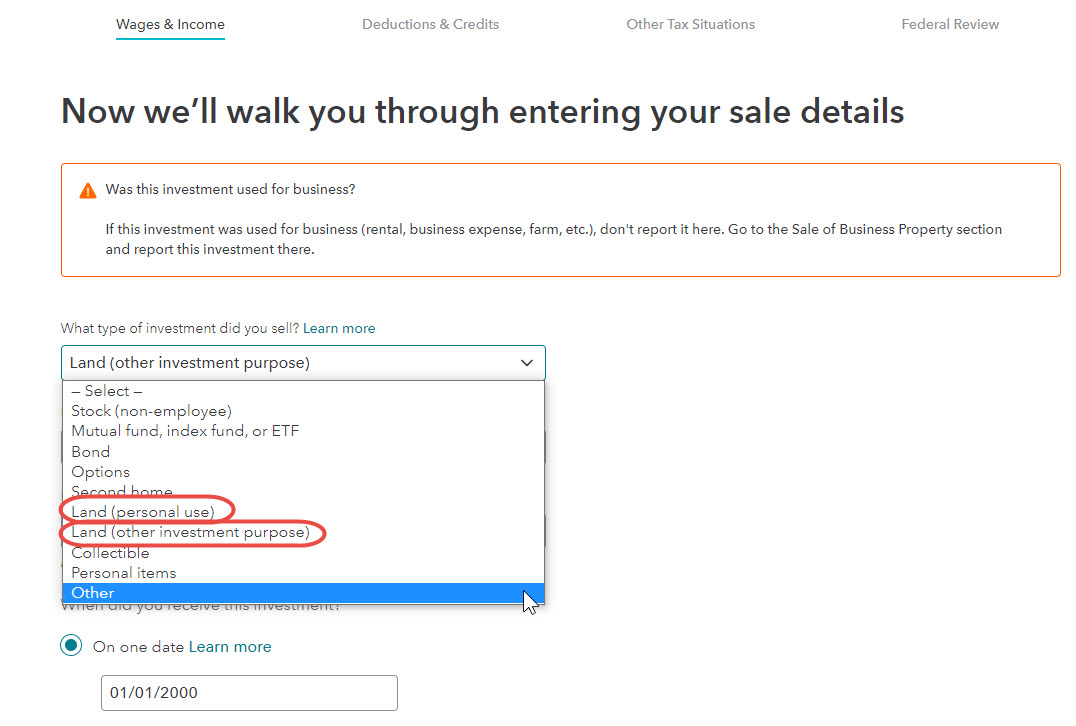

- When you get to the screen, Now we’ll walk you through entering your sale details enter the details of the sale. You will be able to select the type of investment in the first box [second home, land, etc.] [See Screenshot #1 below.]

- Click Continue when done.

TurboTax CD/Download

- On the Wages & Income screen, in the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other. If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 20XX? Click the Yes box.

- On the screen, Did you get a 1099-B or brokerage statement... click the No box.

- On the screen, Tell us about this sale, mark the radio button, I'll enter one sale at a time.

- Enter the information in the boxes that appear. You will have to type in Land Sale in box 1a.

- Enter the total sales proceeds as well as the other information requested. [See Screenshot #2 below.]

- Continue to the screen, Select any less common adjustments that apply.

- Mark the first box The reported sales price did not deduct all fees or selling expenses. [Screenshot #3]

- Enter the sales expenses not deducted from the sales price entered earlier.

Screenshot #1

Screenshot #2

Screenshot #3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of land

Premier does not offer land investment option. Been trying to get for two hours on this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of land

I do not get "other" option in my Premier version. How do I enter a land sale?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

blessedimelda1

New Member

thadley52

New Member

Farmgirl123

Level 4

20bill-mca

New Member

VJR-M

Level 1