- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Sale of Inherited Property Abroad Have the screens for Sale of Foreign Property Changed in the last few years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Inherited Property Abroad Have the screens for Sale of Foreign Property Changed in the last few years.

Have the screens for Sale of Foreign Property Changed in the last few years. I am using TurboTax Premier Desktop version

I have sold an inherited property in a foreign country. How do I enter it in Turbo Tax.

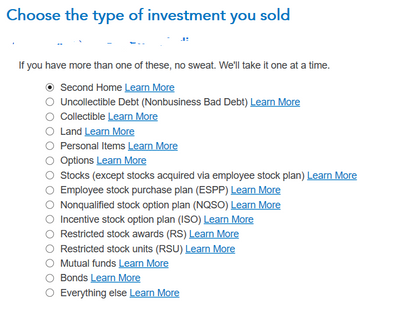

I go in Wages and Income -> Stock Mutual Funds Bonds Others. Enter Add more sales and follow the directions.

I end up on a screen where it prompts for Description, Date Sold, Date Acquired, Sales Proceeds, Cost or other basis,

Holding Period[Long Term Box F].

But in the previous year in a similar instance the Questions and the Screens were different. I no longer get those screens.

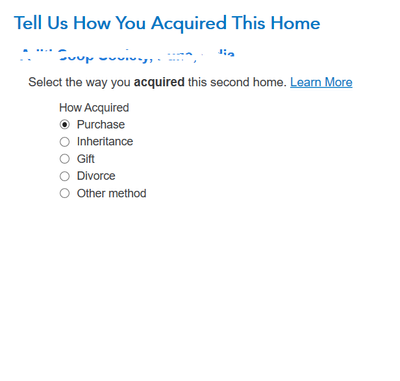

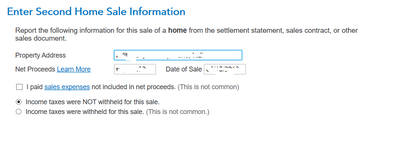

They used to be as follows:

Any idea if the software has changed or do I need to trick TT to get to these screens?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Inherited Property Abroad Have the screens for Sale of Foreign Property Changed in the last few years.

@dhirenk2003 wrote:

Yes the screenshots are from the 2019 version of TurboTax. I cannot navigate to these screens in the 2021 version. Have they updated Turbotax and removed those screens or is there some trick to get to those screens.

TurboTax has been updated so the screens are different.

You can simply use the word "Inherited" for the Date Acquired and ensure that you indicate the property was held long term (property acquired from a decedent automatically has a long-term holding period).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Inherited Property Abroad Have the screens for Sale of Foreign Property Changed in the last few years.

The thing that jumps out at me is the 2nd screen where you have selected that you purchased the property, when you should have selected inherited.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Inherited Property Abroad Have the screens for Sale of Foreign Property Changed in the last few years.

You need to enter "inherited" for the date acquired.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Inherited Property Abroad Have the screens for Sale of Foreign Property Changed in the last few years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Inherited Property Abroad Have the screens for Sale of Foreign Property Changed in the last few years.

Yes the screenshots are from the 2019 version of TurboTax. I cannot navigate to these screens in the 2021 version. Have they updated Turbotax and removed those screens or is there some trick to get to those screens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Inherited Property Abroad Have the screens for Sale of Foreign Property Changed in the last few years.

@dhirenk2003 wrote:

Yes the screenshots are from the 2019 version of TurboTax. I cannot navigate to these screens in the 2021 version. Have they updated Turbotax and removed those screens or is there some trick to get to those screens.

TurboTax has been updated so the screens are different.

You can simply use the word "Inherited" for the Date Acquired and ensure that you indicate the property was held long term (property acquired from a decedent automatically has a long-term holding period).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Inherited Property Abroad Have the screens for Sale of Foreign Property Changed in the last few years.

@dhirenk2003 , having gone through the above and agreeing with the helpful answers from @Anonymous_ and @Carl , I would just like to comment on the "foreign" aspect of the transaction:

1. Recognizing that your inherited property was in India ( probably), the tax treatment of realestate in the USA is different from that of India --- US uses the inheritor's basis in the property as Fair Market Value at the time of demise of the decedent; India uses an indexed valuation system.

2, For purpose of US taxes , you would need to use exchange rate at the time of death of the decedent ( for basis translation to US$ ) and again at disposition --- assuming that you sold the property quite some time post the inheritance. ( usual case )

3. If you wish to avail yourself of foreign tax credit on disposition of the asset, you will need to tell TurboTax that you have foreign tax credit , which will then require you to fill out form 1116 --- note that form 1116 ( in the forms mode ) will need to be inputted with the foreign income ( i.e. gain before taxes but after all sales expenses ). TurboTax will then compute allowable foreign tax credit ( based on a ratio of foreign income to world income).

4. Alternatively foreign tax can also be used as a deduction if you itemize but subject to SALT limits.

5. If you had the inherited prop. rented out for profit, then ( and assuming that you have recognized the income and depreciation on Schedule-E), the basis is eroded by accumulated allowable depreciation ( whether recognized or not ) and the portion of the equal to the depreciation is treated as ordinary gain/income and taxed as such.

Have I missed something ?

Is there more I can do for you ?

Namaste ji

pk

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Inherited Property Abroad Have the screens for Sale of Foreign Property Changed in the last few years.

Thanks everyone!

To confirm TurboTax has made changes to the software and we no longer see the screens that I have posted in my initial post.

I will have to enter the information on the screen that prompts for- as this is the only screen available. Am I right?

Description,

Date Sold,

Date Acquired,

Sales Proceeds,

Cost or other basis,

Holding Period[Long Term BoxF]

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chiroman11

New Member

IslandMan1

New Member

jlfarley13

New Member

admin

New Member

Hunterda1996

New Member