- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Remove form 5695

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remove form 5695

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remove form 5695

To delete your Form 5695 in TurboTax Online please follow the steps below:

1. Open your return, if it's not already open.

2. In the upper right corner, click My Account > Tools.

3. In the pop-up window, select Delete a form.

4. Click Delete next to the form or schedule and follow the instructions to remove the form/schedule.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remove form 5695

I tried it but it does not work

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remove form 5695

To delete Form 5695, go back to the Energy Credit portion of the interview. Please follow these steps:

- Click on Federal > Deductions & Credits.

- In the Your Home section, click on the Start/Revisit box next to Home Energy Credits.

- On the Energy-Saving Home Improvements screen, answer NO to the question at the bottom of the screen,

Did you make energy-saving improvements in 2019 or have a carryforward from 2018?

- On the next screen, Delete Confirmation, click the Yes box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remove form 5695

I have don't this multiple times and it will not delete. It pops back up over and over. How can I fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remove form 5695

Nothing works!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remove form 5695

Have tried this multiple times, also through tools. I am told the form is deleted, but lo and behold, it is still there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remove form 5695

Form 5695, Residential Energy Credits, is not yet ready for 2019. To delete the form in TurboTax Online, try two different options:

- Under Federal, Click on Deductions & Credits

- Under Your Home, Click Start/Revisit next to Home Energy Credits

- This screen will list information regarding the credit. At the bottom, answer No, we did not make energy -efficient improvements or have a carryforward

This process should eliminate the need to proceed with the form. The other option is to use the Tools feature in TurboTax Online to delete that specific form:

- Under Tax Tools, choose Tools

- Choose Delete a Form

- Scroll through your return until you find Form 5695, click Delete to the right of the form

- Confirm that you wish to delete the form

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remove form 5695

None of these work. Tried doing it with a CS specialist as well. Nothing worked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remove form 5695

You do have the option Clear and Start Over your return. To choose this option:

- Click Tax Tools

- Click Clear & Start Over

- Confirm

While this will require you to redo the return in its entirety, it will also delete any and all forms associated with the return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remove form 5695

I have the same issue and none of these things work and it will not let me delete my return and start over. HELP!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remove form 5695

bius

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remove form 5695

Removal of the form did NOT resolve the problem. TurboTax still refuses to e-file my return. I have been using TurboTax for twenty years and this kind of error never occurred until you stopped using the CD delivery method.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remove form 5695

The IRS updated the system this week to start accepting e-filed tax returns with Form 5695 Joint Occupancy. However, a processing problem still exists. To ensure the accuracy of tax returns, TurboTax is working hard to eliminate the issue. The expected resolution date is April 4, 2025. On or after that date, please log back into your TurboTax account, fix any error messages and e-file your tax return.

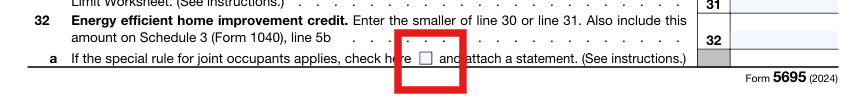

There is also an option to print and mail your return. If the special rule for joint occupants applies to you, please make sure that the box on line 32a of Form 5695 is checked. Then attach a statement to your printed return that explains how the special rule applies to your situation.

This statement should include:

- The names and Social Security numbers of all joint occupants.

- A description of the property and the nature of the improvements made.

- An explanation of how the costs were shared among the joint occupants.

TurboTax does not automatically generate this statement, so you will need to create it yourself. Make sure to include this statement when you mail your tax return to the IRS.

Here is a possible template that you can use:

Statement for Special Rule for Joint Occupants

Taxpayer Name: [Your Full Name]

Taxpayer Identification Number: [Your SSN or ITIN]

Tax Year: [Year]

Names and Social Security Numbers of Joint Occupants:

[Full Name of Joint Occupant 1], [SSN of Joint Occupant 1]

[Full Name of Joint Occupant 2], [SSN of Joint Occupant 2]

(Include additional names and SSNs if applicable.)

Description of Property and Improvements:

The property is located at [Property Address]. During the tax year, the following energy-efficient improvements were made to the property:

[Description of Improvement 1] (e.g., installation of solar panels, energy-efficient windows, etc.)

[Description of Improvement 2] (if applicable).

Explanation of Cost Sharing:

The total cost of the qualified energy-efficient improvements was $[Total Cost]. The costs were shared among the joint occupants as follows:

[Your Full Name]: $[Amount Paid by You]

[Joint Occupant 1's Full Name]: $[Amount Paid by Joint Occupant 1]

[Joint Occupant 2's Full Name]: $[Amount Paid by Joint Occupant 2]

Based on these contributions, I am claiming my allocable share of the energy-efficient home improvement credit. My share was calculated as follows:

Credit Allocable to Me = (Credit Limit for Property) × (Amount Paid by Me / Total Amount Paid by All Occupants)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Oliver

Returning Member

andreathomas221

New Member

user17691454475

Level 1

user17693798907

New Member

nautikarose

New Member